Apple Is Going Wireless

Taipei Times is reporting that Apple Inc is hiring engineers for a new office in southern California to develop wireless chips.

Job listings show that Apple wants employees with experience in modem chips and other wireless semiconductors. One job listing specifically says “Apple’s growing wireless silicon development team is developing the next generation of wireless silicon!”

Apple’s interest in hiring talent related to wireless technology means bad news for the existing providers. In this case, industry experts agree that this could eventually mean the replacement of components supplied by Qualcomm, Broadcom, and Skyworks.

In 2018, Apple recruited engineers in San Diego. Two years later, Apple was developing its own cellular modem to eventually replace Qualcomm’s offerings.

The new site will reportedly work on wireless radios, Rf integrated circuits, a wireless SoC as well as semiconductors for connecting to Bluetooth and Wi-Fi. Those are all components currently provided to Apple by Broadcom, Skyworks, and Qualcomm.

Apple and Broadcom have a $15B supply agreement in place for wireless components that end in 2023. Apple accounts for ~20% of Broadcom’s sales. Skyworks is even more dependent on Apple, which makes up nearly 60% of its revenue.

The IC Mega Suppliers

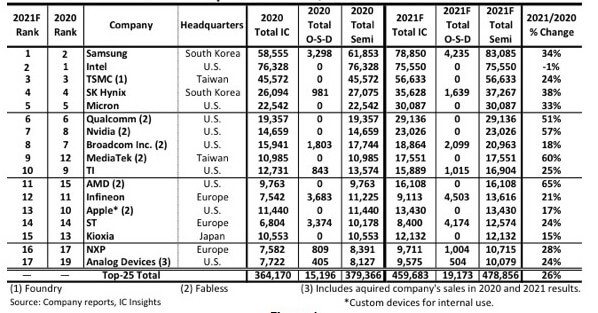

IC Insights has released its list of the 17 companies forecast to have worldwide semiconductor [IC and O-S-D (optoelectronic, sensor, and discrete)] sales of >$10B in 2021. For those who haven’t seen it I have reproduced it below.

These mega suppliers include nine from the U.S., three from Europe, two in Taiwan, two in South Korea, and one in Japan. The list includes six fabless companies (Qualcomm, Nvidia, Broadcom, MediaTek, MD, and Apple) and one pure-play foundry (TSMC). Based on strong DRAM and NAND flash sales, Samsung is forecast to open up a $7.5 billion lead over second-ranked Intel in total sales this year.

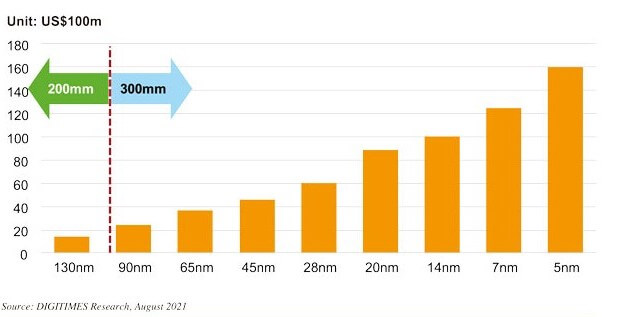

Fab Building Costs Continue Rising

Digitimes reports that it costs approx. $2.4B to build a 12-inch wafer fab using the 90nm process node with a monthly output of 50,000 wafers. The investment can reach $6B for a 28nm fab and $16B for the most advanced 5nm fab. Since not many companies can handle such hefty investments, chip manufacturing is becoming more concentrated in fewer hands.

In 1998 the top five wafer foundries accounted for about 27% of global investment. In 2008 this had increased to 58% and has now reached 72%. For example, TSMC’s capital expenditures are estimated to reach 54% of its revenues in 2021.

Digitimes reports rumors that chipmakers like Qualcomm, AMD, and Nvidia might shift orders to Samsung. But, they also point out that Samsung’s wafer foundry revenues are currently less than $15B, and based on such sales numbers Samsung should not be able to put the capital in place to absorb the requirements of all three of these customers in the near term (2025). IFTLE disagrees with this conclusion since corporate Samsung, with sales of $83B, could see this opportunity to gain on TSMC’s foundry revenues and make a move to put the capacity in place to satisfy all three of these major customers. What will limit Samsung is the time required to do this not the dollars required for the capital.

Digitimes predicts that the growth of the semiconductor industry will remain robust. They anticipate increasing demand for larger bandwidth for data centers. The EV business is also expected to bring surging demand for the semiconductor sector. New design architectures, along with technological changes, are coming into play. They predict that “Chiplets” and advanced packaging and test will be the industry’s new innovation areas (Figure 2).

Talent Shortage Coming

Digitimes Asia reports that there is a shortage of employees in Taiwan. They see talent as a potential bottleneck slowing down the rapidly growing market demand, as well as future innovation.

They report that the demand-supply gap of semiconductor industry talents in Taiwan has reached 27,700 per month as of Q2 2021, and the average vacancy of engineers in the first three quarters in 2021 reached more than 17,000, up 46.4% from the same period last year. Job vacancies at IC foundry firms grew 55.3% (vs last year) in Q2, while those of packaging and testing and IC design companies increased by 51.2% and 40.8% during the same period.

With the US, China, the EU, and Japan all determined to secure critical resources, the previous focus on cost-efficiency is no longer as relevant for critical chip supplies that governments want to get hold of. With more and more countries giving corporate subsidies to attract semiconductor companies to build new fabs and produce chips locally, they ask the question “will there be enough trained semiconductor talent to run all these extra fabs? “

For all the latest on advanced packaging stay linked to IFTLE…………………..