As long as the “social distancing” requirement is in force, you won’t see me in person at conferences or any other kind of events, where people get closer than six feet. Thanks to webinars and the internet in general, I’ll be able to continue capturing news and – with Francoise’s help – bring them to you.

The latest SemiWiki webinar, on April 2nd, 2020, featured Walden C Rhines, aka Wally Rhines, who is known for his scientifically solid and valuable industry forecasts and, as CEO for 24 years, his highly successful leadership of Mentor Graphics. As CEO Emeritus of Mentor, a Siemens Business – since 2017, he now advises companies, industry organizations, and government agencies on semiconductor topics.

The latest SemiWiki webinar, on April 2nd, 2020, featured Walden C Rhines, aka Wally Rhines, who is known for his scientifically solid and valuable industry forecasts and, as CEO for 24 years, his highly successful leadership of Mentor Graphics. As CEO Emeritus of Mentor, a Siemens Business – since 2017, he now advises companies, industry organizations, and government agencies on semiconductor topics.

In Part One of the webinar, Wally Rhines gave an overview of his new book, now available on Amazon, and discussed slides extracted from his many keynotes (Figure 1). Part Two was a Q&A session, during which Rhines conveyed his perspectives on important industry topics.

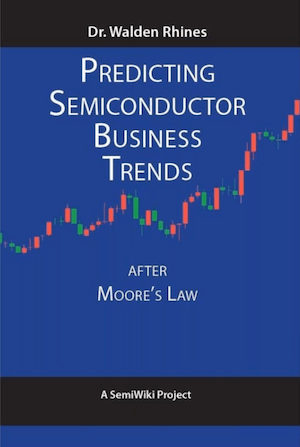

As an executive, Rhines uses historic data and proven models to predict the medium and long-term future of our fast-paced semiconductor and electronic systems industry. Just like in his keynotes I was able to attend in the past, he also emphasized during this webcast his favorite forecasting model – the widely applicable Gompertz Curve, (Figure 2). Why did Rhines put so much emphasis on forecasting? Because we all serve a very dynamic and innovation-driven market.

Figure 3 shows which companies managed to win big and which ones fell out of the top 10 in the last 60+ years, primarily because of disruptive innovations/transitions like Germanium to Silicon, transistors to integrated circuits, the microprocessor, System-on-Chip, IDM to Fabless business model.

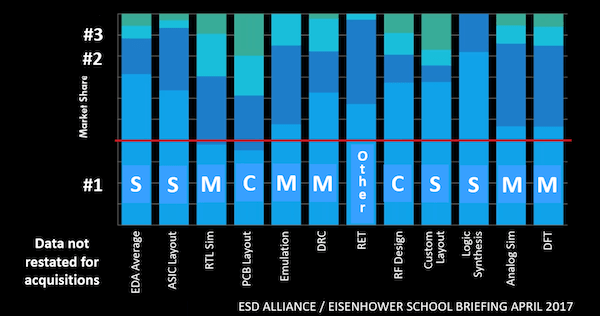

Focusing on the EDA industry, he stated that the “Big Three” (Cadence, Mentor, Synopsys) hold the lion’s share (~ 85%) of the EDA revenues. Further, Rhines showed that, except in resolution enhancement technology (RET), one of these “Big Three” clearly dominates every major segment. Figure 4 substantiates this fact.

Q&A With Wally Rhines

Q: How will Covid-19 impact our industry’s growth in 2020 and beyond?

A: It’s currently very difficult to predict how long and how deep this recession will be. Previous upturns followed periods of significance over then under investments. Coming from a down-year (2019), and expecting another double-digit decline in 2020, Rhines projects a slow recovery, primarily driven by new products and services.

Q: Is Moore’s Law coming to an end?

A: Short answer – NO. Moore’s Law, like all exponentials, can’t go on forever. However, Moore’s Law refers not only to feature-size shrinking – which is clearly becoming less economical – but also to other means to follow the linear learning curve to reduce cost per function. Vertical die stacking (e.g. 3D NANDs), new device architectures, advanced packaging technologies, and other innovations will enable us to continue growing industry revenues and profits.

Q: What about China’s quest for self-sufficiency?

A: No country or company can do everything efficiently! In spite of significant government investments in semiconductor R&D, China is not likely to achieve self-sufficiently in semiconductors. Electronic systems for domestic consumption and especially for Chinese exports need to be competitive worldwide. Therefore they’ll need to continue to import components from other countries. Nevertheless, China will become a serious competitor for the U.S. and Europe’s semiconductor industry.

In this context: Europe has a unique strength because European system companies (e.g. Automotive, Communications,…) work very closely with their major semiconductor vendors (STMicro, NXP, Infineon) to define and develop high-value solutions.

Q: When will shrinking features sizes no longer be reducing component cost?

A: If the wafer cost per area goes up faster than the number of transistors you can pack into this area, shrinking will not be economical anymore.

Q: What about neuromorphic computing?

A: The von Neuman architecture doesn’t lend itself to some of the new applications – e.g. pattern recognition. Therefore it needs to be complemented by other, special purposes, functions.

Q: About 20 years ago PC designers built their systems around Intel’s microprocessors. Remember the “Intel Inside” marketing campaign? Today’s system designers expect semiconductor vendors to fit their subsystems/components into the customers’ system environment. Suppliers can only do this if they have an in-depth understanding of the applications. How will our industry’s component and subsystem experts make the transition towards system-level building blocks and become valuable system design partners?

A: I have seen a similar change in abstraction-level when RTL coding was replacing schematic capture. The young designers, many fresh from universities, made this transition very quickly. The older engineers had difficulties and adapted much more slowly, to not diminish their market value significantly.

Q: What will be the impact of Chiplets on our industry?

A: Chiplets offer great possibilities! They are going to simplify design and prototyping – as soon as building-block libraries and user-friendly design flow are available.

Q: What comes after silicon transistors and when?

A: We’ll need a better (faster/lower power/smaller/…) switch, but it will take a decade or more to get there.

Q: Will the role of backend suppliers (OSATs) increase?

A: YES, innovative IC packaging and materials vendors will have a much larger role to play in the future. As Moore’s Law is slowing, it limits the number of logic gates and memory bits that fit on a die, makes heterogeneous integration difficult or too costly and constrains the introduction of new – e.g. highly parallel – system architectures. Multi-die packaging technologies (a.k.a. More than Moore, System-in-Package) will enable us to continue integrating more (heterogeneous) functionality while reducing design-time, power, and cost.

Q: What do you do to remain so young? (Comment: Compare his Then and Now portraits above)

A: I always stay engaged, keep an open mind and a sense of humor. Most importantly, I like to work with smart people – and we do have many of them in our industry.

My Observation

As most of us know, Wally Rhines has lots of experience in our industry and the ability to analyze available data thoroughly. He also can reason very convincingly about trends and their future impact on our industry. This blog can only capture a fraction of Rhines’ message during this 1-hour webinar. SemiWiki recorded this event and has already posted it here. I strongly encourage you to invest the time to hear Rhines’ thoughts directly, understand his vision and follow his strategic reasoning. Don’t forget to check out the book!

Thanks for reading….Herb