When I started writing this blog post, SEMICON West 2023 was to be a historic event — the last one held in July in San Francisco. However, it turns out that the 2024 show will be held in San Francisco in July; and again in subsequent alternating even years (2026, 28…). In 2025, 2027, and 2029 the show will take place in Phoenix in early October.

For 2023, the weather cooperated, and the days were sunny and cool, with fog in the mornings and blowing in during evening festivities, a bit cool for some from the warmer semiconductor climates.

This year’s tagline was “Building a Path Forward.” The primary sub-topics were the path to $1 trillion, the path to net zero, and the path for talent. Presentations during the show, especially by the executives, touched on all three, especially the keynotes. The supply chain was highlighted, but the focus was not as prominent as in past years. There was also a heavy emphasis on collaboration, I’ll get back to the collaboration topic later.

Flex and DAC are also associated with SEMICON West, so it’s been a busy few days, and more challenging to take it all in than it’s been in the past due to the number of different focuses. Fortunately, Francoise will also be blogging and podcasting about the show so for those that didn’t attend you will hopefully get a good idea of what was going on.

SEMICON West 2023 Market Symposium

The show kicked off with the market symposium on Monday afternoon. Dan Gamota, Jabil, delivered what was effectively the keynote talk titled: Intersection of Trends, Markets, and Capabilities Electronics Manufacturing Ecosystem. Gamota shared that trends and the timing of those trends can be hard to predict.

If you’ve been in the industry long enough you might remember predictions about bubble memories, 450mm wafers, and 157nm lithography. Gamaoto spoke about how the industry has evolved such that we are now building complex integrated systems (CIS) and that the lines have been blurring between the foundry, OSATS, and the EMS. While Gamota was focused on how EMS companies have evolved, this evolution is also apparent in how TSMC is now delivering systems to their clients using 3D packaging.

SEMI had two consulting companies present this year. Ernst & Young (E&Y) discussed the supply chain, and then Goldman Sachs and Co discussed the mergers and acquisition (M&A) environment. Both speakers discussed how geopolitical changes have impacted the supply chain and M&A.

E&Y focused more on reshoring, and how countries are viewing semiconductors as a strategic resource, and are providing incentives for companies to re-shore operations, which has significantly increased the dollars available for Capex.

According to Goldman Sachs, the M&A market is pretty quiet. One reason is because of the increase in interest rates, so it’s more expensive to execute M&A. Additionally, the recent banking flare-up appears to have sidelined both private equity as well as companies looking to borrow money for M&A. China also has had an impact. When a US company looks to acquire a foreign entity, China is contesting the acquisition and asking for considerable concessions.

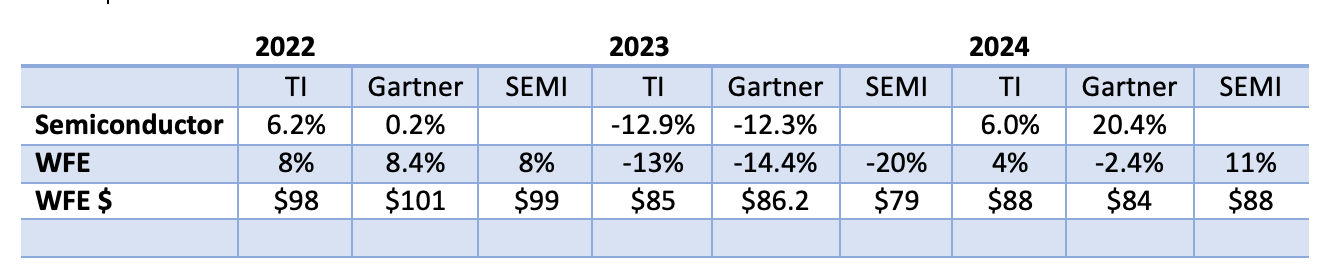

Then there were the forecasts. Historically at the market symposium, there is an economic outlook, a semiconductor outlook, and then an equipment forecast. This year Gartner, TechInsights, and SEMI all gave equipment forecasts. Gartner and TechInsights both discussed the semiconductor forecast and added some thoughts on sustainability, in addition to the current wafer-front end (WFE) spending. The three forecasts are highlighted in Table 1.

There is agreement that memory will be the driver for the increase in semiconductor revenue. The question is how fast the memory recovery takes place and what happens to ASP, which appears to be the discrepancy in growth between tech insights, and Gartner. The same goes for the differences in the WFE growth with SEMI having the lowest revenue prediction for 2023. The memory market first has to adsorb the excess capacity that has been taken offline before memory WFE will see significant growth.

Micron in their earnings call suggested that they will not resume new capacity purchases until the April 2024 quarter. The Bulls and the Bears discussion mentioned that for the past few years, memory spending has been in the 40 million range, in 2023 it will be about 20 million, the Bulls and Bears did not give specifics on 2024. The cycle has been devastating for the memory sector, and the PC and mobile markets are not projected to see positive movement until 2024 at the earliest.

Are We Still on the Path to $1Trillion?

Tuesday morning, the CEO Keynote Summit kicked off with greetings from SEMI’s North American President Joe Stockunas, followed by Ajit Manocha the CEO of SEMI, and then Mary Puma the chairperson of Axcelis technologies and the chairperson of the board for SEMI. The title of the session was The Path to $1 Trillion.

With the current slump, $1 Trillion is no longer considered feasible by 2030, so estimates of sometime in the first half of the next decade are being bantered about. To get to the $1 Trillion mark, the word collaboration is being used a lot. The thought that runs through my mind, is that collaboration is great, but who at the equipment level is going to collaborate with whom? Each company seems to have its own collaboration plan. Having worked and analyzed the industry for 40+ years, playing together nicely is something the equipment companies have yet to put on their resume.

Tim Archer, CEO of Lam Research, led off the CEOs with a discussion on the Semiverse. This involves using artificial intelligence (AI), digital twins, and process simulation to enable faster process and materials development for advanced chips. This fits well with the chip industry’s evolution, moving from statistical process control and chamber modeling to now AI.

Historically most fabs had a golden tool, which is the one used for process matching for that fab and sometimes several factories. So, developing a digital twin for the industry would give an ideal virtual process tool, and then process flow. This concept has been in use for a little over a year, and I first learned about it at the IMEC ITF in May of 2022. The company has several partners that are collaborating with them in the Semiverse.

Lam is also leveraging the Semiverse and augmented reality (AR) to address one of the industry’s key issues in workforce development. With a virtual tool, they are training engineers on how to operate and repair the equipment and run simulated processes. With AR they are also reducing the number of field service experts’ trips to the field, as a senior engineer can now train, and supervise a procedure from his home base, helping to reduce carbon emissions due to travel.

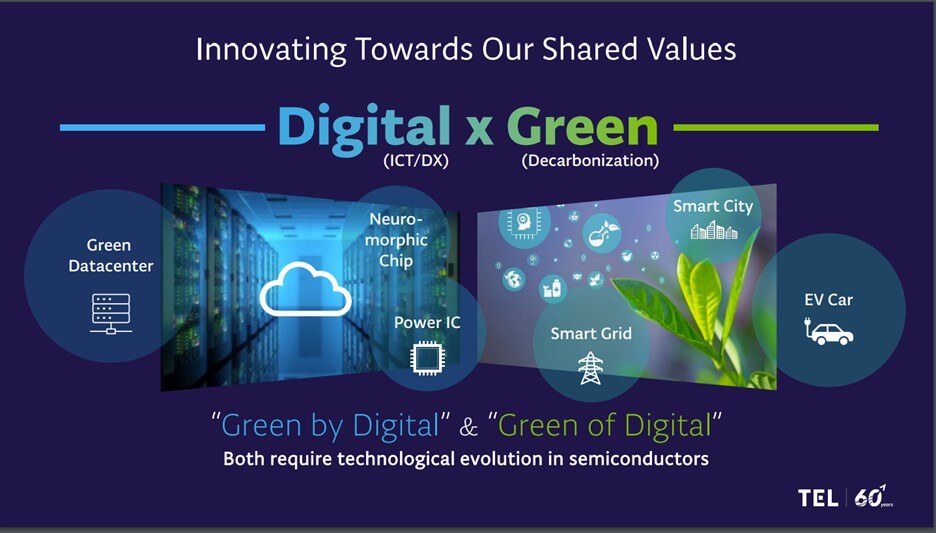

Tony Kawai, CEO of TEL, presented Keys to Create $1T in Shared Value. It is TEL’s 60th anniversary. Kawai, touched on the fact that many of the drivers of the chip industry are driving us towards green technology and that some of the advances of the digital revolution are requiring us as an industry to be greener. He explained that because the die size for AI and data centers is 800mm2 and data centers’ energy use is growing at an unsustainable rate due to training AI models, the equipment and chip manufacturers need to find a way to reduce their energy consumption as well as carbon footprint. Kawai presented a new TEL etch tool that reportedly uses 43% less power and reduces the carbon footprint by 83%, and to top it off is 2.5x faster than the current etch technology.

Compound Semiconductors At SEMICON West 2023

Finally, compound semiconductors made it to the SEMICON West keynote stage. Compound semiconductors are a critical component in decarbonizing the grid and transportation, as well as one of the keys to power reduction in data centers as the industry moves to optical interconnects. Vincent Mattera, Jr., CEO and Chair of Coherent, took us on Coherent’s journey into compound semiconductor manufacturing and a look at the expected growth of the compound semiconductor industry.

Wrap up

While the chip and equipment industry is in a significant downturn, the mood at SEMICON West 2023 did not reflect it. With a focus on electrification for sustainability, companies continuing to shift to the cloud, and the demand for AI accelerating rapidly, the path to a $1 trillion dollar chip industry might come sooner than expected.

Source TEL Semicon West 2023