The geopolitical race to take the lead in semiconductors is heating up as global investments in semiconductor manufacturing take hold.

Several weeks ago, the Department of Commerce finally made a big US CHIPS Act award, giving Intel $8.5 billion of the allotted 38 billion set to go to semiconductor manufacturing. Along with the award came some additional grants and loans. You can find more details on the Intel package in this blog by Phil Garrou. The Intel award came after a great deal of speculation about when and who will get the bigger awards from the US CHIPS Act.

This week, TSMC was awarded up to $6.6 billion in direct funding for its Arizona subsidiary and a potential $5 billion in loans under the CHIPS Act. TSMC committed to the construction of a third fab and also upgraded the second fab’s intended technology node from 3nm to 2nm, which is significant for its US customer base of Apple, AMD, and Nvidia.

We expect that Micron and Samsung are also in line for awards. Samsung might be next as it committed to building a second fab and there are reports of additional fabs in the offing. Also on the radar is SK Hynix, which is setting up a packaging plant in Indiana for HBM packaging for Nvidia. The fab is part of the Purdue University semiconductor program. This should make SK Hynix a candidate for future CHIPS consideration.

Other US CHIPS Act awards thus far are 1.5 billion to GlobalFoundries, $162 million to Microchip Technology, and $35 million to BAE. This leaves ~$28 billion to be distributed for construction and expansion projects. Even before funding the first batch of projects, U.S. Commerce Secretary Gina Raimondo called for CHIPS Act 2. It will be interesting to see how Congress responds to this request when at least one Senate member, with a considerable high-tech constituency in Vermont, opposes this type of funding.

Asia Tops the US in Semiconductor Manufacturing Investments

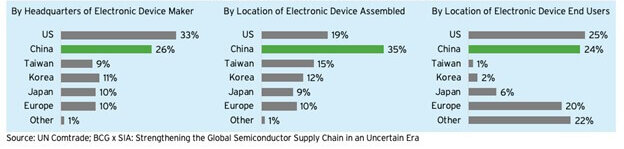

The funding from the U.S. CHIPS Act pales to what China, Korea, and Taiwan are spending to subsidize the high-tech space. The SIA estimates that China’s government spent $150 billion between 2014 and 2030 on semiconductors. Figure 2 explains why the investment as they are the second largest consumer of electronic devices worldwide, and as reported in a previous blog post, the largest importer of chips to support this demand.

Since the SIA report in 2021, Reuters reported that China is raising $143 billion to be allocated over five years due to the increasing restrictions on the Chinese semiconductor industry.

Korea has investment plans of $ 471 billion dollars or 622 trillion won. 482 trillion won are expected to be invested by Samsung and SK Hynix. The Korean Government could contribute 10-20% for the facilities to keep the Korean domestic semiconductor industry humming along.

The Taiwanese government is spending $9.28 billion US dollars over the next 10 years to support innovation in the Taiwanese semiconductor space. In place of direct spending, the Taiwanese government offers considerable tax incentives to domestic companies that invest in Taiwan.

Japan implemented a project-by-project strategy with the TSMC Kumamoto plant receiving a $3.5 billion investment. Rapidus received a $530 million grant for EUV and a $1.94-billion-dollar grant for its R&D facility. Japan also announced a $13.3 billion dollar fund to boost its semiconductor industry. Additional funds will likely be released when Rapidus moves towards full-scale production. If Rapidus achieves its goals, there will be 4 foundries capable of 2nm production when the facility comes online.

We can’t leave out India with its $15 billion dollar fund to attract semiconductor manufacturing. Tata Electronics and Powerchip are one of joint ventures looking to produce at 28nm. Another JV is between Murugappa Group’s CG Power, Renesas, and Stars Microelectronic building a fab to address India’s consumer, industrial, automotive, and power needs. Tower Semiconductor is also looking at using funding to build a fab in India but it has not yet been approved.

The current worldwide government and private funding investments in semiconductor manufacturing suggest there will be no shortage of facilities soon. The current round of construction and funding takes most countries through 2030 and appears to ensure a solid supply of semiconductors for the microelectronics industry once the chip and packaging facilities are up and running.

The chip industry is experiencing a fab building boom that looks to be stronger than previous cycles. The real question is whether the ongoing economics of the semiconductor and microelectronics industry support all these fabs and what will happen with the cyclical supply and demand cycle as these fabs come online. We are in an AI and data center boom. Will there be a bust? And will a domestic supply chain in nearly every region and the move to heterogenous packaging trump the economics of affordable chips? Only time will tell.