China’s semiconductor industry has been in the news a great deal over the past year. 7nm technology advancements, sanctions, new sanctions, allegations of future dumping of semiconductors, and China is the only region to see year-over-year growth in semiconductor equipment in 2023.

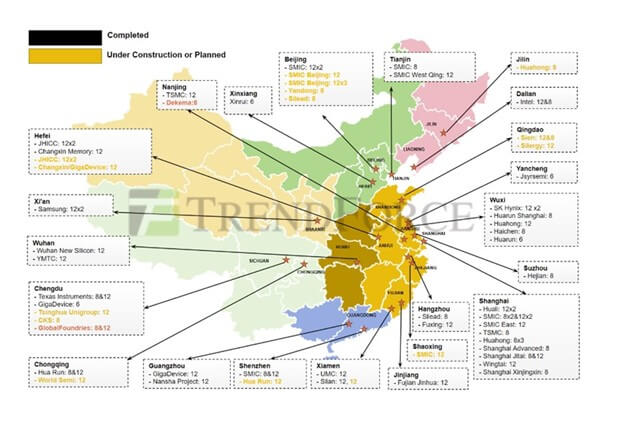

Trend Force published a report in early November on the fabs in China and the future growth of fabs in China. Figure 1 shows the locations and ownership of the fabs. There are a few foreign fabs in operation including TSMC, UMC, and Texas Instruments. Hynix now owns the Intel Dalian fab and Global Foundries has divested its 2 fabs in Chengdu. According to Trend Force, approximately 44 fabs are in production in China, with another 22 or 23 under construction, and 10 future fabs planned. Other than trying to achieve world dominance in the semiconductor industry, as many fear, including the US Government. Why is China building so many fabs?

China spends more on importing semiconductors than crude oil. In 2022 according to a Citibank report, semiconductor sales accounted for 15.3% of imports compared to 13.5% of crude oil. The dollar value of these imports totals $415 billion. In 2022 China produced or sold to the world (including China) only $180 billion worth of semiconductors out of the $574 billion semiconductor market. In rough numbers, imports are 2x that of domestic production. Add in sanctions, where they cannot purchase certain chips on the open market and it is understandable why China is building fabs at an unprecedented rate.

The world has made China the center of manufacturing of many things, including microelectronics. China also is one of the larger producers of EVs and is growing its renewable power at a rapid rate. This requires a massive number of semiconductors and power semiconductors, of which China is already a major producer.

Figure 2: ST Microelectronics is one foreign company building fabs in China. (Source: Reuters)

The growth rate and demand for power semiconductors in China are strong enough that ST Microelectronics has formed a JV with Sanan Optoelectronics to build a fab for SiC power devices for the automotive and power markets in China. China is working to decrease its dependence upon semiconductor imports to be able to supply most of its domestic consumption. Will this impact the amount of semiconductor imports? Definitely. This is likely why you see ST Microelectronics and Texas Instruments building fabs in China for power automotive and industrial markets. China also exports a significant number of chips. According to the Citi Bank article most of the chips that are exported cost less than $1.00. In 2021 China exported $49.2 billion worth of chips.

A recent article in EE Times interviews former Department of Commerce (DoC) Under Secretary Nazak Nikakhtar who is predicting that China will soon be dumping legacy chips. If you look at the number of chips China buys versus what they export, it is improbable that this will happen for a while. Another factor that makes this unlikely is most of the fabs making these legacy chips in China have a significant amount of depreciation still on their books. The depreciation of the fab and equipment increases the cost of those chips. Nearly all 200mm legacy fabs in the US, Taiwan, and Europe have been written off and have no depreciation, only operating costs. This significantly reduces the manufacturing costs of the chips and keeps the fabs in the US and Europe very competitive in pricing.

From a semiconductor equipment perspective, these new fabs have been good news and bad news for semiconductor equipment companies. The good news is that the growth of China’s semiconductor industry has helped fuel growth in the semiconductor equipment markets in 2022, and helped to soften the slowdown in 2023. In 2022 semiconductor equipment revenues were $79.85 billion after the third quarter, in 2023 after 3 quarters semiconductor equipment revenues stood at $78.21 billion. This is much better than the forecast in January of 2023.

In 2022 China accounted for $21.9 billion of equipment revenue, and in 2023 China accounted for $24.5 billion. This is not quite 30% of total semiconductor equipment sales. At the end of the third calendar quarter of 2023, semiconductor equipment companies are seeing 30% or greater of their revenue coming from China. The exception is ASML, which is running at 26% after Q3 earnings.

The bad news for equipment companies outside of China is that due to sanctions against foreign companies selling certain types of equipment, as well as China trying to create an independent chip market, Chinese semiconductor equipment companies are seeing above-market growth. Naura Technology, AMEC, and ACM Research at mid-year of 2023 are seeing 68%, 27%, and 47% growth respectively over 2022. Most of this is driven by the China market.

Is the China market showing any signs of slowing? Not at the moment! With 22 fabs in different phases of construction and 10 more on the way, China is building a solid chip infrastructure for semiconductor manufacturing, packaging, and equipment sales to support its internal demand. Will there be an impact on the overall chip industry? Yes – as China becomes independent, the 415 billion dollars of semiconductor imports will change to 415 billion dollars of internal semiconductor sales.