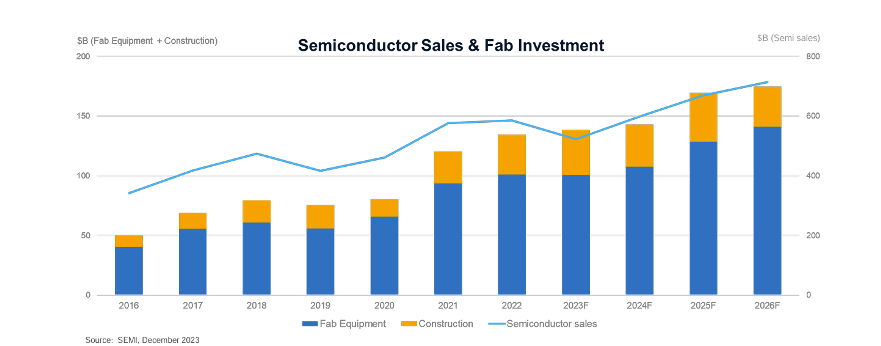

At ISS 2024, SEMI reported that fab equipment sales look to be flat in 2024 — right around $100 billion. We won’t know for sure until the final numbers are in for the year, but at the moment, it’s a pretty good estimate. TechInsights has wafer fab equipment (WFE) coming in slightly positive for 2023 and close to $100 billion.

The WFE number is a bit of a surprise when chip sales are forecast to be down about 10%. Typically, when chip sales are negative, equipment sales are even more negative. However, you would have to go back to the 2012, and 2013 downturns to find years where equipment growth was lower than chip growth. Chip growth came in at -3% and +5 respectively and WFE growth was -12% and -2%. In 2019 chip sales were down 12% and WFE was down only 8% a flip flop from historical norms.

The question is what has been driving the stronger equipment growth over these past few cycles?

From listening to semiconductor equipment company earnings calls in 2023, two bright spots have appeared. One is in the power, analog, and automotive sectors, as companies in this space are spending to increase capacity to match demand in the industrial and automotive space. EVs and renewable power have grown dramatically. Applied Materials cited a record 200mm sales in their second fiscal quarter.

The other bright spot has been the equipment ramp in China. On January 25, 2024, Digitimes published that China had imported over 400 lithography machines from ASML over the past 5 years. In 2022 and 2023, 78 and 176 lithography units were imported respectively. The article went on to mention that according to data from the General Administration of Customs of China, China imported $27.4 billion of IC manufacturing equipment in 2023. This is over a quarter of WFE spending in 2023. It is also an increase of 46.48 % according to the Digitimes article.

In 2023 ASML reported that approximately 29% of its revenue came from China, the Digitimes article makes a big deal about that number; however, in reviewing other leading equipment manufacturers’ China revenue over the past 4 quarters it ranges from a low of 27% for Applied Materials, to a high of 36% for Dia Nippon Screen. Lam Research, TEL, and KLA all look to have received over 30% of their revenue from China in 2023. So, using the old saying, a rising tide lifts all boats, China helped to make the year for semiconductor equipment companies outside of China. As I pointed out in a recent blog, Chinese equipment companies performed even better in China during 2023.

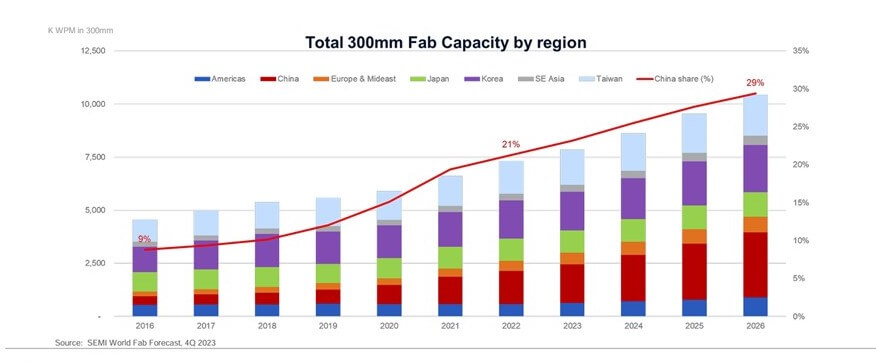

According to SEMI’s market research group, China isn’t slowing down. SEMI is forecasting China’s capacity to keep growing at a significant rate over the next few years. For 300mm, SEMI expects China to have 29% of the worldwide capacity in 2026, increasing from 21% in 2022 (Figure 2). The 200mm capacity is expected to grow from 16% to 24%. And foundry capacity is expected to reach 42% in 2026 up from 27% in 2022, outpacing the Taiwan foundry capacity expansions.

China has its goal set on being more chip-independent and spending less than $300 billion a year on importing semiconductors. To accomplish these goals, they are spending a lot of money on fabs and equipment, and in some cases forming JVs to get the right chips for their industries. So, will the European and US CHIPS Acts help to increase Europe’s and the US’s capacity? A little, but as Peter Wennink recently commented, the EU chip goal is unrealistic. I’ll add in as is the CHIPS Act in the US. China has a significant head start and it will take significant investment by the EU and US to catch up, and it is unlikely politicians and shareholders will continue to fund the exercise to reach the desired goal of 20%.