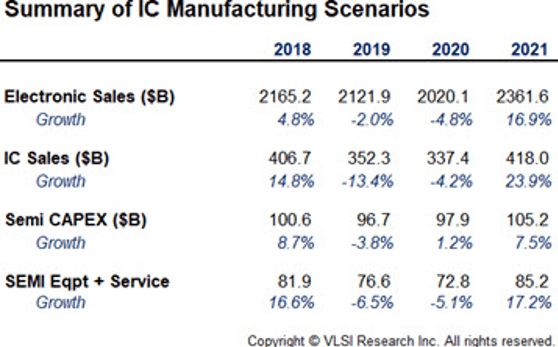

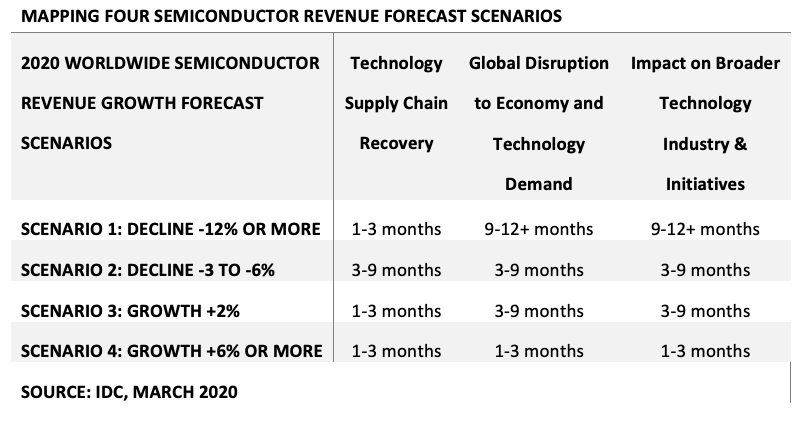

While the fog surrounding COVID-19 is still heavy out there, over the past week it has started to clear enough that two semiconductor forecasts have emerged. One is from VLSI Research and the other from IDC. (Tables 1 and 2). SEMI published their FAB forecast on March 9th, prior to shelter-in-place orders and company shutdowns. VLSI Research gives some hard numbers, while IDC gives several scenarios that depend upon how fast the recovery takes place. Both forecasts suggest that the coronavirus will have a negative impact on the semiconductor industry in 2020.

Other forecasts or estimates on Q1 growth are at the moment positive. SEMI’s Fab forecast published March ninth has proposed a moderate recovery of global fab equipment spending in 2020 growing 3% with a jump to 14% growth in 2021, which is in line with VLSI Research’s forecast above.

There have also been reports that China is well on the road to recovery, with the Nikkei weekly reporting that some IC facilities in China were operating throughout the entire crisis. Although, EE times reported on March 24, that European semiconductor companies are facing production issues as customers have shut down operations. It was reported on March 26th that Huawei had 90% of its workers back online in China, so it appears the Chinese manufacturing engines are starting to rev up again.

From a semiconductor perspective, TrendForce is estimating that Q1 top 10 foundry revenues will increase 31% year over year. The caveat is that this could be restocking ahead of the potential shutdowns to get some inventory in place to provide some supply chain cushion when factories start up again. Then there is the follow-up question, is it sustainable throughout the remainder of the year?

There are bets that TSMC will revise its 2020 revenues during first-quarter earnings in March. Applied Materials and Lam Research have both issued notices that they will revise their fiscal Q1 estimates due to the need to close operating facilities. This would suggest that equipment will not ship or be installed, and that other supplier or semiconductor manufacturing facilities will need to shutter for weeks or more to comply with government shutdown requests, or that end demand might slow, which would then have an impact on the supply chain. At the moment it is too early to tell as the situation is very fluid worldwide.

Semiconductor Recovery Could Be A Year Out

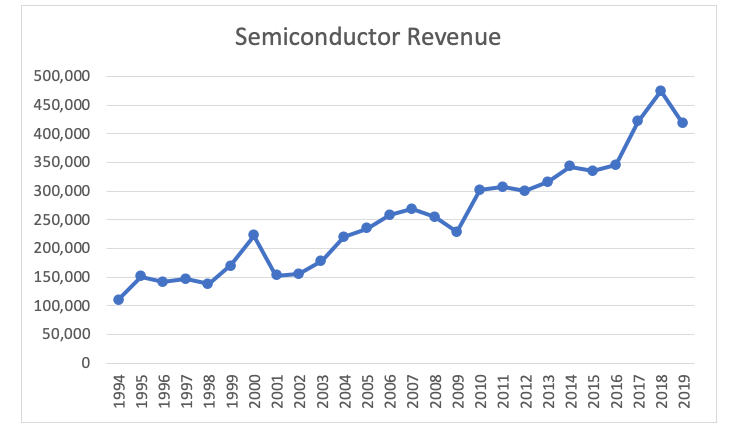

As a result of the mixed information, I decided to take a look back in history to see how the semiconductor industry has emerged from other crises in the past. I went back to 1995 to take a look at dips and recoveries and the timing. 1995 is when the Korean’s emerged as significant players in the DRAM market spiking Capex to gain market share.

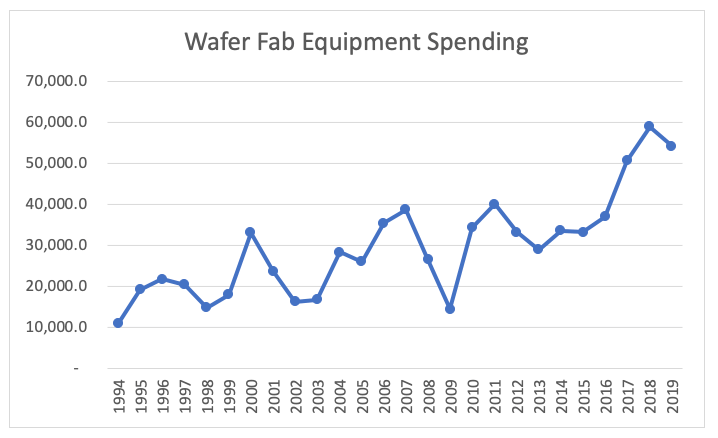

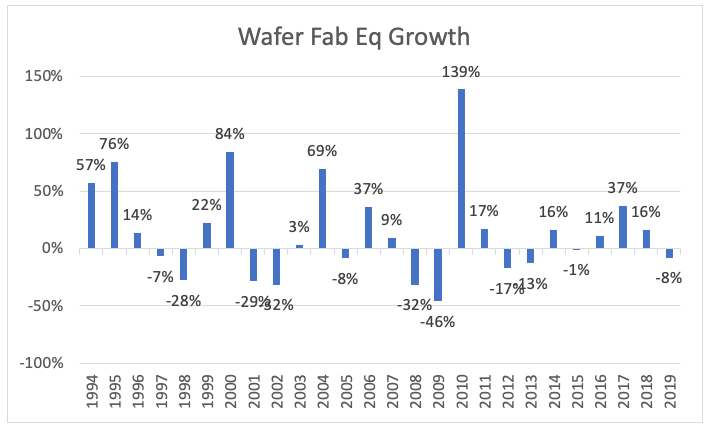

During this time frame, there were three major downturns in the semiconductor industry. The dips show up better in the capital spending graphic (Figure 2) in part due to scale, and the fact that equipment spending has more significant growth swings than the semiconductors themselves.

The three economic crises were:

- 1997-1998 The Asian Financial Crisis

- 2001-2003 The Dot Com bust

- 2008-2009 Home Mortgage Crisis

During these three financial crises there were also four significant flu epidemics. The MERS Virus did not have the same impact on the world as the other three, although there was capital spending slowdown during that time period that I’ll include in the discussion.

- 1997-1999 The Bird Flu

- 2002-2003 SARS

- 2008-2009 H1N1

- 2012 MERS Virus

The Economy and Epidemics

For me, the first point of interest was that the three major epidemics occurred in the same time period as financial incidents. The MERs epidemic did not have a major economic incident associated with it, but the semi-equipment growth rates follow the same pattern. The second was how the semiconductor wafer fab spending consistently had two years of negative growth followed by at least two years of positive growth, with one of those growth years being greater than 50% (Figure 3). This would suggest that since 2019 showed negative semiconductor equipment growth, 2020 would also be a down year for semiconductor equipment, potentially followed by significant growth in 2021, if we use history as our guide.

Based upon the current news, I expect the 2020 downturn will be due to a combination of not being able to ship and install equipment, as well as a year of lower semiconductor shipments due to a slowdown in demand for electronic equipment, as well as the shuttering of factories and then having to restart those factories.

From a semiconductor growth perspective, it is rare to have two consecutive years of negative growth; however, what has happened in 2020 will make it a rare year. With the shuttering of small businesses and layoffs that have accompanied those closings, both consumer and business demand is likely to be significantly slower than originally forecast at the start of 2020. This will likely result in a negative year for electronic equipment and semiconductor revenues. However, as businesses reopen and both businesses and employees recover, there is a high probability that 2021 will have a strong snapback, which has historically been the case when demand in the previous year slows significantly. The timing of the semiconductor recovery will be a difficult one to call. If the world-wide industry is back to work sometime in Q2 2020, recovery will be evident in early 2021. If the shutdowns and demand linger into Q3 or further, then the recovery may be delayed to 2022, but hopefully not. ~ D. Freeman