The GDP is down, the stock market is up, unemployment, at least in the USA, is confused, so what is the semiconductor and semiconductor equipment market going to look like in the second half of 2020? Second-half forecasts typically begin to emerge in early July shortly before or during Semicon West. With Semicon being pushed to late July and now a virtual show it will be interesting to see when the numbers are released, and what are the predictions.

At the end of the first quarter, or during the second quarter, most forecasters reduced their optimism for the year predicting a flat year for both semiconductors and equipment. Most of the reduction in forecasts has been due to the COVID-19 crisis and the shutdown of businesses, with part of the reduction coming from the US commerce’s departments actions against Huawei, and the potential $20 billion loss in annual semiconductor revenue, as well as the potential impact on the equipment market. Let’s take a look at the market conditions and some of the latest forecast outlooks to see what the second half might look like.

In most cases in a normal year, electronic industry forecasts are issued quarterly. 2020 has been anything but a normal year. Additionally, it has been difficult to forecast because many companies are not giving guidance due to the market uncertainly that stems from a multitude of issues, from supply chain hiccups due to countries and manufacturing being shut down, to slowing in business due to certain segments such as automotive and aerospace shutting factories.

Consumer spending has also contributed to the confusion. In Q1 and 2 there was a strong demand for mobile PCs and other consumer electronics due to the work from home, and homeschooling needs. The economic uncertainty of when people might start back to work, and what new electronic resources businesses might need if and when they start offices back up, has significantly altered forecasts from the beginning of the year.

Economics, Unemployment, and Predictions

The current economic outlook is beginning to improve, but according to a Wall Street Journal article on June 1, 2020, it may be a slow climb out. The purchasing managers’ index for May shows some improvements, but the value is not over 50 yet for most countries, which indicates a decline in manufacturing activity. The WSJ article also mentions that large layoffs in India and South Korea suggest that, at least in those countries they don’t expect demand to rebound soon.

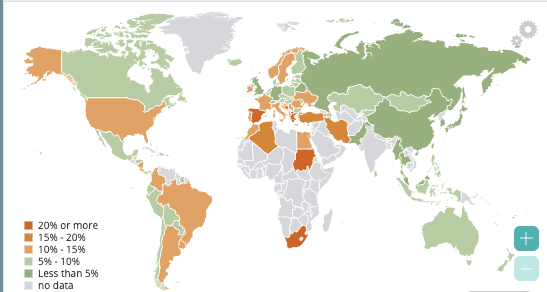

Unemployment in the United States reached 30+ million at one point, and currently appears to be hovering at 13.3%; however, Forbes reported that Bureau of Labor Statistics made a 5 million person error so unemployment is actually in the 16.1% range The International Monetary Fund (IMF) is showing worldwide unemployment at 8.3% in April of 2020 for advanced economies, up from 4.3% in 2019. A significant increase in the advanced economies unemployment rate (Figure 1)

To me, this would suggest that after the recent work from/school from home purchases, the consumer markets — including PCs, smartphones, automotive, entertainment — will be slow to recover. Depending upon when people start back to the office and staffing needs, an enterprise may not require as much hardware and software to complete the year. Gartner’s Q2 IT spending forecast predicts an 8% decline in 2020, suggesting that enterprise will be extremely conservative for the remainder of 2020 as they figure out how to restart the business.

The work-from-home purchases in Q1 and 2 are partially highlighted by the PC and smartphone forecasts by IDC and Gartner. The PC market fell between 9.8% and 12.3% in Q1 2020, according to research firms Gartner and IDC. The Gartner press release stated that the “work from home trend saves the PC market from collapse”. Thus, the current PC handheld forecasts are actually better than they would be if there had not been a rush to purchase laptops during the COVID shutdowns. This also suggests that restocking needs to take place when supply chains are up and working again, but the analysts’ outlook would suggest that it would be slow and steady rather than a rush to fill the shelves resulting in a decline in compute and mobile devices for the year.

TSMC reported good numbers for Q1 2020 but commented they foresee the rest of the year will be flat, and that there were cancelations of Q3 orders. With the timing of the quarterly call and the commerce department announcements of constraints of doing business with Huawei, it is difficult to tell if this was a foreshadowing of the commerce department’s decisions. Even more interesting is a recent report from the Asia Nikkia weekly that Huawei has stockpiled 2 years’ worth of critical semiconductors, which may be one reason for the TSMC and compute numbers being as strong as they were in Q1 earnings reports.

Semiconductor Industry Outlook

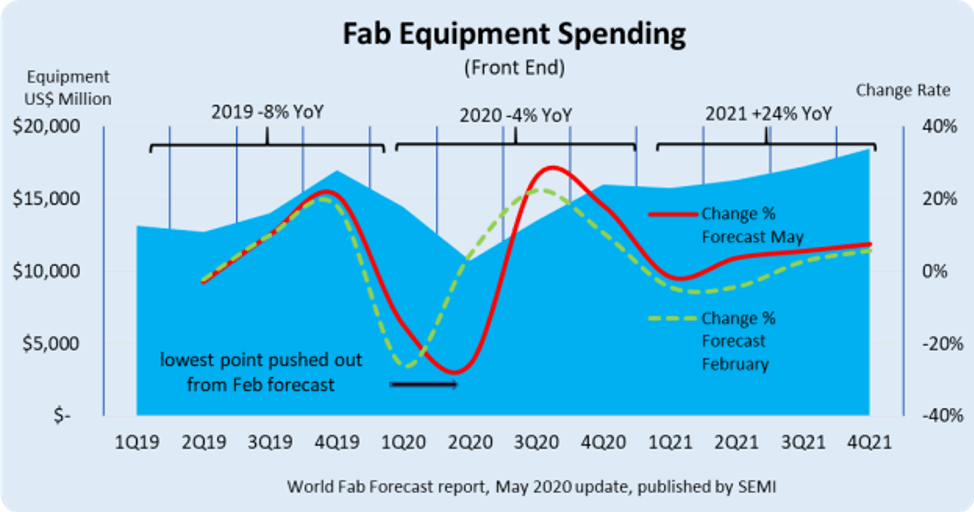

On June 2, 2020, SEMI reported Q1 semiconductor equipment billings. The good news is that it is up 13% year over year, a growth of $1.78 billion, but the bad news is that it declined 13% or 2.23 billion from Q4 2019. The June 9th, second-quarter 2020 update of the SEMI World Fab Forecast report gives a 2020 forecast of down 4% for front end equipment: however, the forecast is for a robust recovery in 2021 of 24% YoY growth. Figure 2 shows equipment sales are expected to grow strongly in the second half of the year.

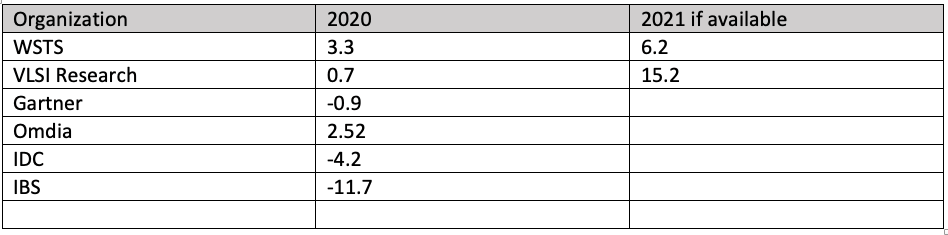

The World Semiconductor Trade Statistics (WSTS) forecast was released on June 9th, revising the 2020 semiconductor forecast they made in December of 5.9% growth to 3.3% growth, which is currently at the high end of the semiconductor forecasts. However, the WSTS report was released in June, whereas most of the other organizations had released forecasts earlier in the quarter, so they have had longer to look at the situation and develop their assumptions.

If like when judging a diving contest, you throw out the top and bottom scores the range is -4.2% to +2.52%, which averages to a negative 0.5%, if this holds, 0 +/- 5% growth isn’t a bad thing for the semiconductor industry in 2020 all things considered.

From an equipment perspective there exists a fairly large spread, VLSI Research has updated its forecast to a positive 7.3% but this also includes the service component, which typically is stronger in a year with low equipment sales. As pointed out above SEMI is forecasting 4% growth in 2020, dependent upon when the upswing starts. In presentations at finance conferences both Lam Research and Applied materials suggested that Q2 would be stronger than Q1, but neither company was willing to comment on a longer-term outlook.

From this analyst’s perspective, the strength or weakness of 2020 will depend if the top semiconductor manufacturers keep to their Q1 and Q2 Cap-ex proposals, and nothing gets in the way to prevent the worldwide economy from continuing the electronics industry recovery from the shutdown in Q1 and Q2 of 2020.