The CHIPS for America Act is still winding its way through Congress. The Senate has sent its version back to the House of Representatives where it faces an uphill battle due to partisan divide.

The America COMPETES Act is the House counterpart to the U.S. Innovation and Competition Act (USICA, S.1260), which the Senate passed in June 2021. That bill, which was championed by Senate Majority Leader Chuck Schumer (D-NY) and Sen. Todd Young (R-IN), was approved by a bipartisan 68-32 majority, including support from 19 Republicans. The America COMPETES Act, on the other hand, was largely crafted by House Democratic leadership, with no input from Republicans.

Speaker Nancy Pelosi (D-CA) may ultimately need Republican support to pass the legislation because many progressive Democrats do not support the CHIPS for America Act and view it as corporate welfare.

Thus, it will be some time with a lot of political wrangling before the CHIPS for America Act becomes reality. Another potential fly in the ointment that will kill the bill, or at least take a few days of negotiations, is TSMC and Samsung would like to see some of that funding directed towards them, since they are spending billions for new Fabs in the US and creating jobs.

What Samsung and TSMC fail to point out or maybe it should be pointed out, is that they are highly subsidized in their home countries, as their governments view the semiconductor industry as strategic to success. Such is the case in China, where multinationals were wooed with free land and subsidies, and home-grown companies until recently seem to have had access to an endless supply of capital.

Many of the arguments for the CHIPS for America Act cite that in 1990, 37% of the world’s chips from a unit perspective, were manufactured in the United States, while today only 12% are manufactured in the US. What the arguments fail to point out is that in 1990 the USA was still making and building DRAM factories, as DRAM was the technology driver for integrated circuits (ICs). Today, due to the higher cost of producing DRAM in the U.S., most DRAM production has moved overseas to maintain a reasonable profit margin. Samsung, Hynix, and Micron are annually in the top five for revenue market share, and it is likely they would also be in the top 10 for units shipped. It is highly unlikely the U.S. will regain a significant number of units back in the memory space.

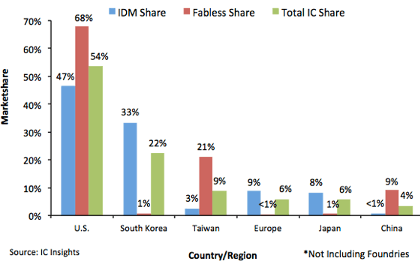

It’s possible that part of the counterargument to the CHIPS for America Act is data recently published by IC Insights, where the 2021 revenue for market share shows that the U.S. manufacturers still dominate in revenue market share. This is by headquarters’ location, so it would include Micron’s business as well as Intel’s business. Foundry revenue is not included in this analysis (Figure 1)

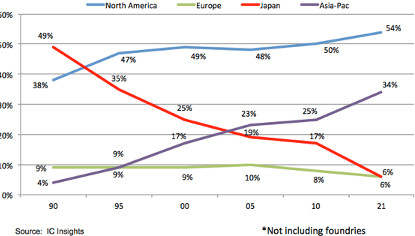

The U.S has a dominant 47% share in IDM and a 68% share in fabless semiconductors. One could probably surmise that most of that 68% in fabless revenue comes from chips manufactured at TSMC in Taiwan, from the likes of Nvidia, Qualcomm, Broadcom, and AMD. South Korea follows next. China only has a 4% revenue at the moment. Figure 2. shows the historical revenue trend, and shows the demise of Japan, once Korea and Taiwan became dominant in Memory.

So, while the data shows that even while the U.S. leads in revenue, a high percentage of the chips are fabricated in Taiwan, and Korea as the U.S. has had limited success with foundries. The reemergence of GlobalFoundries, and now Intel restarting its foundry effort might push the dial a little bit, but even Intel is manufacturing multiple chips at TSMC in the near term, as it ramps up needed capacity for both foundry and its own operations, and it will take years to move the capacity needle in Intel’s direction.

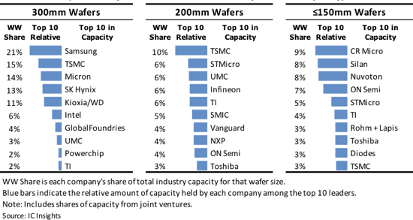

Figure 3 gives the data from the end of 2020, showing 300mm, 200mm, and 150mm capacity. At 300mm where most of the world’s chips are produced, the U.S only has 12% of the worldwide capacity, which is approximately equal to the percentage of units produced on a worldwide basis that is being mentioned by politicians.

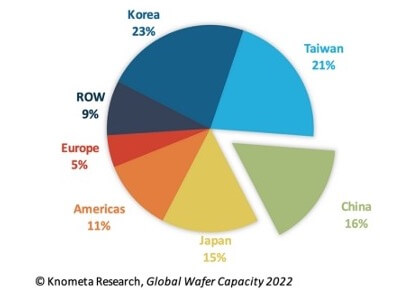

Figure 4 shows the 2021 worldwide capacity distribution. It was interesting to note the 16% capacity number for China, but it needs to be remembered that Samsung, Hynix, TSMC, and others have a semiconductor manufacturing footprint in China, due to the incentives that the Chinese Government has given to companies to build fabs to support the ramp-up in the China electronics industry.

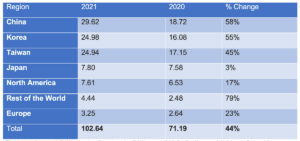

Meanwhile, the Chinese industry is spending heavily on equipment. The recent SEMI 200mm Fab report forecasts China to have 21% of the world’s 200mm capacity at the end of 2022, and this is on top of their 300mm spending. The annual equipment billings have China outspending Taiwan, as well as Korea. SEMI predicts this to slow in 2022 to $17.5 billion, but they are still outspending the U.S.

Taiwan is expected to spend $35 billion in 2022, 4X what the U.S will spend on fab equipment. Even with the multiple numbers of Fabs that are starting up in the U.S.

Where to Go From Here?

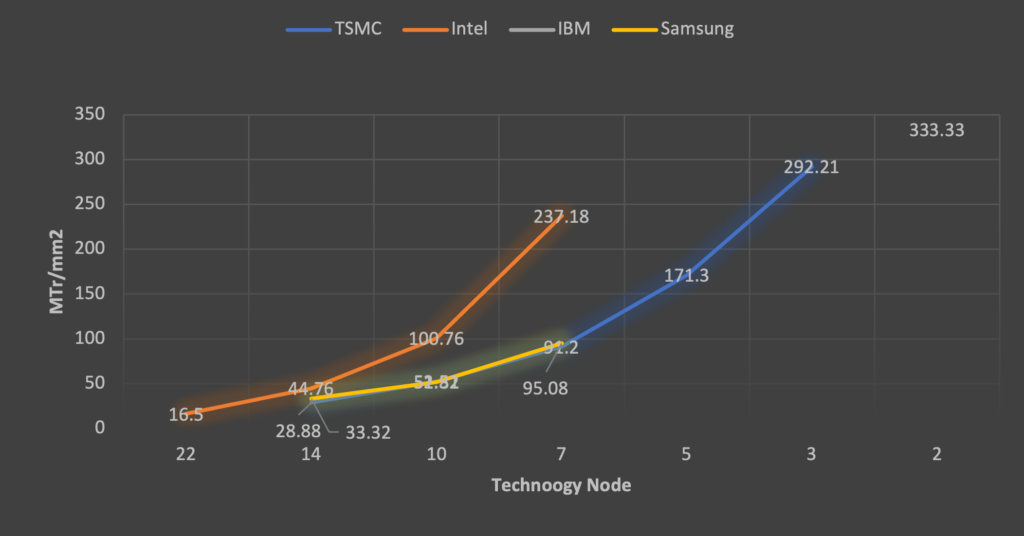

Looking at the investment being made, it’s pretty obvious that the epicenter of chip manufacturing will remain in Asia. Can the U.S regain the technical leadership in transistor technology? Possibly, as each technology node presents its new challenges for success. But look at Figure 5. This came from an IBM 2nm announcement regarding transistor density. When I graphed it out it was apparent that Intel’s transistor density is greater than its competitors, which may explain in part why there have been struggles getting to market. Intel’s interconnect technology also appears to be a bit more advanced than TSMC’s, so there appear to be tradeoffs in the transistor technology race. In the packaging space, it still appears to be a close race; however, Intel’s packaging is still pretty much for internal consumption, while TSMC is producing chiplet packaging for multiple customers.

So, for the foreseeable future, there will be healthy competition across the board, as there has historically been in the semiconductor industry.

Will the CHIPS for America Act as currently written eventually pass? Very challenging to say, but when a very vocal Senator from Vermont, where there used to be a strong technology base which is now gone is not supportive, I think there is still a lot of debate that will take place before we see progress or passage.

Meanwhile, as they have in the past, economics will drive the semiconductor industry. Where is it most advantageous and welcoming to build a fab, and that’s where we will see them built. The fab announcements over the past two years in the U.S are welcome news and will help to reinvigorate the U.S. industry. Europe is seeing similar activity. But if I look at current investment, it looks like business as usual, and it will take a lot more than $52 billion to change that.