The SEMI year ends with Semicon Japan and kicks off with SEMI’s Industry Strategy Symposium. The 2023 ISS was the return to the normal schedule with the 2022 event having been held in April. At the 2022 event, the big news was the semiconductor chip revenues being forecast to top $1 trillion dollars in 2030. The title of the 2023 event was Reaching $1T the Right Way: A Sustainable Path.

Out of the Past

Having not been in attendance since the key topic was the path to 450mm, which by the way, we still have 3 years left to meet most of the analyst’s predictions from 2014/2015, I was interested to see how the audience had changed, and if the format of the conference had changed much. On the audience, there was a considerable change, with not as many CEOs speaking or presenting. Less of Asia was in attendance due to travel challenges and health concerns. But the event was sold out, the room was full, and networking opportunities abounded.

Is $1 Trillion on the Minds of CEOs?

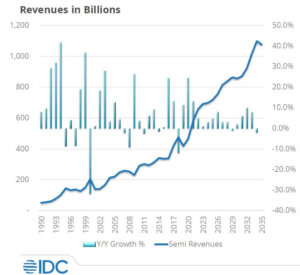

As the conference title suggests there was a focus on how to get to $1 trillion dollars in revenue, but also significant discussions on how to do that sustainably. With the signing of the CHIPS and Science Act in August 2022, there was a focus on how to start implementing it, so that companies can reap the benefits of the legislation. And as always there were the economic and industry forecasts, followed by Wall Street predictions (Figure 1)

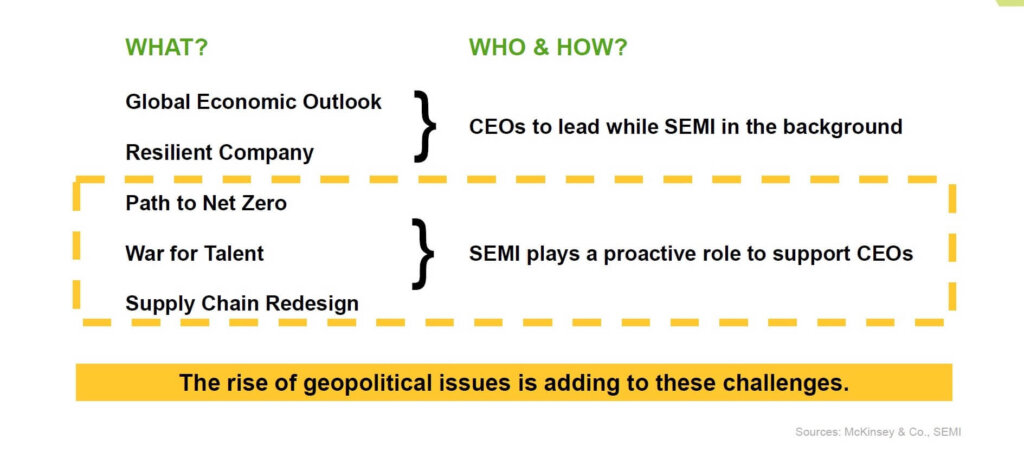

Ajit Manocha started off the presentations with a call to action by the industry. Figure 1 shows what, according to a McKinsey survey, is on the industry’s CEO’s mind, and how SEMI can help support companies in addressing these key issues. SEMI has created a significant presence for the path to net zero with the start of the SEMI Sustainability Initiative.

Approximately 75 companies have signed on to support, and create a path to net zero for the industry, and work on the supply chain sustainability issues. SEMI is also revamping its educational focus to help with the war for talent; although, no one asked the question: If we are having a talent challenge, why are we laying off talent? As one of the workforce development focuses, for the first time ISS had four student papers highlighting different areas of semiconductor manufacturing. The graduate students had the opportunity to network and discuss their work during the breaks, and also were able to do an elevator pitch on their research. Even more exciting was the display of diversity with two female students presenting papers.

The economic and forecast portion of ISS held no real surprises. David Doyle, Head of Economics at Macquarie gave the economic overview. The question was not if, but when there would be a recession, and how deep. Macquarie is predicting a 2% drop in GDP, while consensus is slightly positive.

Source SEMI ISS

From an industry forecast perspective, IDC Linx consulting and Gartner gave their respective views on the semiconductor and semiconductor equipment markets. Gartner is assuming the industry will still reach the $1 trillion mark in 2030, while IDC is a bit more conservative looking at 2032. Both forecasters are looking at a dip in semiconductors and equipment in 2023 IDC has a -5.3% for semiconductors with a rebound in 2024.

Gartner focuses mostly on equipment in its presentation and has the equipment market declining 19%, rebounding in 2024, with the bottom occurring in Q4 of 2023. When the forecasting panel discussed the forecast, it was surprising how close the consensus was in the numbers. The decline in equipment spending ran from -15 to -22. The bottom was either Q3 or Q4 in 2023. The exception was Mark Thirsk of Linx, who predicted a 2-year downturn for the equipment markets declining 13.1% in 2023, and 27.6% in 2024. From my perspective, a 2-year downturn is a more likely scenario, as one-year declines are a bit unusual (Figure 2).

Keyvan Esfarjani of Intel did a nice job of summing up the headwinds of getting to the $1 trillion mark. He also presented another slide that gave other underlying reasons that the $1 trillion dollar mark will be challenging by 2030. Costs have gone up considerably along the supply chain. This will mean silicon costs will increase (Figure 3).

Figure 3: Headwinds on a path to one trillion. (Source SEMI ISS)

One underlying question that the analysts didn’t touch on is will the customer shoulder this burden. Carolin Seward of Google made similar remarks in her presentation. So, with a broken supply chain can the industry successfully achieve the trillion-dollar mark by 2030? (Figure 4)

The other challenge in reaching a trillion-dollar mark is that with revenues closing 2022 at close to 600 billion dollars, a significant increase in manufacturing capacity is needed across the board. According to Linx, it is expected that silicon MSI will grow by 4000 MSI by 2026 to 18000 MSI. If the industry is to grow to a trillion dollars, it is likely silicon would need to grow to the 22,000 to 24,000 MSI range to achieve the trillion-dollar mark by 2030.

NXP and Excyte pointed out it takes 3-4 years from concept to production. Excyte calculated that to reach the potential 1 trillion mark in 2030 an additional 60 million wafers per year needs to be added to the industry’s manufacturing lines. This effectively means the industry would need to add close to 60 of TSMC’s mega fabs that manufacture approximately 100,000 wafer starts per month. That’s a lot of real estate, fab construction, and equipment that needs to be built over the next 7 years with government funding or no government funding.

The other question is with such rapid expansion can it be done sustainably? Energy conservation, water conservation, and significant changes to process equipment will be needed over the next 2-3 years to support the amount of silicon needed to meet the $1 trillion target by 2030. So will the industry reach the $1 trillion dollar mark the right way by 2030? That’s the nice thing about predictions, as time goes by they can be modified, sort of like the 450mm predictions. – D.F.