Historically, the integrated circuit (IC) substrate and board industry have assumed a passive role, especially when it comes to innovation. However, in the past few years, things have changed. The dedicated landscape welcomed innovative solutions and new players. “Today, we are facing an increasingly competitive ecosystem and players are looking to differentiate from each other’s” asserts Mario Ibrahim, Technology & Market Analyst at Yole Développement (Yole). “As the mobile segment matures with saturating growth, the value creation efforts are shifting towards emerging products, especially in telecom and infrastructure (datacenters, 5G) and automotive.”

The Impact of SLP and ED

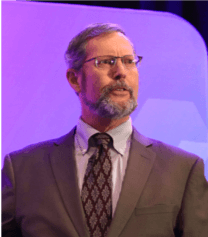

The substrate and printed circuit board (PCB) global market will record a modest compound annual growth rate (CAGR) of around 4% between 2018 and 2024. However, if we consider advanced substrate technologies as substrate-like PCBs (SLP) and embedded die (ED) technology, the market exhibits a much higher growth rate, up to 49% CAGR for ED over the same period…

These figures are part of the new technology & market report, “Status of advanced substrates” published by Yole. Under this dynamic context, this report points out the actual trends and their impact on substrate manufacturing. This new edition is analyzing FC BGA and FS CSP substrate capacity. It also includes new Substrate Like PCB (SLP) applications and highlights the latest adoption of the embedded die package. Two other trends are also analyzed in this report: substrate manufacturers are today switching to mSAP. The Chinese industry is also consolidating its substrate manufacturing ecosystem…

Yole Développement and System Plus Consulting, both parts of Yole Group of Companies announced a dedicated online event on July 2. Titled, The Sleeping Substrate Giants are Awakening, Mario Ibrahim from Yole and Stéphane Elisabeth, Expert Cost Analyst, RF, Sensors & Adv. Packaging, System Plus Consulting, proposed this engaged webcast to present their vision, from technology to market, on the past, present, and future of advanced substrates. The advanced substrate industry has begun innovating to keep up with advanced packaging trends. Make sure to get a deep understanding of the market drivers and key challenges and register today!

Following Advanced Packaging Trends

Megatrends are pushing the packaging technologies to the extreme in order to answer their stringent requirements with a smaller footprint, higher performances, and lower power consumption. Substrate makers have been working for a few years to improve their technology portfolio and innovate in order to follow these trends.

Industry players are looking to differentiate from each other… The advanced substrate industry is now following advanced packaging trends. Miniaturization, greater integration, and higher performance are becoming mainstream in this industry. Huge investments by several players are ongoing for ED and SLP, showing increased interest in such technologies.

Chip Embedding for Power MOSFETS

As an example, Infineon Technologies and Schweizer Electronic have recently announced a co-developed solution for the mild-hybridization of cars: chip embedding for Power MOSFETs…With chip embedding, the Power MOSFETs are no longer soldered onto a circuit board but integrated within. ”The resulting thermal benefits allow a higher power density and board integration enables further improvements in system reliability,” said Dr. Frank Findeis, who is heading Infineon’s automotive MOSFET business. “These advantages result in a higher power or more cost-effective 48 V systems.” Click I-micronews to read the full press announcement.

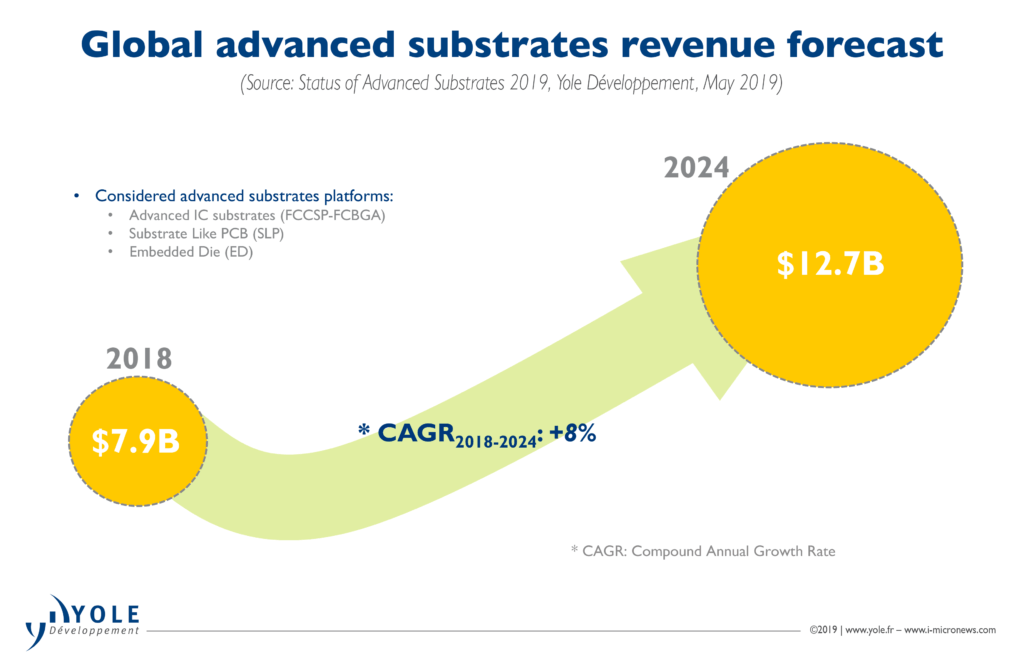

Flip Chip, SLP, and ED are gaining market share from the conventional board and IC substrate markets. That’s especially true for SLP and ED, which have the capability to either reduce the board/substrate footprint or to increase the number of dies. “Indeed, with technology like Embedded Multi-die Interconnect Bridge (EMIB), Intel, if they decide to license the technology to external players, will be capable to compete with Interposer based packaging technology from suppliers like TSMC announces Stéphane Elisabeth, a Cost Analyst at System Plus Consulting. Undoubtedly, these technologies can address the integrational needs of this new digital age applications, but bring complexity and request innovation before the adoption takes place. In addition, such technology brings huge value to the market. Hence it is not surprising they are expected to fetch a higher Average Selling Price (ASP) and revenue.

“Increased SLP adoption by leading OEMs is driving market growth significantly”, announced Favier Shoo, Technology & Market Analyst at Yole. “The global SLP market is valued at US$987 million in 2018 and is expected to grow through to 2024, driven by the global cell-phone market.”

Impact of High-end Smartphones

The SLP market is still heavily dependent on high-end smartphone growth, particularly Apple iPhones and Samsung Galaxies. Moving forward, Huawei is expected to release high-end products with SLP technology in 2019. “Huawei started to produce this type of substrate for the Premium phone “P30 Pro” release in March 2019”, said Stéphane Elisabeth from System Plus Consulting. “As Apple and Samsung, Huawei uses SLP to support the RF area”. Furthermore, cell-phone-producing OEMs are planning to use SLP in other consumer electronic products like smartwatches and tablets. SLP will become more mainstream than ever before.

Currently, SLP manufacturers from Taiwan, South Korea, and Japan are dominating production activities. Players like Japan-headquartered Meiko and Taiwan-headquartered ZD Tech are expanding new SLP production lines in Vietnam and China for more than one smartphone customer. Certainly, China will gain SLP technical know-how progressively with technology transfer from the major players…

The full collection of advanced packaging reports is available on i-micronews.com, advanced packaging reports section.

Sources: www.yole.fr – www.systemplus.fr