Fan-Out packaging solutions have been the hottest topic in the advanced packaging industry for two years, and that will remain true, announces Yole Développement (Yole). Will the fan-out market growth keep going? Who can challenge the leading semiconductor company, TSMC? Is panel technology coming? What will be the next killer application?

Many important questions face the fan-out packaging industry. Yole, the “More than Moore” market research and strategy consulting company updated its famous Fan-Out packaging report published last year taking into account the industry evolution, entrance of new players, new business opportunities and much more. The 2017 report, “Fan-Out: Technologies & Market Trends 2017” will bring you today an overview of the new technologies available and under development, a comparison of different platforms and associated markets. Yole’s report also details an update of commercialization status with market adoption for new applications, updated market forecasts as well as an in-depth strategic analysis of main players and newcomers including JCET/STATS ChipPAC, TSMC, ASE, Amkor and Samsung Electro-Mechanics.

Yole’s analysts tell you the story of the incredible boom of fan-out platforms.

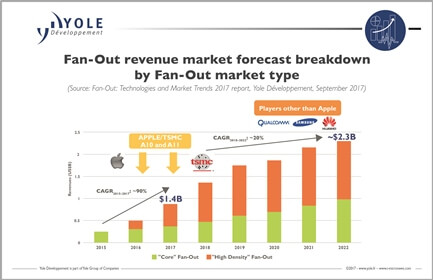

“In 2016, TSMC’s InFO FOWLP solution was used to package Apple’s A10 application processor, which was implemented in the iPhone 7,” explains Jérôme Azémar, Senior Technology & Market Analyst, Advanced Packaging & Semiconductor Manufacturing at Yole. It created huge interest in the platform and demonstrated its capability to address complex applications in large volumes. Apple confirmed its potential when it chose InFO for its next application processor, the A11, in 2017. Could it mean fan- out packaging is going to spread all over the market? Will every fan-out supplier benefit from that? As usual in the advanced packaging industry, things are not that simple.

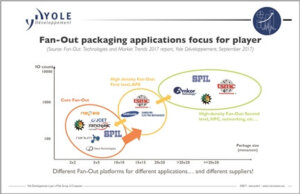

The fan-out packaging market can actually be split into two:

- The “core” fan-out market, including single die applications such as baseband, power management, and radio frequency (RF) transceivers.

- The high-density fan-out (HDFO) market, started by Apple’s application processor engine (APE), which includes applications with higher counts of I/O connections such as processors and memory.

“While both markets have great potential and are expected to grow fast, they have different drivers and can be addressed by different players,” explains Jérôme Azémar from Yole.

The core market is the main historic pool for fan-out wafer level package (FOWLP) solutions, which initially to address Intel Mobile’s needs in 2009. Now, the technology has managed to convince several heavyweights in the industry, like Qualcomm, for numerous small size/low IO count applications such as audio codecs, power management integrated circuits, baseband, radars, etc. Major outsourced semiconductor assembly and test service providers (OSATs) are well positioned in that market and have been supplying the technology for quite some time. Players include JCET/STATs ChipPAC, ASE, Amkor, especially after its purchase of Nanium, etc. With FOWLP being acknowledged for its advantages such as reducing the form-factor size, flexibility in die embedding and electrical performance, the market is expected to grow steadily in coming years, especially in mobile applications.

The HDFO market is quite different. Applications targeted are higher-end and can have several thousand IOs, requiring the package to handle much more than the core market. The main application so far is in application processors, like Apple’s A10 and A11, which benefit from the thin profile of the package and its excellent performance.

Now Apple is the only customer but Yole’s expectations are high: therefore, others such as Qualcomm, Samsung… will join them. In the future, other high-end applications may appear, seeking the high bandwidth capability of FO, such as high-performance computing and networking.

The APE market is currently the main contributor to HD FO, and the supplier landscape is rather different to the core market. Only TSMC is involved so far and OSATs will probably have to wait for a few generations before being able to enter the market. The HD FO market is already worth US$500 million in 2017 and could reach more than US$1 billion in coming years if players other than Apple are willing to switch to fan-out packaging.

With such great potential for high-density fan-out and solid growth of core fan-out, Yole’s analysts expect the fan-out supply chain to evolve.

A detailed description of this technology & market report is available on i-micronews.com, advanced packaging reports section.

These results will be detailed at SEMICON Taiwan (Sep. 13-15, 2017 – Taipei, Taiwan) on Sep. 15 at 1:20 PM, at the SiP Global Summit 2017, Embedded & Fan Out Package Technology Forum. Jérôme Azemar, Senior Technology & Market Analyst, Advanced Packaging & Semiconductor Manufacturing proposes a relevant presentation titled: “Fan-out Packaging Technologies and Markets”.

Make sure you will be there to discover his presentation and exchange with him at Yole’s booth, #828.

To arrange a meeting with our team, please contact Camille Veyrier (veyrier@yole.fr).

Source: www.yole.fr