The world’s understanding of the semiconductor industry has gone from — What is a semiconductor? — to front-page news, as the chip shortages that happened because of the pandemic made the semiconductor industry finally newsworthy in the eyes of the non-technical press. At the height of the shortage, The Wall Street Journal published weekly articles, and local papers in non-semiconductor regions covered the shortages as well. CNBC reported on the industry daily and continues to do so as the shortages have turned into excess, and at least for memory chipsets. It’s one of the more significant downturns that has occurred.

As these outside reporters turned their eyes on semiconductors, I find their reactions interesting as they discover after one cycle what is well understood by those of us who’ve been following the industry through its ups and downs for decades. On July 27, CNBC reported in seeming surprise that the industry went from shortage to glut. But while it looks like the industry hit bottom, the industry analysts have been speaking on the downturn and recovery since December of 2022 when they released their 2023 forecasts.

If we know one thing about the semiconductor industry, it’s that it is cyclical, and every time someone reports that the cycles are over, watch out — another one will hit. I gained an early understanding of the cycles when I joined the industry in 1982 during a memory downturn. Japan had just taken over market share in the memory market, (the first Chips Crisis), and we were in a significant recession.

The company I was with had just re-organized. Looking back, I am thankful they gave me a new position instead of having to look for a new job. During my first year as an analyst, I ran smack into the dot com bust and the panic of 911. Everyone in the industry missed that forecast. Another big miss was the financial crisis. Let’s dive into the cycles a bit more.

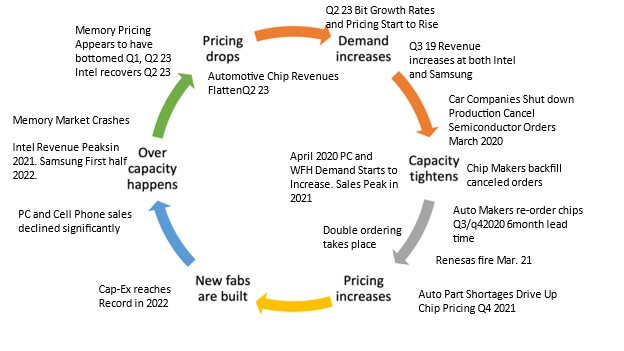

Typically, downturns are associated with some sort of outside driver, but most follow the same cycle. Every semiconductor or semiconductor equipment analyst has a graphic that discusses the cycle. The one I use was created by Bill McClean of IC Insights, now a part of Tech Insights. I appreciate it because it’s in a circle, not a Gaussian curve, or a hype cycle curve. I inserted text boxes on this version to highlight my interpretation of this current cycle. Note that most cycles start with a downturn in memory, and then memory is one of the first movers as the cycle improves. In that aspect, this cycle was no different. Memory recovered from a 2019 slowdown, peaked in Q3 of 2021 through Q2 of 2022, and came crashing back to earth. The rest of the industry with the exception of automotive and Industrial followed.

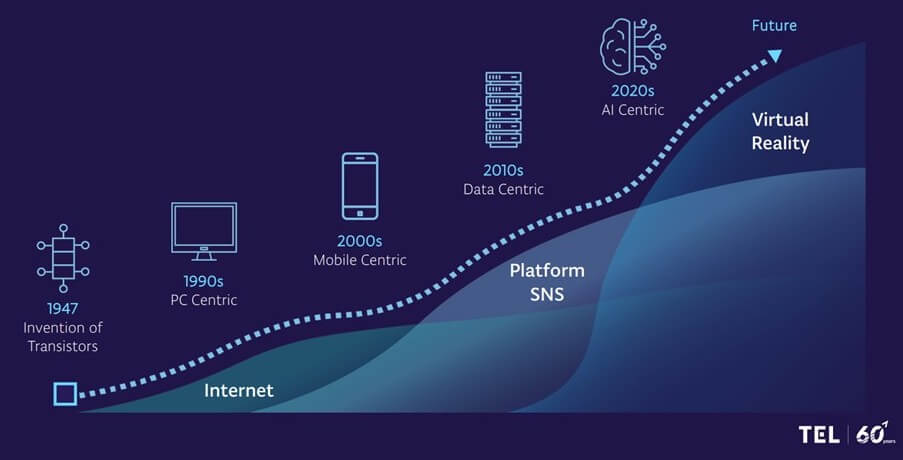

Each cycle is different. In the early years, they were driven by government and computers, and then the industry branched out. During this cycle, we’ve noted that now, chips are in nearly every product we purchase or are used in the supply chain to manufacture those products. The ramp in 5G edge computing, autonomous vehicles, cloud, and smart things had a significant impact on the supply chain because the large systems-on-chip (SOCs) used in many of those applications are manufactured at foundries. PCs and mobile device purchases ramped up quickly as everyone began working and attending school online. Routers, WiFi extenders, and switches were in short supply as the need for bandwidth in homes increase due to all the devices online.

As this cycle played out, once the rush on home devices slowed, 300mm logic and memory started to come into balance. It took much longer for automotive and industrial chips to reach parity. And while still growing at some companies, the growth curve for automotive chips has flattened significantly.

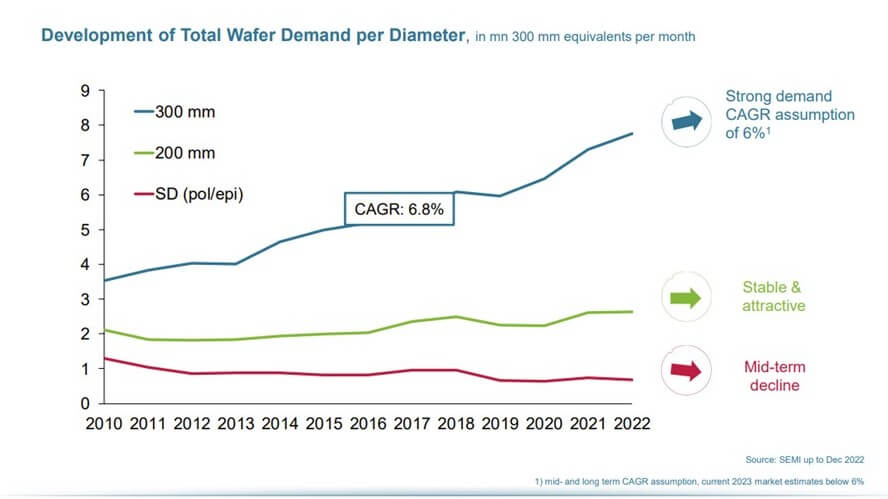

For those not in the semiconductor industry day to day, it’s hard to understand why you just can’t ramp capacity rapidly. The majority of automotive, analog, and power chips are manufactured on 200mm wafers. 200mm fabs are not mainstream, 300mm are, and most of those 200mm fabs have very limited space to expand. If you build one from scratch it’s a two-year journey, and the chips from those fabs cost more due to depreciation of the equipment and the factory.

Figure 3 from Siltronic AG shows the growth levels for 200mm wafers over the years, which are very limited. According to SEMI, spending on 200mm equipment accounts for about 5% share of the $79 billion wafer front end (WFE) spending in 2023, and accounts for 24% of worldwide capacity.

During the pandemic, 200mm added 7% in 2021, and in 2022, new capacity respectively reached 7 million wafers annually, up from just under six million in 2020. This is a significant increase for a technology that is more than 20 years old. (Note some of this is for LED, GaN, and SiC, which would not be reflected in the graph above.) Thus, when there is a run on the market for power management integrated circuits, some of which are manufactured on 100mm technology, it’s going to take a while before the 200mm fabs and below can catch up. The shortage gets compounded by double ordering, which takes place frequently when chips are ramping. At the moment, based on earnings calls and the lack of comments from the automotive and industrial sectors about chip shortages, it looks like automotive and power chips are no longer in short supply.

Thus, the cycle begins again, and depending upon new drivers, double ordering, and new fabs, we will possibly be having this conversation again in two to three years.