September and October are busy months in the technology world, as companies have their annual analyst day, where they show off and introduce new technology. Shortly after the analyst day comes earnings season. This timing gives CEOs the opportunity to use the old adage: Tell them, tell them again, and then tell them what you told them.

As the chip industry appears to be pulling out of its downturn with two quarters of growth for the CPU and memory companies, the messages were filled with optimism and highlighted the growth opportunities for companies. However, if you look for growth drivers in recent forecasts, it is challenging to be overly optimistic about 2024.

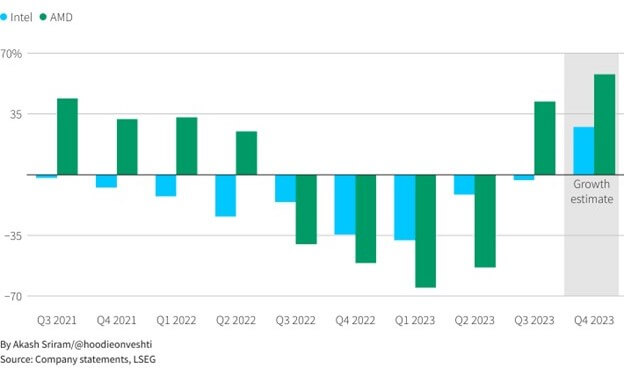

IDC, a market intelligence company, thinks PCs will only grow by 3.7% year over year in 2024. The consensus forecast for mobile phones is in the 5% range. Trendforce has the server forecast at 2.3%, and Gartner’s IT forecast, which includes software, is only at 8% for 2024. As a result, it is hard to get overly optimistic about strong growth in 2024. Figure 1 comes from a Reuters article on November 1, showing a rebound in PC chip growth.

AI model training and inference have been one of the brighter spots for chip manufacturers in 2023 driving high-performance computing for data centers. Most of this training and inference needs to be done in the cloud, due to the amount of computing power and memory needed to accomplish these tasks. However, as CEOs were letting us know all the new news about their companies, a new application emerged from their presentations, AI-enabled PCs.

Rumblings of this new application have been floating around for a while, but during the past few weeks, AMD, Intel, Qualcomm, Apple, and Nvidia all have made comments on chips and the introduction of AI-enabled PCs. This is very likely the basis of the ARM Nvidia discussion on building a CPU for Windows software in the recent press.

According to a Reuters report, Microsoft has been encouraging chipmakers to build AI capability into the CPUs used to run the Microsoft operating system and Microsoft’s AI-enhanced software like Copilot. Microsoft envisions AI-enhanced software such as its Copilot to become an increasingly important part of using Windows. In addition, PC users have been using AI applications at an increasing rate on hardware that has not necessarily been designed for AI applications. Thus, it would make sense for chip manufacturers to add the technology needed for end users to incorporate AI in their workstream on PC hardware designed for AI applications.

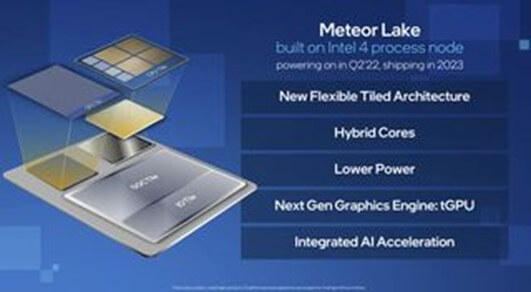

Over the past few weeks AMD, Intel, Qualcomm, and Apple have all introduced hardware that can run inference AI models on a PC without needing to access the cloud. The chip or package includes a CPU, NPU, and a GPU. The Apple chip can access 128GB of memory, which is needed to run the AI software, the other chips likely have similar memory capability. Apple, Qualcomm, and AMD will be using TSMC’s process technology with Qualcomm and AMD using the 4nm process for their first set of AI PC chips. For its upcoming 8000 series, AMD says it will move to the 3nm process. Intel will be using its 4-process node for its upcoming Meteor Lake chip (Figure 2).

Figure 2: Intel’s Meteor Lake Chip. (Source: Intel)

The AMD and Intel chips will be manufactured using chiplet technology, the Apple chip is an SoC (Figure 3), and it appears that the Qualcomm chip is also an SoC. Most of the first-generation AI PC chips above are in production and on their way to PC manufacturers and based on presentations will be available for enterprise or consumers in laptops sometime in early 2024.

Will AI-Enabled PCs Drive Growth?

One of the growth challenges in the PC industry over the past few years, apart from the pandemic rush, is getting consumers to replace their PCs more frequently. Historically, there was an inflection point when there was significant improvement in system performance due to new CPUs or memory, or the older system would not perform as well on new software. At those inflection points, consumers and corporations purchased new PCs to increase productivity. Employees could be assured that a new PC would arrive on their desk every 2-3 years as the technology changed.

As chip performance slowed and software iterations became fewer, PCs came to have a significantly longer shelf life, especially in the consumer world. This has caused a slowing PC market over the past several years.

AI-enabled PCs create a new inflection point. Pat Gelsinger thinks it’s enough of to sell over 100 million AI-enhanced PCs. AMD and the memory companies also view this inflection point as a positive growth opportunity, as they also believe that consumers and corporations will increase spending to have PCs capable of using AI more effectively. The question will be, if companies will trust AI on their employee’s computers instead of in the cloud and if consumers feel comfortable enough with AI to adopt it for home use. On both these questions, only time will tell if this is an inflection point or business as usual.