“It ain’t over till it’s over.” is a frequently used Yogi Berra saying. The current semiconductor cycle has that feeling. While for some parts it appears to be over, for other parts it looks like most segments are at the bottom, and there are no strong growth indicators for the industry.

A bit over a year ago, in the second quarter of 2022, the memory and processor companies were tipping rapidly into a downturn with the first hints of either quarter-over-quarter or year-over-year decline. Companies in the microcontroller and analog space servicing the automotive segment were still seeing flat to positive growth as the automotive space was still experiencing shortages for some chips. The semiconductor equipment industry was still chugging along and would not see the initial impact of the slowdown until either calendar Q1 or Q2 of 2023.

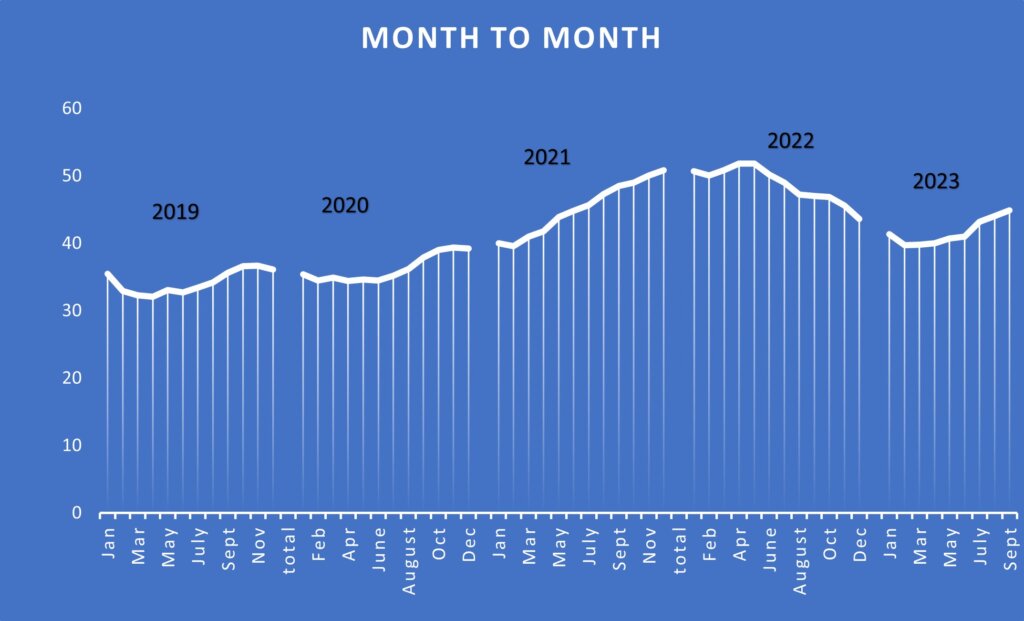

As the semiconductor industry closed out 2023 and moved into 2024 the outlook was still cloudy. Starting in the second quarter of 2023 the memory and leading-edge logic segments started to see positive momentum. Conversely, the microcontroller, analog, and power side of the business looked at a soft Q4 2023. Infineon announced a 5% growth rate for its next fiscal year. The equipment side of the business gave mixed signals for 2023 of up and down, depending upon which business segment and geographical they are the strongest. The Silicon Industry Association (SIA) data in Figure 1 shows the shape of the last cycle and the start of the rebound as the industry moves into 2024.

Depending on your point of view, the current semiconductor cycle started in late 2019, with a brief hiatus due to the pandemic, and then kicked into high gear in the second half of 2021. At its Industry Strategy Symposium (ISS), in 2022, SEMI predicted that $1 Trillion in revenue for the semiconductor industry was achievable by the end of the decade. As the chart shows in May 2022, month-to-month semiconductor revenues started to decline.

In the November 2022 timeframe, analysts were cautiously optimistic about the downturn. Gartner had a decline of 3.6% and in the WSTS fall 2022 forecast, its analysts were predicting a 4.1% decline for 2023. On the equipment side, SEMI was forecasting a decline of 16.8% for 2023.

At ISS 2023, the analyst panel consensus was that semiconductor revenue would decline by approximately 5%. The one exception was Malcolm Penn of Future Horizons, who predicted a 20% decline in semiconductor revenue with a rebound in 2024. On the equipment side, the consensus was a 15% to 22% decline with a rebound in 2024. Mark Thirsk of Linx Consulting predicted a two-year downturn for equipment with a 13% downturn in 2023, and 27% in 2024. For the record, at that time a two-year equipment downturn was looking likely.

What Actually Happened

Forecasting is an inexact science that depends heavily on your assumptions, as well as your instincts, as no two downturns are alike and something from outside the box can come along and significantly change those assumptions. What happened in 2023 and where does it look like the industry is headed for 2024?

Two of the many assumptions for 2023 were that China would see a strong second-half recovery and that 5G and China would help to drive mobile phone purchases and thus provide some bright spots during the year. These assumptions would help memory recover, and drive some logic revenue. Neither of these assumptions came to be. As a result, memory prices continued to decline throughout most of the year, only stabilizing when inventories had been worked through or written off, resulting in a revenue decline of greater than 30% for the segment dependent upon Q4 23 growth. Companies building computer and mobile processors also saw greater than a 10% decline in revenues for those segments with 10% being the high side.

Bright Spots in High Bandwidth Memory

The key positive drivers for memory in 2023 were high-bandwidth memory (HBM) for Artificial Intelligence (AI), and automotive applications. AI and automotive were segments that had positive growth across the industry. For microcontroller units(MCU) and power chip manufacturers, automotive and electrification led to a positive year for most of those manufacturers.

This led to a bit of an unusual year where the MCU and analog manufacturers reported growth, while the memory and PC and mobile logic manufacturers headed for a negative year from a growth perspective. Typically, when there is a downturn, revenues are down across the board, so the automotive and power semiconductor growth is one of the unique aspects of this cycle. As renewables drive the electrification of the grid and the electric vehicle (EV) market continues to grow, it will be interesting to see if the automotive and power semiconductor industries continue to have a different cycle than the computing and consumer segments.

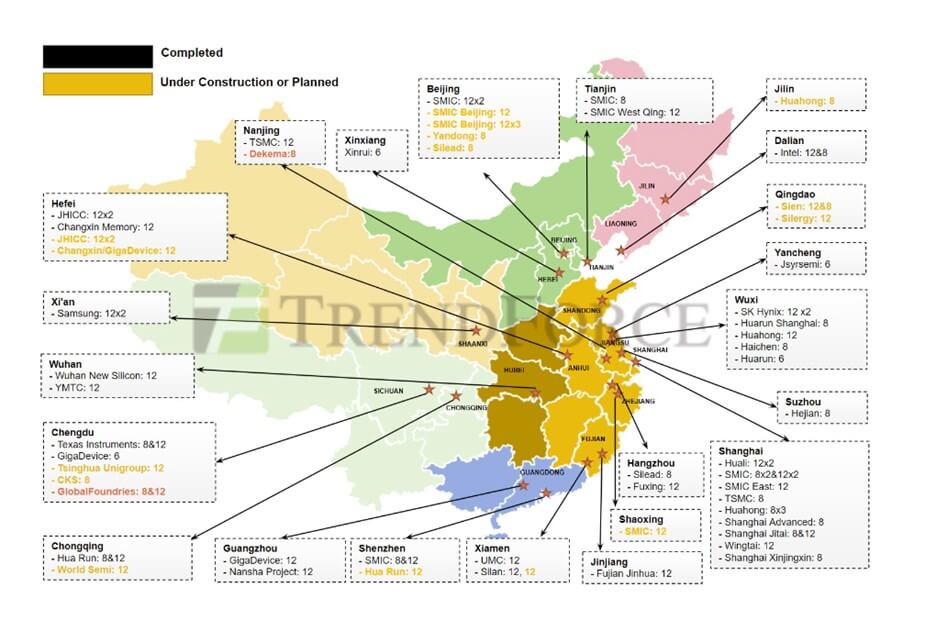

In the equipment segment, there were significant pushouts at the leading edge in 2023. There were also delays with the first TSMC fab in Phoenix. The restrictions in China also had an impact, but not as significant as first feared, and some equipment companies had great years in China. In China and the world, the power, automotive, communication, industrial, and IoT segments kept on purchasing equipment.

According to Trend Force, in China, there are currently 22 or 23 fabs in different phases of construction and 10 more planned. The bulk of these are projected to be 28nm and above with fifteen 300mm and eight 200mm (Figure 2). This is a significant amount of equipment as some of these fabs, when completed, will be running 100,000 wafer starts per month. Depending upon the equipment sanctions, China’s manufacturing growth will continue to be a driver for equipment sales during this next cycle. Silicon Carbide (SiC) for electrification and EV will be a key growth area for 200mm fabs.

Will We See Growth in 2024?

Where does it look like the industry will end up in 2023 and what are the assumptions for growth in 2024? When writing this article, the latest published SIA numbers ran through September of 2023. The chip industry needs to see approximately 4% growth quarter-over-quarter to hit the WSTS forecast of a 10% decline. This would put chip revenues at $515 billion for 2023. Q3 revenue grew 10% over Q2 so hopefully it’s safe to say that there is an opportunity for some upside to those numbers and the year will end a little better than currently forecasted.

On the equipment front for the top few companies, revenue growth looks like it will range from positive 29% growth to a 25% decline, so now it will be challenging to determine where equipment will end up for 2023 until the final numbers are in. The Chinese equipment companies are having a banner year, which will also help the year-end number. For the fourth quarter of the 2023 calendar year, ASML is forecasting a positive 4% growth in Q4 over Q3. Other equipment companies are forecasting flat to slightly down growth for Q4 calendar year 2023. So, while chip revenues are improving, it looks like the equipment segment is taking a short breather as it moves into 2024.

For 2024 the most recent forecast on the chip market is by IDC predicting a 20.2% growth. The WSTS spring forecast predicted 11% growth for 2024, which will likely see an upgrade in the fall 2023 report. Other reports are starting to emerge, and currently, they are falling in between the above predictions.

Key Drivers for Recovery

What are the key drivers for the recovery? According to the most recent Gartner forecast, IT spending will increase by eight percent. Data center systems are the biggest driver with 9.5% growth year-over-year as cloud and AI data centers continue to expand. The PC market is expected to be at 4.9% growth according to Gartner. Mobile phone growth will be in the same vicinity depending upon the success of the recently released models.

Increases at the system level will drive chip growth but, how does the chip industry get to 20& growth? From a chip perspective, the stronger asking selling price (ASP) for HBM DRAM, and higher performance DRAM for systems such as EV, will be the key driver for memory growth. NAND is expected to see growth later in the year as the need for storage grows.

Prior to and in the Q3 earnings announcements, Intel, AMD, QUALCOMM, Samsung, and Nvidia discussed processors for a new AI-enabled PC and AI mobile applications that would become available in 2024. These new devices would use a processor designed to enable personal AI performance and move AI from the cloud to the local device. Depending upon the demand, these new devices could be a market driver for higher-end chips with higher ASPs before the end of 2024. The question to ask is whether industries or consumers are enticed to purchase these new PCs and mobile devices.

On the equipment side, demand will be driven by equipping the new advanced fabs coming online in 2024 and 2025. China will likely continue to have strong demand for equipping its fabs. A key part of the equation is how fast will the capacity that has been taken offline during this downturn get re-adsorbed. Foundry utilization rates are currently in the 70% range and it is likely that the memory fab utilization is in a similar range. Thus, the equipment forecast for 2024 depends heavily on end demand and improving fab utilization before equipment purchases will see a significant pickup.

While chip forecasts in the fourth quarter will likely come out in the 10-20% range, due to what seems a stronger-than-expected 2023 for semiconductor manufacturing equipment, it’s possible that equipment sales will start the year slow, and then begin to ramp in the second half of 2024, ending the year close to the positive 10% number that has been predicted. However, there are a lot of assumptions that must fall into place for that to happen. In the third quarter of 2023, consumer spending was slowing. Analysts will need to determine if this trend continues into 2024 as they make up their forecasts.

Yogi Berra also is reported to have said it’s tough to make predictions, especially about the future. I expect 2024 to be one of those years until the drivers for growth clearly emerge.

This article first appeared in the 2024 3D InCites Yearbook. Read the issue here.