What a time to be in the semiconductor industry! If you’re a chip manufacturer you’re currently being blamed for the woes of the supply chain and shortages, because you failed to anticipate demand. Fortunately, billions of dollars are emerging to help increase capacity. Money is coming from all quarters and new fabs are being planned to increase capacity are being planned and built worldwide or are at least being proposed worldwide.

Semiconductor Spending In the US

The USA wants to regain its tarnished crown in semiconductor manufacturing and R&D, the result is the U.S. government is proposing $50 billion to help facilitate the revival. Intel is spending $20 billion in Arizona, $3.5 billion in New Mexico, $10 billion in Israel. Samsung is spending $17 billion in Austin, and TSMC is spending at least $12 billion in Phoenix. And that is just the United States and near leading-edge technology.

Semiconductor Spending in Asia

Not to be left out, South Korea has committed $450 billion for technology over the next 9 years — that’s dollars not Won — to make sure that Samsung and Hynix continue to be dominant in the semiconductor space. Samsung will also spend a reported $117 Billion by 2030, and Hynix has committed to at least spending $106 billion for 4 new memory fabs and $97 billion for capacity expansion at existing fabs.

Taiwan is also participating in the spending, but it appears to be more funded by the foundries and partner, rather than Government intervention; however, the Taiwanese government has been very active in building the science parks that the high-tech industry uses. TSMC plans to spend approximately $100 billion over the next 3 years. And UMC has tapped its customers for a $ 3.5 billion-dollar fab expansion.

Plans for Fab Expansion Infuses 200mm Equipment Market

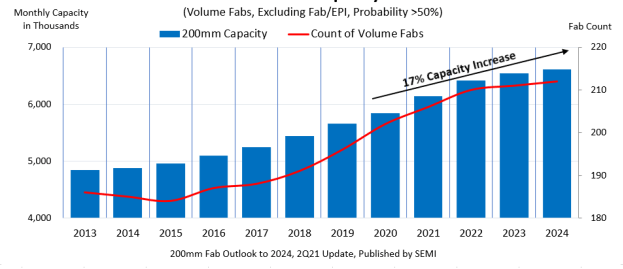

The industry is expanding at an unprecedented rate for both leading-edge and legacy semiconductors. According to SEMI, 200 mm is projected to grow by 950,000 wafers and 22 new 200 mm fabs from 2020 through 2024. 200 mm equipment spending expected to be in the $4 billion dollar range in 2021. A pretty significant amount considering a significant amount of 200 mm equipment is refurbished. However, with the number of 200mm fabs emerging, there will be a significant amount of new equipment that is needed to support the 200mm growth. Good news for companies that still manufacture 200mm equipment.

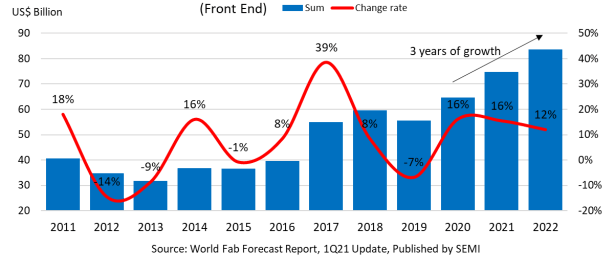

However, the $4.0 billion seems like a trivial amount when compared to the $70 plus billion total expected to be spent in 2021. Although, according to SEMI’s World Fab Forecast report, 100 new fabs will be added in 2021 and in the foreseeable future (Figure 1). This means that 200mm accounts for approximately 80% of the new facilities in the foreseeable future, but only around 6% of the spending in 2021, which accounts for a 17% growth in 200mm capacity.

And as shown in Figure 2, semiconductor equipment spending will be very robust, at least for the next 2 years, with growth reaching over $80 Billion in equipment spending by 2022.

Will this Super Cycle Crash?

The question on my mind is, what happens next? Is this a supercycle? Will there be a crash? or is this a needed infusion of Capex to catch up with the new normal of the internet of things (IoT), the cloud, edge computing, 5G, and the electrification of the world and the automotive industry? Or, is this an attempt at the nationalization of the semiconductor industry by Taiwan, Korea, The United States, and China?

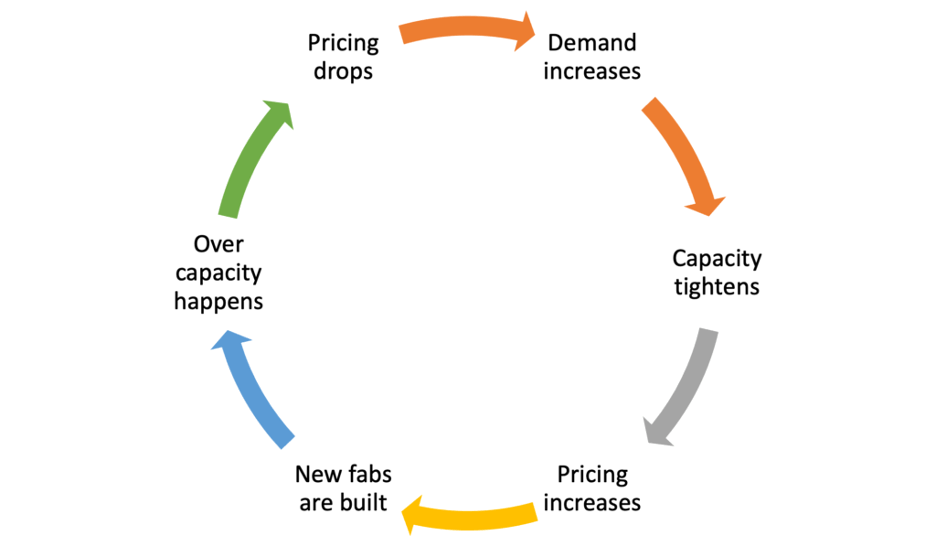

Unfortunately, only time will tell. But if we look at the semiconductor cycle that was discussed last month it would suggest that after the investment in new fabs, there will be a downturn, or at least a slow down as the industry digests excess capacity. As shown in Figure 3, the industry remains cyclical, and one would expect a downturn in 2023 based upon industry history.

The Silver Lining

As the semiconductor industry continues to move through the spending boom and the chip shortage a few positives have been emerging.

- Automotive and others are looking to better planning with the foundries and semiconductor manufacturers. They are either paying upfront or purchasing capacity to ensure a spot in the supply line.

- Just-in-time supply lines will be modified to a just-enough supply line to weather a minor crisis.

- Companies will open up lines of communication with their chip suppliers to enable better production planning.

- Most foundries are showing a profit and are fully loaded for 2021.

- OEM’s near-term fortunes are also looking positive.

Lisa Su the CEO of AMD, who has experienced a few semiconductor cycles in her career in a recent interview with Bloomberg Technology had the following to say:

“Su said she refuses to brand the global chip shortage as a disaster. Instead, it is simply an example of the periodic imbalances between supply and demand in the semiconductor market, she explained.

Su also said the chip shortage has made customers become more open to long-term commitments. It has also forced people to plan their worlds together, she added.”

The Nationalization of Semiconductors

This is not the first chip shortage the industry has been through; although, it is one of the most highly publicized due to automotive makers getting caught without an ample supply of chips. And it will not be the last; however, with the amount of capacity being added across the board there may be some flat years for the equipment companies coming up, and possibly chip makers.

The only real danger I see coming out of this massive semiconductor spending is the potential nationalization of semiconductors. Over its history, the semiconductor industry has been a good example of economics and cost-driving the market. DRAM production moved from the USA to Japan to Korea and then Taiwan. Samsung and Hynix have managed to maintain a significant share of the market with Micron rounding out the big three through some strategic moves. China is trying to gain a share in the memory market, but unless the Chinese government continues to intervene, it is likely the Big Three will prevail.

Historically, logic technology moved from the USA and Europe to Japan, and then Taiwan as TSMC was able to develop leading-edge technology to provide the USA fabless companies a chance to compete with the Logic OEMs.

Microcontroller/mixed-signal companies use the foundries to supplement their capacity. When demand is high, foundries can provide an extra supply, when demand drops, OEMs can keep their factories running and avoid layoffs. Foundries also supply leading-edge manufacturing capability to OEMs that are not willing to invest in 300mm fabs.

Thus, if each country adds enough capacity to meet internal demand for domestic industries there will be a significant excess of capacity when the supply balances out. To a certain extent, it would be stepping back from the globalized industry that has been created and create higher costs and a more cyclical industry rather than the typically well-balanced and rational spending that typically takes place. However, in the meantime, let’s enjoy the cash influx and enjoy the industry growth, as this cycle sorts itself out.