As sustainability matures, the fall of the year seems to be when there is a significant focus on sustainability, culminating in the Conference of the Party (COP) meetings in late November. Companies publish their ESG reports if they have done so earlier in the year. Ratings companies release their rankings, and company management breathes a sigh of relief and starts preparing to decipher their current year data to start the process over again.

Tracking and Reporting Sustainability

Tracking and reporting sustainability is a challenge. It takes a lot of resources to collect, compare decipher, and then create a report on the data. In the semiconductor space, SEMI is working to try and assist its members with structuring and reporting their carbon footprint. Larger companies have been working on tracking and reporting sustainability numbers for several years and are getting close to having a reporting system that works smoothly and gets most of the data. Smaller companies may not have the resources to develop the process, particularly when it comes to tracking scope 3 numbers. This is where SEMI can hopefully come in and help to develop some streamlined processes using prior learning from more experienced members.

This Fall, the Semiconductor Climate Consortium released their first report: Transparency, Ambition, and Collaboration. If you are associated with the semiconductor industry it is worth a quick read to see the direction that SEMI is currently headed. The report is broken down into five takeaways, along with an introduction and conclusion.

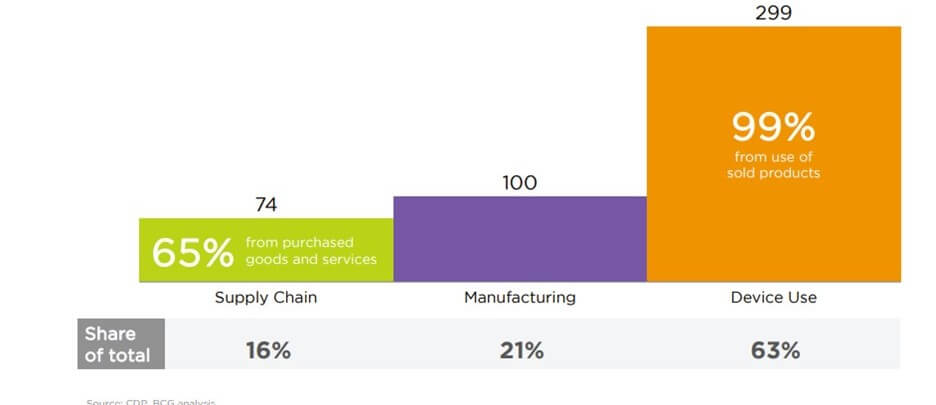

- Baseline of value chain emissions: Semiconductor devices produced in 2021 have a lifetime CO2e footprint of 500 megatonnes (MT), 16% from the supply chain, 21% from manufacturing, and 63% from device use.

- Electricity as the largest lever: Low-carbon energy sources can address >80% of industry emissions primarily by reducing electricity used to manufacture and then use devices, which could be achieved with bold and decisive investments in low-carbon energy.

- Investment and innovation to solve the remaining 16%: Emissions from the supply chain and from manufacturing process gases will require considerable research and development to address, necessitating investments now.

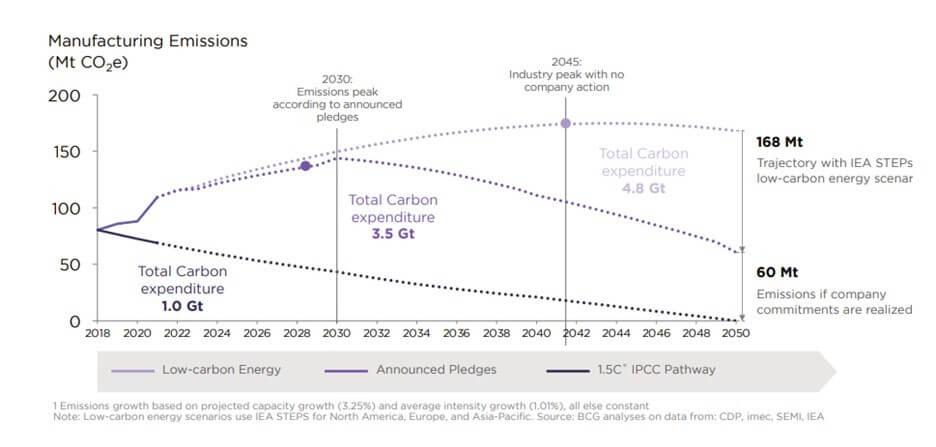

- Future manufacturing emissions scenarios: Current government and company commitments will substantially reduce manufacturing emissions, but they are still forecasted to overshoot the carbon budget for the 1.5°C pathway.

- The dilemma of value chain emissions: Digital technologies requiring semiconductors play a crucial role in reducing energy use and emissions across industries.

The Introduction was a justification for creating this report. IMEC has been looking at the industry’s carbon footprint in great detail, publishing its first report in November of 2021, along with subsequent others. Other companies such as Intel and Samsung have published data on their carbon footprints discussing the different contributions of chips and electronic devices in the carbon value chain. Some of the data reported had been analyzed previously with pretty good numbers.

According to the report:

Past studies have attempted to provide visibility into the sources and quantities of emissions from semiconductor production. However, these studies have not been sufficiently comprehensive across the entire value chain, failed to examine each source of emissions in-depth, and did not offer credible forecasts of how emissions may shift in the future.

So, from SEMI’s perspective, a deeper dive was needed to explore the breadth and depth of the industry emissions and create a forecast for future emissions. The details of SEMI’s work show that:

Semiconductor manufacturing, including electronic design automation and intellectual property (EDA & IP), wafer fabrication, chip design, and package, assembly, and test, is directly responsible for 0.3% of global carbon emissions today and induces another 1% in upstream and downstream suppliers and users.

And:

Baseline of value chain emissions: Semiconductor devices produced in 2021 have a lifetime CO2e footprint of 500 megatonnes (MT), 16% from supply chain, 21% from manufacturing, and 63% from device use.

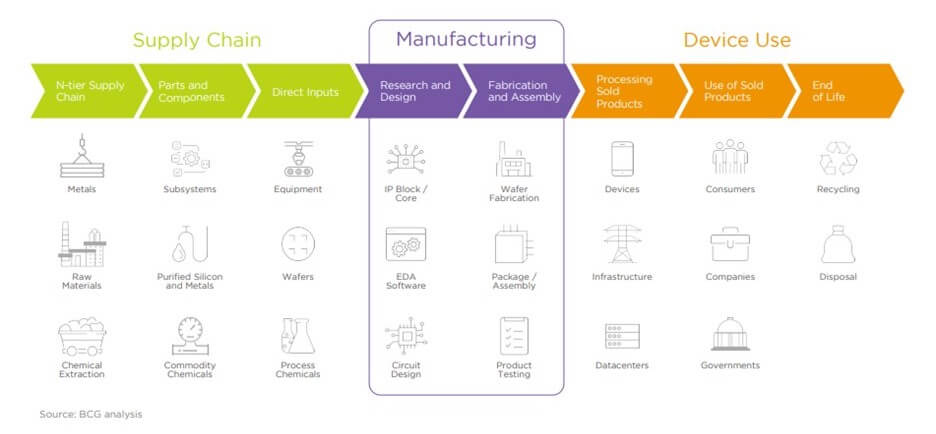

SEMI created a graphic that gives its perspective on the semiconductor value chain activities, which now provides a baseline from which companies can draw to help them set up their analysis of their data.

SEMI also broke down the lifecycle of emissions. IMEC and others have done similar work in the past. The numbers are slightly different but in the same ballpark (Figure 2).

It is interesting to note that 16% of emissions come from the semiconductor manufacturers’ supply chain. This would suggest that 16% is from the equipment and material suppliers. Not surprisingly, 63% of emissions come from the use of the semiconductor chip in its different applications. One point that the report made was looking at location-based and market-based emissions. Most of the data center providers are either 100% renewables or close to that for energy consumption. While that takes some of the heat off, I also think it avoids looking at the huge electricity demand by data centers and enables them to keep using poorly designed algorithms for their applications that use inordinate amounts of power for AI training. Thus, while electrification is the biggest lever for reducing greenhouse gases, it also seems to gloss over the need for looking at how to better conserve energy across the carbon emissions spectrum.

The semiconductor manufacturing industry has been working hard at the third takeaway. Several new chemistries and processes are in development to reduce process carbon emissions. But there are developments with motors, temperature control, cooling, and other technologies that look at conservation, and elimination of GHG sources. Many of these have been presented at the Sustainability Startup Summits at Semicon West.

While reducing the final 16% of emissions is important, more important is looking at how to address the value chain issue of emissions. The chip manufacturers have little control over how their end users employ their chips. The semiconductor industry has been improving the power performance equation with every new generation of chips. The users of the chips have been increasing the amount of power they use nearly geometrically. One company has doubled the amount of energy they use to power servers by 100% every 2 years over the past few years. But according to them, it is okay because it is renewable.

The report does a nice job of defining the problem and setting the direction; although, not everyone fully agrees. In an EE Times article, imec sounds off about what they think are some of the shortcomings of the industry.

SEMI is at least realistic. While some factions of sustainable manufacturing call for full electrification using renewables, in some parts of the world, that is not currently practical. Lack of land mass, challenges in implementing wind, longer periods of cloudy weather, storage challenges, and at least in the United States, a grid infrastructure that needs revising to move renewables from where they are produced to where they are needed. SEMI has suggested alternatives such as modular nuclear, and hydrogen, but those alternatives are still a long way off as well if we are expecting carbon neutrality by 2040 (Figure 3).

While this report sets a good baseline for SEMI and its members to move forward, one thing that I think was missing was a more detailed look at the equipment side of the equation. While many of SEMI’s members are chip companies, most of them are equipment and materials companies. Hopefully, that report is not too far behind this one.