On Sept 21, SEMI hosted a webinar with BDO and mySilicon Compass titled “The CHIPs Act Passed, Now What?” The participants were Joe Stockunas, President of SEMI America; Tom Stringer, National leader of Site Selection and Business Incentives at BDO; John Stringer, VP of Global Public Policy and Advocacy at SEMI; and the Honorable Ian Steff, Former Asst. Secretary of Commerce, and President and CEO of mySilicon Compass. If you are a SEMI member company thinking about how you might benefit from the CHIPS Act, I would contact SEMI and see if this webinar is available on replay, as it will be helpful to your strategy.

There has been a great deal in the press lately about how the funding for the CHIPS Act will be divided, and some of the basics of what is going to take place. However, at this moment, the how-t0-participate has been lacking. This webinar put together the “How To” for the industry. The presentation’s biggest takeaway was that if you’re not already working on your capital project for the CHIPS Act, you might be too late. This was a bit surprising since the funding for the CHIPS was officially defined in early September, and the administrative team has just been announced.

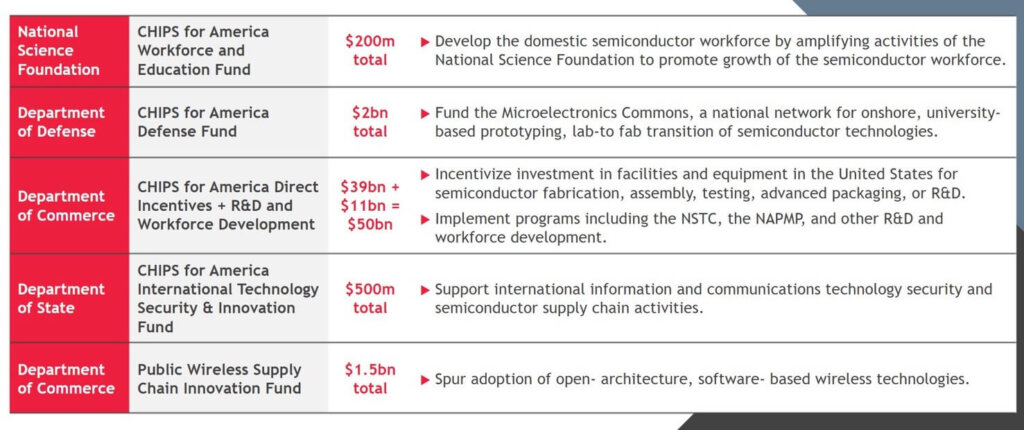

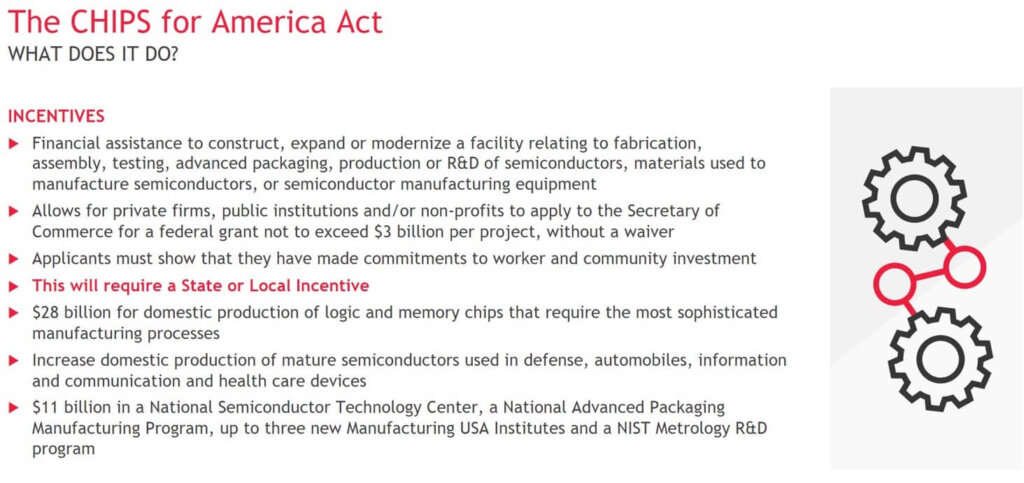

Ian Steff laid out the breakdown of the spending (Figure 1). In his drill down, he explained that approximately 75% of the $39 billion would be for leading-edge manufacturing and that the remaining 25% would be for, as I would define it, legacy nodes. The ultimate goal is to turn back history to when the United States manufactured approximately 24% of the worldwide chips. This would be a significant amount of growth from the current 10-12% currently manufactured domestically, especially since there is now only one DRAM manufacturer in the United States, and in the 1990s there were at least four. Steff also included advanced packaging programs in his comments. Packaging is a critical component of creating a completely resilient chip supply chain, and there are very few packaging operations in the United States. Later comments in the webinar did not seem to limit the awards to just advanced packaging. If you can demonstrate there is a limited supply or the critical nature of your product to the supply chain, your company might be eligible for an award. This is alluded to in figure 2. Enabling the reshoring of packaging for legacy chips such as analog and mixed-signal devices would go a long way to ensure a more resilient supply chain in the United States.

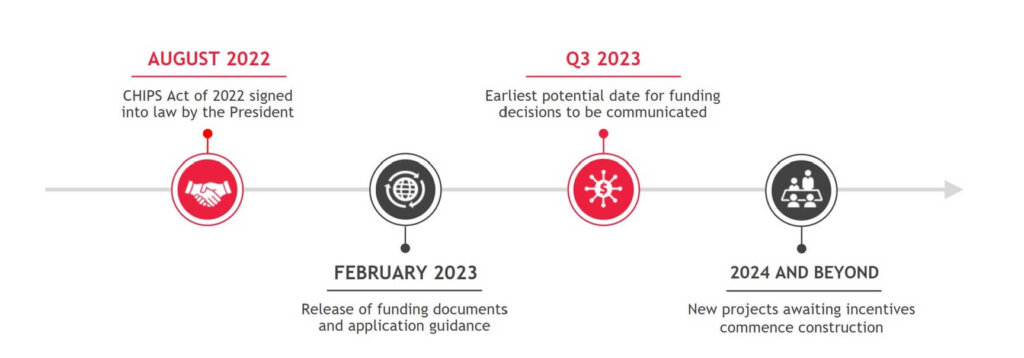

The timeline for the first awards appears to be extremely fast, with the first award starting in Q3 of 2023. This would suggest that projects already underway would see some of the earliest awards. While this thinking was not confirmed. In the how-to portion of the webinar, it was pointed out that you need to organize quickly to set up your company for success. Fortunately, this is a 5-year program so there should be time to bring your company up to speed and participate in awards that will occur later in the process.

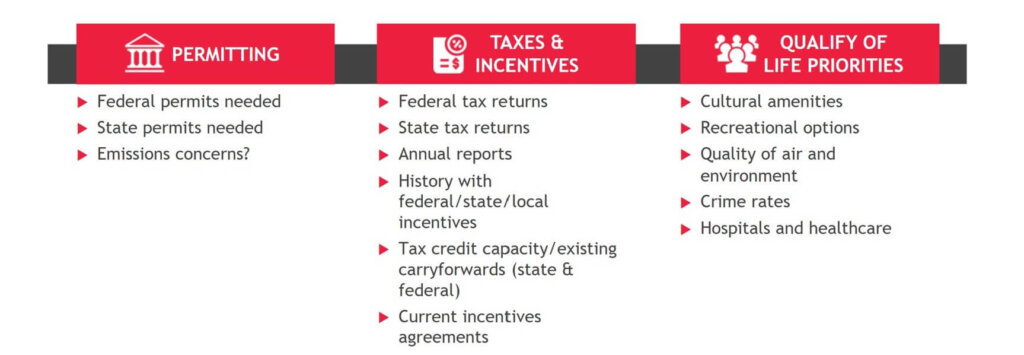

One of the key criteria for CHIPS funding awards is to have local, state, and private capital or incentives already in place, or at least ready for the project. Looking back at the recent fab projects, you can see how Intel, TSMC, Samsung, and Micron have engaged with local and state agencies to secure incentives, thus setting them up to be early recipients of the CHIPS Act. Skyworks partnering with Purdue University for a new fab is also a strategic move that could help to ensure their CHIPS act funding. Figures 4,5, and 6 review the checklist SEMI put together for the webinar to assist companies in applying for funding. Another key point from figure 2 is the worker and community interest. Getting companies to re-engage in workforce development and training is critical to the success of the semiconductor community and a resilient supply chain.

The checklist is very comprehensive, and as with any government project, has the required level of bureaucracy. Smaller companies may not have the necessary resources to gather all the data. John Coony of SEMI, recommends engaging a consultant, as there is not enough time to learn as you go. The implication is that if you haven’t started planning, you had better do so quickly. It takes considerable time to plan a project of this size and then obtain all the permits and approvals to go ahead with a greenfield project.

He emphasized that this is a competitive process, and that building ecosystems and co-locating with customers would help applicants obtain grants.

Tom Stringer concluded the webinar by sharing the keys to success, one of which was engage outside consulting agencies to assist your company in the CHIPS endeavor. This webinar points out that due to the size and scope of preparing a proposal for CHIPS funding, outside help will definitely be needed. How will this impact smaller SEMI member companies that lack significant resources? There is likely to be a critical mass/size cutoff point for companies that will apply for CHIPS funding. Based on the presentation and the complexity of the process, smaller companies supporting key parts of the ecosystem will likely not have the resources to apply for CHIPS grants. Will the trickledown effect from their customers receiving grants be enough to provide, or will a creative solution arise to enable smaller companies to participate in this funding?