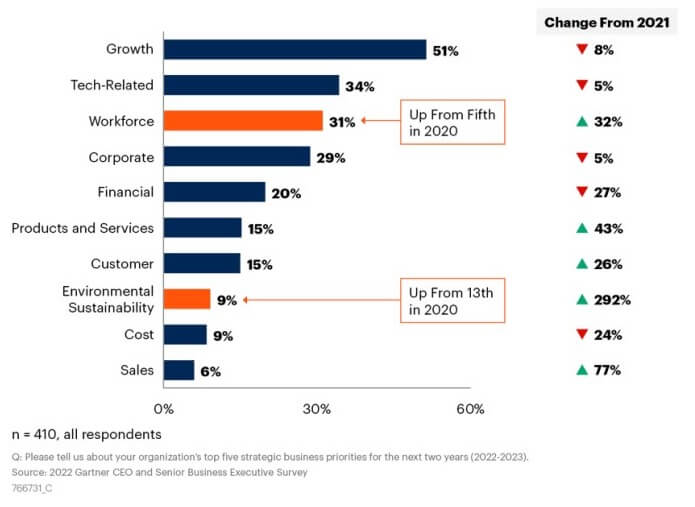

The last month has been an interesting time in the world of sustainability. First, the SEC released its estimates on costs for reporting on climate change, and a document for review on suggested reporting standards. The S&P Dow Jones index removed Tesla from its top 10 ESG index, The Davos economic summit chimed in on sustainability, and Gartner released a CEO survey of IT executives that finally has sustainability ranked as number eight of concerns that those 400 CEOs need to worry about.

The good news is that sustainability is on tech companies’ radar, the bad news is that as the 8th priority, it is likely to receive very little attention, especially with the workforce challenges facing all industries. It also seems from the pushback on the SEC and comments that came out of Davos, that while sustainability is on the tip of everyone’s tongue, actively doing something about sustainability is still left to a few companies.

In addition to all the sustainability news, in my recreational reading, I stumbled across some information on the 1992 Earth Summit in Rio de Janeiro Brazil. One of the key actions out of this summit was to, “stabilize atmospheric concentrations of “greenhouse gases” at a level that would prevent dangerous anthropogenic interference with the climate system”. The outcome of the summit was a focus on reducing gases that would impact the ozone layer, as well as beginning to address greenhouse gas abatement. The book I was reading was I’m Stranger Here Myself, by Bill Bryson published in 1999. In the chapter, The Waste Generation, the goal of the Earth Summit was to reduce GHG emissions to 1990 levels in 2020. The administration in the United States at the time wanted another 15-16 years before rolling back emissions, as the thinking at the time was it would impact the economy as well as company profits.

Well, I guess it’s good news that after 30 years, the world is finally stepping up and trying to address GHG and climate issues, the bad news is that think about what might have been accomplished if industries and Government had really focused on the challenge 30 years ago.

The ozone concerns were addressed in the 1990s. The semiconductor industry addressed the ozone gasses with abatement systems eliminating most of the fluorine and chlorine processes by-products. Other industries also took action and the level of aerosols being released into the atmosphere has been reduced.

However, with sustainability, the recent news shows there is still a considerable amount of pushback or uncertainty surrounding sustainability issues. A large part of the uncertainty is the reporting of GHG and energy usage. The SEC is proposing that companies start officially reporting on GHG emissions. From an analyst/media perspective I view this as a good thing. Companies will finally have the understanding or begin to understand how much GHG gases they produce, and hopefully, then the data used for company sustainability will be standardized and not all over the map. According to Deming, “If you can’t measure it, you can’t manage it”.

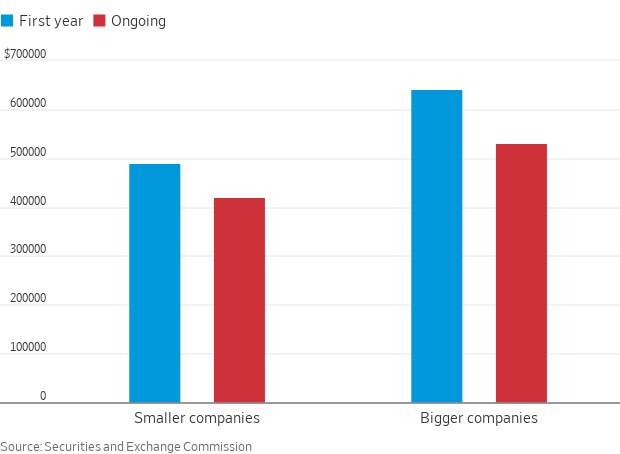

The crux of the problem is twofold. First is the cost of measuring and reporting GHG. The SEC has posted estimates and it’s not cheap. See Figure 3. It reminds me a bit of when Sarbanes-Oxley was implemented.

The SEC states the numbers are a rough estimate and are possibly higher than they will be. This is due to companies needing to collect and report on data that they have not collected before, as well as having to propose potential risks and losses to their company as a result of rising CO2 levels and the temperature increases that come along with the increase of GHG. Estimating potential losses is one of the points of contention regarding the reporting.

To me, this seems like a lack of strategic thinking. If I have a potential risk as a company, don’t I evaluate the pros and cons and come up with a plan of action? Companies do this frequently with business units looking at the strategic long-term gains and losses. Those businesses are either invested in, spun off, or shut down. Recently planning for and then recovering from a disaster has been termed resilience and has been pretty popular on the management lecture circuit.

The second challenge is tracking down scope 3 emissions. Scope 3 emissions are those that arise from upstream buying and transporting inventory to make product and downstream emissions that the product produces once it has left the factory. For most companies, the majority of their GHG emissions are scope 3, and as one can imagine they are difficult to track, as well as control the level of GHG emitted. There are also no real standards or methodology to track down and report on these emissions, as a result, a considerable portion of scope 3 GHG gasses are estimated. They also can change from year to year as companies either discover a source of emissions they had missed or improperly estimated. As the SEC proceeds, they should also consider creating standards and reporting structures to assist companies participating in reporting their sustainability numbers.

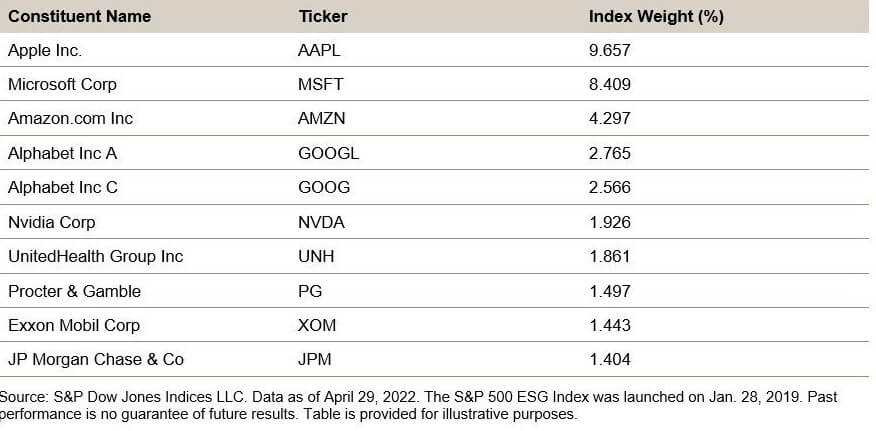

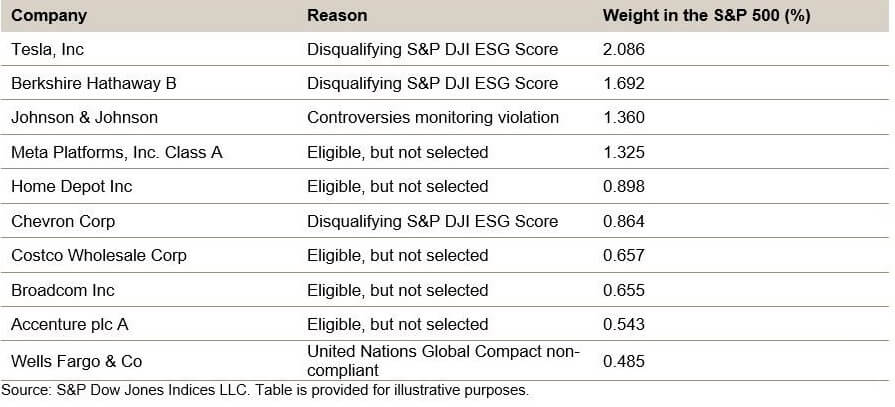

A bit of the challenge in standardization and third-party reporting can be observed in the dropping of Tesla from the S&P 10 ESG index. In my work on sustainability, each reporting/awarding institution has slightly different criteria for recording and reporting data. Some rate sustainability and environmental efforts higher, others governance or social. These are all important issues, but if you are more focused on sustainability than social or governance, a company’s scores can be impacted, and as a result, you can fall off the list.

Figure 4 demonstrates the difference in scores from the different reporting agencies. The parenthesis are the environmental numbers that the agency uses. This makes it challenging for a company to report as there are different metrics used to score the data.

Figure 4: 2021 ESG Results (2020 data) Source ESG reports, FTMA

One of the comments coming out of the Davos economic summit by Emmanuel Faber, the head of the International Sustainability Standards Board, is that smaller companies will be left behind by establishing standards. The thinking is that you can’t require smaller companies to do what the larger companies need to do.

I’m not sure if I agree with this. Companies should be able to determine scope 1, 2, and 3 emissions. Companies should be able to articulate risk due to GHG and temperature rising. They are going to need to do it along the course of year-to-year business as GHG emission reduction becomes a priority, or an environmental disaster hits and they have to adjust anyway.

In their 2020 TCFD report, TSMC gives considerable focus to the environmental risk associated with climate change. The impact of water, drought, and flood, hurricanes, loss of biodiversity are all considered in the TSMC report. TSMC has developed a risk management matrix to assist them in addressing and minimizing the risk involved with climate change. For companies embarking on an ESG and risk reporting structure, the TSMC report and corporate structure is a good place to start.

From the recent reports, there still seems to be considerable momentum toward implementing GHG and ESG reporting structures. Let’s hope that the momentum to create standards and simplify the collection and reporting of data gets more companies on board, and gets us moving towards net zero.