In early October the Semiconductor Industry Association (SIA) released its fiscal year-end report on the State of the Semiconductor Industry for 2021. I will skip the detailed focus on how the industry helped pull us out of the pandemic and stick to technical and economic data.

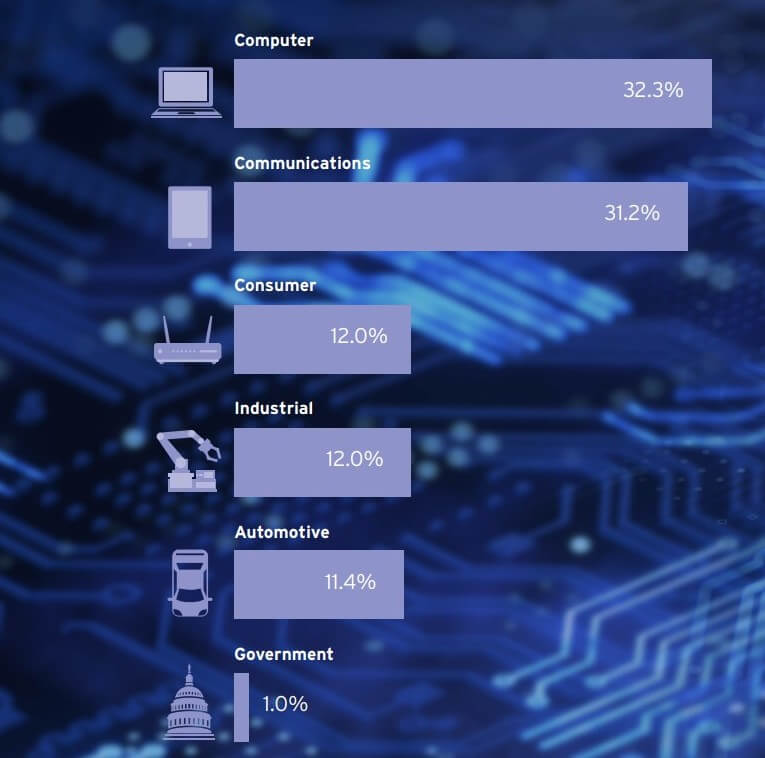

In 2020, sales into some end-use categories, such as computers, experienced significant increases, as COVID-19 spurred more remote work and school. Other markets, such as automotive, ultimately ended the year with negative annual growth (Figure 1). The first half of 2021 has seen strong end-market sales across the board.

Looking at demand share by end-use we see that computer and communications are at about 30% each and consumer, industrial and automotive about 12% each (Figure 2).

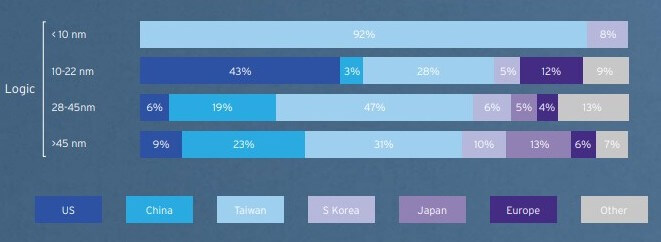

A breakout by region and activity is shown in Figure 3. The US maintains market share leadership in the activities that are most intensive in R&D: EDA and core IP, chip design, and manufacturing equipment.

Raw materials and manufacturing, both wafer fabrication and assembly, test, and packaging, which are more capital intensive, are largely concentrated in Asia. Asia is home to about 75% of the world’s total semiconductor manufacturing capacity.

The US is a leader in chip design. U.S. fabless firms account for roughly 60% of all global fabless firm sales, and some of the largest IDMs, which do their own design, are also U.S. firms. The US also accounts for the largest share of the global design workforce. While both IDMs and fabless firms design semiconductors, fabless firms choose to focus exclusively on design and outsource fabrication, as well as assembly, packaging, and testing. Fabless firms typically outsource fabrication to pure-play foundries and outsourced assembly and test (OSAT) firms.

While the U.S. leads in R&D-intensive activities, it has fallen behind Asia in manufacturing technology particularly for logic. According to a recent SIA/BCG report, there is currently no cutting-edge logic capacity below 10nm being done in the United States. It is all being done in Asia where 5nm process technology has been achieved and 3nm technology is on the horizon. In memory manufacturing technology, the US is regaining competitiveness in DRAM and 3D-NAND. U.S. firms are also at the cutting edge of advanced packaging technology using 3D-heterogenous integration. Finally, the U.S. industry is leading the way in a number of emerging manufacturing technologies such as compound semiconductor manufacturing technology and silicon carbide (SiC).

The semiconductor industry has a considerable economic footprint in the US with nearly 277k people work in the industry; designing, manufacturing, testing, and conducting R&D on semiconductors. In 2020, the total impact of the US semiconductor industry on GDP was $246 B.

In terms of the impact on income, the industry was responsible for generating $161 B in income in 2020 in the United States. U.S. exports of semiconductors totaled $49 billion in 2020, fourth-highest among U.S. exports behind only airplanes, refined oil, and crude oil.

For all the latest on Advanced Packaging stay linked to IFTLE…………………..