While a significant part of the rhetoric surrounding the CHIPS for America Act (CHIPS Act) focuses on improving manufacturing in the United States and supply chain issues, there is also a discussion about semiconductor R&D. In recent postings, I have discussed some of the how’s and why’s US companies have lost the lead in manufacturing. Another part of the CHIPS Act focuses on U.S. semiconductor R&D leadership.

A great deal of discussion around the CHIPS Act has involved Intel’s slowing of Moore’s law and not keeping up with TSMC and Samsung on technology node shrinks. One could argue this is as much an economic discussion as it is a technical discussion. Why move to a new technology node with all the associated costs involved, when the current technology node still produces a chip that is ahead of the competition? But since that’s not the point of this discussion let’s leave that debate for another day.

At one time the U.S was a leader in semiconductor R&D. The solid-state transistor was developed at Bell Labs (Figure 1) and the integrated circuit was created by Jack Kilby and Robert Noyce of Texas Instruments and Fairchild (Figure 2).

These developments launched a very active semiconductor industry with a significant amount of R&D to support the growth over the next few decades.

In the 1980s prior to the breakup of AT&T and Bell Labs, most companies manufacturing ICs had a significant amount of investment in R&D both in material development and chip development. These included Bell Labs, RCA, IBM, HP, Texas Instruments, Digital Equipment Corp, Motorola, and Westinghouse just to name a few. In Europe, SGS Microelettronica, Thompson Semiconductors, Phillips, and Siemens were all active in materials and chip development. In Japan, key players included Hitachi, Sony, NEC, and Fujitsu. The competition for patents, and getting papers accepted at conferences such as IEDM was intense. Here is a great resource for companies that were founded prior to 2006, along with the industry consolidation that has taken place.

Having a materials lab essentially next door to the fab in which one was working was essential to the development of new materials to improve chip performance. Moving from the 80s to the 2020s, the number of dedicated semiconductor R&D facilities like the ones in the 80s are few and far between. In the 80s nearly every large company had a significant R&D operation. In the 2020s this number has shrunk considerably. Intel, and IBM, in the U.S. are the two most significant R&D facilities left.

Sematech, a research consortium formed in 1987, was initially funded by the U.S Government as the result of the U.S losing chip dominance to the Japanese. It made it possible for U.S companies to gain ground on the Japanese from a technology aspect and take dominance on the logic front. The initial national effort morphed into an international effort to defeat the red brick wall, as government funding dried up. Now all that is left of Sematech is in the TEL Technology Center, America in Albany, New York, and is affiliated with IBM and the State University of New York. SUNY. Thus, the strength that the U.S had in semiconductor research and development in the 1980s has dwindled as the research and material labs that had been funded by companies have shrunk or been outsourced due to government intervention, economics, and industry consolidation.

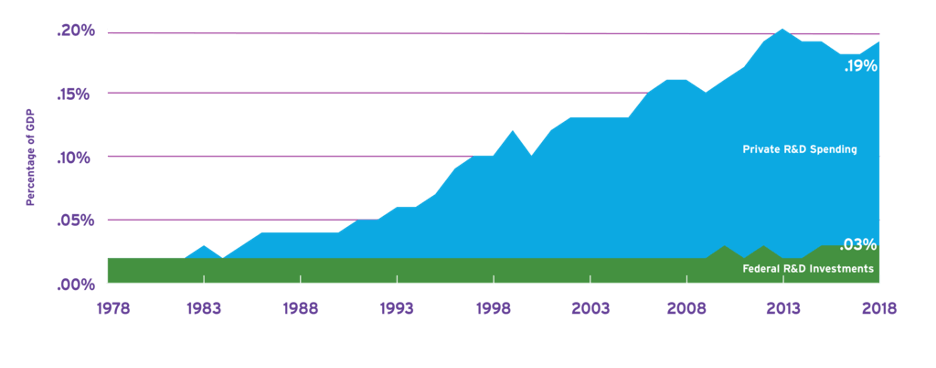

Government funding for semiconductor development comes from the NIST, DARPA, and other avenues; however, Government spending on semiconductors has dried up in recent years according to the SIA or just hasn’t grown with the industry. With only $1.7 billion dollars spent directly on Semiconductor research, and 4.3 billion spent on related semiconductor fields in 2019. Private funding is running at around $40 billion dollars in 2019.

Another source of research dollars for the industry is The Semiconductor Research Corp, which is a consortium of more than 20 premier semiconductor companies. According to its website, the SRC partners with more than 100 universities and multiple government agencies. The SRC manages three programs with a combined 55 research topics and more than 500 research projects carried out by more than 1,200 SRC-sponsored students. Since 1982, SRC has funded more than $2 Billion in research, built a semiconductor workforce by sponsoring more than 12,000 graduate students, and provided over 700 patents to member companies.

In discussions with semiconductor and semiconductor equipment companies about their R&D programs, several companies have active programs with universities, either with the SRC or independently to fund what has been called Intel pathfinding research. This research looks at materials, transistor technology, and processes that are typically 10 plus years in the future, and serves as a source for future researchers and employees in the semiconductor industry. One can see the results of these pathfinding efforts at conferences such as the IEDM and VLSI conferences. However, the pathfinding papers from universities are not just from the U.S. Korea, Japan, Taiwan, China, and Europe all have significant university programs that are focused on semiconductor technology, helping to grow a global business.

Government Labs

In the heyday of the industry, even the Government labs were heavily involved with research projects. Sandia Labs in Los Alamos New Mexico and in Livermore CA Labs contributed to materials and equipment development. The First EUV test stand was built at Sandia in Livermore, with Government and industry support. Eventually, Nikon and ASML began commercialization efforts, with ASML being successful in developing all of the pieces that were needed to successfully create the EUV system. A big part of the success of EUV development and one of the semiconductor industry’s key research and development centers is IMEC in Belgium. In the past 20 years, IMEC has been central to collaboration across the semiconductor industry, in logic, memory, power semiconductors, and 3D packaging.

The National labs continue to play a role in semiconductor development, with Sandia partnering with Intel over the next 10 years on advanced chip development, and Argon Lab’s using AI to optimize the fabrication process, so while many of the research labs have faded the DOE labs are still playing a role in chip development.

However, a large percentage of industry pre-competitive research is occurring overseas. IMEC has been central to the success of EUV as mentioned above. They were instrumental in the development of Hi-k metal gates. Imec is currently at the center of next-generation transistor development for gate-all-around and monolithic transistors that are emerging at TSMC, Samsung, and Intel. IMEC also plays a significant role in the packaging space with pioneering work on 3D packaging and chiplet technology. According to a recent IMEC report, globally, imec is partnering with over 800 companies and over 200 universities each year. As a result, imec is amongst the top contributors to globally leading conferences and peer-reviewed publications in its domains.

IMEC is not the only precompetitive development center in Europe. CEA-LETI in Grenoble France is also playing a significant role in pre-competitive development. Intel and ST Micro are key collaborators at CEA-LETI as are other semiconductor companies. At one time, IMEC and CEA-LETI were looking to partner in pre-competitive research for the industry, but it seems like that partnership was a casualty of Covid. It will be interesting to see if there is a regrouping now that there is more face-to-face and collaborative efforts.

So while the CHIPS Act continues to be debated in Congress, it will be interesting to see how the pieces of the pie are sliced up, and if the dollars will keep flowing after the first go-round. What will also be interesting is how U.S companies will behave. Intel currently participates both with IMEC and CEA-LETI. If a U.S. center of semiconductor research is created out of the CHIPS Act will companies such as Intel invest more R&D dollars at home, or will the European centers continue to flourish?