February and March have been very active in the semiconductor industry. Quarterly announcements wrapping up 2021, pundits’ initial semiconductor industry forecast predictions for 2022, and capital expenditure announcements, that to a certain extent boggle the mind, set the landscape for a solid future for the semiconductor and packaging industry, at least for 2022.

The announcement by Intel this past week caps a series of new factory announcements by Intel, TSMC, TI, Samsung, Bosch, and others over the past year. Some of these announcements are driven by emerging demand for electrification of the auto industry, but also growth across the board of semiconductor content in nearly every aspect of our lives.

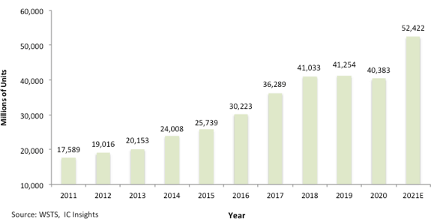

We have all felt the pain of the shortages, some due to supply chain issues and others due to a significant increase in demand. Bill McClean of IC Insights highlighted this increase in demand in January of 2022, citing that the IC industry shipped 30% more IC units in 2022 to the automotive industry. This compares to the industry average of a 22% increase year over year. So, a significant jump in demand is not just a result of the supply chain or poor planning in the automotive industry. There is the question of double ordering, but since we still hear of tightness in the automotive as well as other industries, double ordering would not be the whole reason for the jump. With the strong demand, it appears we have entered into a new growth era for the semiconductor industry.

As a side note on the chip shortage, the Build-a-Bear company cited a chip shortage that impacts their talking bears. So, it looks like the shortage, or supply chain problems will be around for a while, especially now with the recent earthquake in Japan and microelectronic production and supply facilities being shut down to assess the damage.

Figure 1: Motor vehicle IC unit shipment trends (2011-2021E – Source WSTS, IC Insights)

Before I was able to read the details of the Intel announcement, my first thoughts went to Intel helping to build microcontrollers for companies such as ST Microelectronics and NXP in Europe to help reduce the uncertainty of manufacturing and packaging in Asia.

I was pleased to see that the fab will be leading-edge, or at least close to leading-edge and that Intel is also investing in a packaging facility in Italy. The packaging facility in Europe will be an improvement in Europe’s supply chain reducing, dependency upon Asia. It is also exciting to see the R&D center in France. Intel has ties with both IMEC and CEA-Leti so it will be interesting to see how the R&D center evolves. The move provides the potential for European innovation to be combined with the efforts of Intel’s development centers in America.

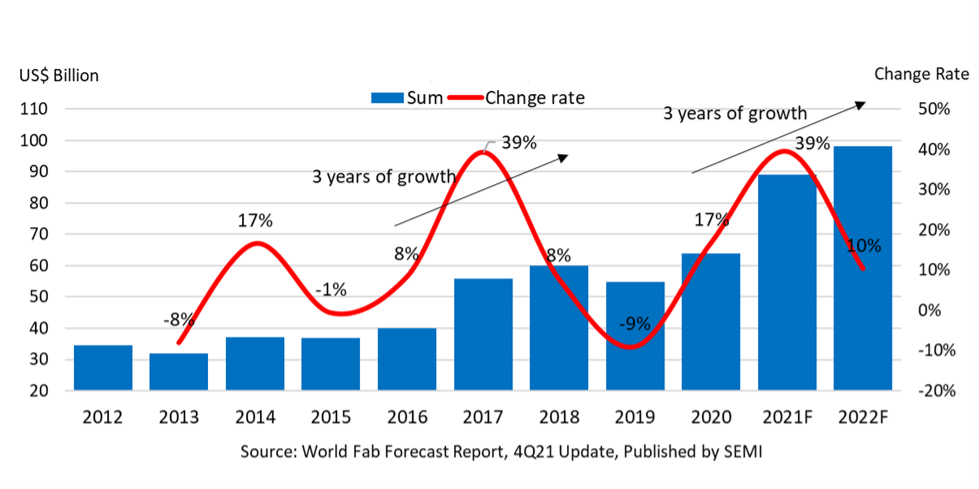

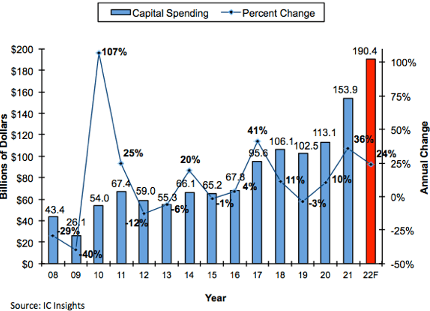

Intel’s announcement will add to the capital expenditures and fab equipment spending numbers released by SEMI at the end of December. The additional 10% growth SEMI expected in 2022 is probably a bit low based upon new fab announcements. The March IC insights capital spending report confirms this. IC Insights is predicting a whopping 24% increase in 2022 following the 36% increase in 2021. IC Insights puts capital spending at $190.4 million dollars in 2022; an astonishing number for those of us who have been in the industry for a while.

Figure 2: Front-end fab equipment spending (Source SEMI Global Fab Spending Report Q4 2021)

Three-year spending increases are rare in the semiconductor industry, as one can see from the graphic. The last time it occurred based upon my records was 1994-96 when Korea was establishing DRAM dominance in the marketplace.

The Next Semiconductor Industry Forecast Wave

From the semiconductor industry forecast perspective, the WSTS released its most recent update in late March. 2021 came in at $556 billion dollars, a 26.5 percent increase over 2020, and the WSTS is predicting a 10.4 percent increase in 2022 bringing the market to $613.5 billion dollars.

However, with the recent earthquake in Japan, and sanctions that are currently happening, it will be interesting to see if 2022 gets a reset when new numbers come out at SEMI’s Industry Strategy Symposium (ISS) in April, and in the June reporting cycle by the WSTS. Challenges with NAND production, and a temporary shutdown at Renesas and other manufacturers in Japan to access earthquake damage, will likely revise the 2022 semiconductor industry forecast downwards if production does not resume quickly.

2023 numbers will also be interesting when they start to emerge. To a certain extent, I’m glad I’m no longer actively forecasting, only commentating. There have been multiple predictions of a semiconductor glut as new factories come online, or the supply of 200 mm parts catch up with demand. There are also talks of a recession as interest rates begin to tighten, and sanctions are having a downwards impact on the GDP of various entities. The earthquake, sanctions, and interest rates will all have an impact on 2022 as well as 2023. The question forecasters will need to discern is how much!

There is significant pent-up demand that in the near term does not appear to be abating, supply chains are still a concern, and 200 mm manufacturing is still impacted due to demand. It will be a challenging year to forecast, and users should pay close attention to the assumptions that are being made to come up with the forecast.

One signal that 2023 might be better than expected is that the silicon wafer manufacturers have announced significant expansion plans. SUMCO, Global wafers, and SK Siltron are all increasing production to meet global demand. While there has been tightness in the silicon supply chain for a few years, the industry-wide expansion suggests that business is growing enough to support a significant increase in the wafer manufacturing sector, which historically adds capacity very cautiously.

Historically, there have never been four years of consecutive growth in the semiconductor equipment industry, so it’s hard to imagine that 2023 would be positive or even flat. However, the most recent SEMI fab spending report, released in January, mentions that there are 128 new facilities under construction or awaiting equipment installation: 27 to be equipped in 2021, and 25 are expected to equip in 2022. This would suggest there are 78 fabs to be equipped in 2023 and beyond, along with the new fabs that have been announced since the end of 2021. With supply chain issues at the forefront of the industry’s mind, and potentially government money needing to be spent, 2023 could be stronger than one would expect. On the flip side, if you don’t need chips, you typically don’t equip a fab. Intel’s Chandler site is a good reminder of that for those of us who expected it to start up in the normal Intel manner.

Thus, the upcoming semiconductor industry forecast season will be interesting for those of us watching and challenging for those having to put up numbers and stand by them. The good news is that even if we have a slow year or two in our future, the long-term outlook is still strong.