For the first time in its 71-year history, the ECTC committee veered away from strictly technical topics to include a panel discussion on market trends and the economic outlook. Moderated by SemiEngineering’s Ed Sperling, much like a relay race, the session was structured to start with the big picture story, and then drill down into specific segments, ending with a very lively and interactive Q&A session on Zoom. I was glad to join the live session, and appreciated it was held at 5 pm in my time zone!

The Global Economic Outlook

Carolyn Evans, Chief Economist Intel Corporation took the first leg in the story-telling relay, providing a picture of the global economic outlook. She said the speed and depth of the downturn were unprecedented, and especially impacted consumer sentiment and labor markets. As we’ve all witnessed in the last 18 months, the shift in consumer spending is what put our industry into a growth cycle, and a subsequent chip shortage. As spending on services dropped off (we couldn’t GO anywhere), spending on technology increased and the digital transformation sped up.

Due to her position at Intel, however, Evans was unable to comment on the semiconductor supply chain, for that she passed the baton on to Duncan Meldrum, Chief Economist Hilltop Economics who talked about the implications the economic outlook has on semiconductors.

Its Impact on the Semiconductor Industry

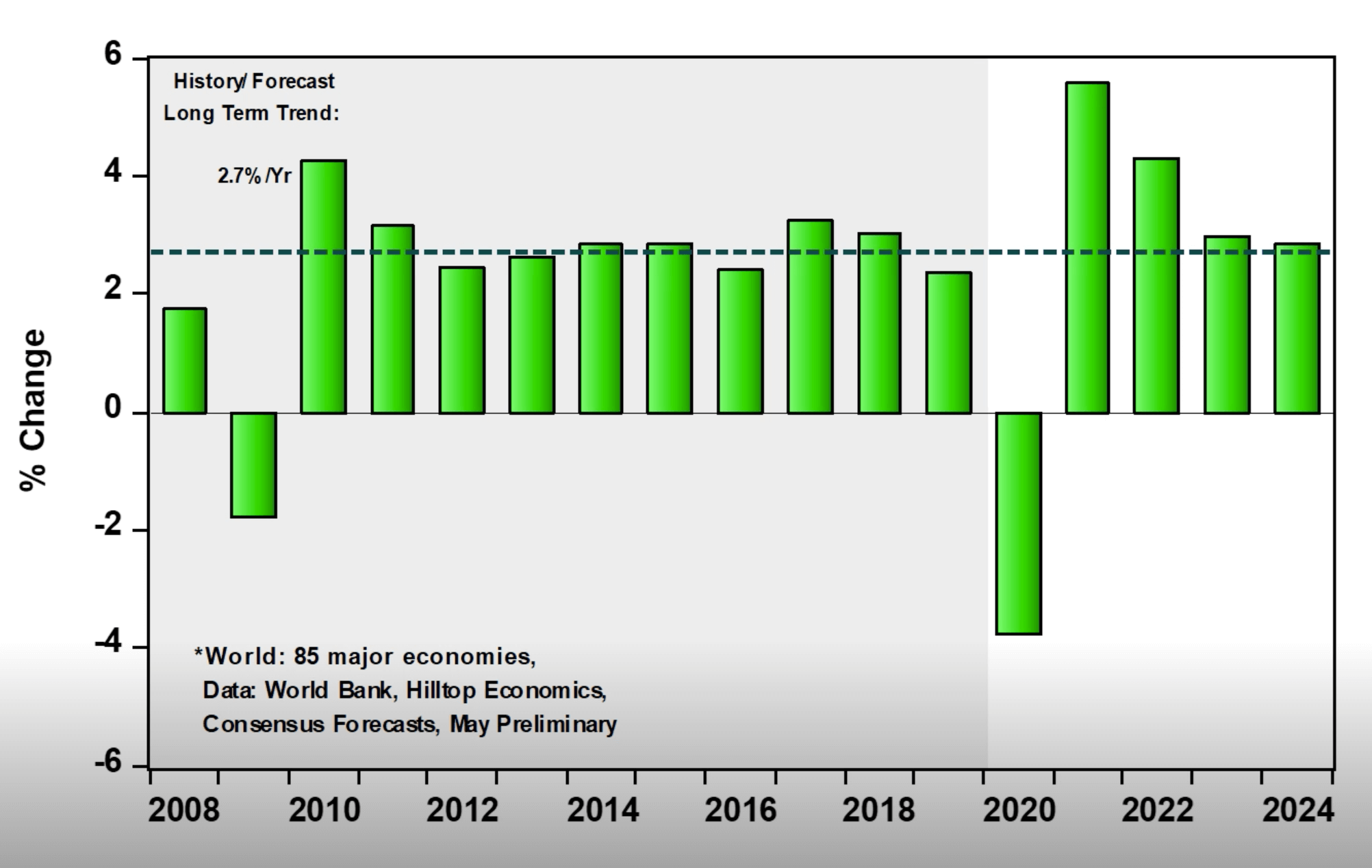

Meldrum says we are in the midst of a healthy economic recovery. However, there could be some softening once the initial impact of the pandemic fades. He said the vaccines are working, and stimulus packages are effective. He also said the current jump in prices we’re seeing for goods is temporary, and the risks will not grow into real concerns.

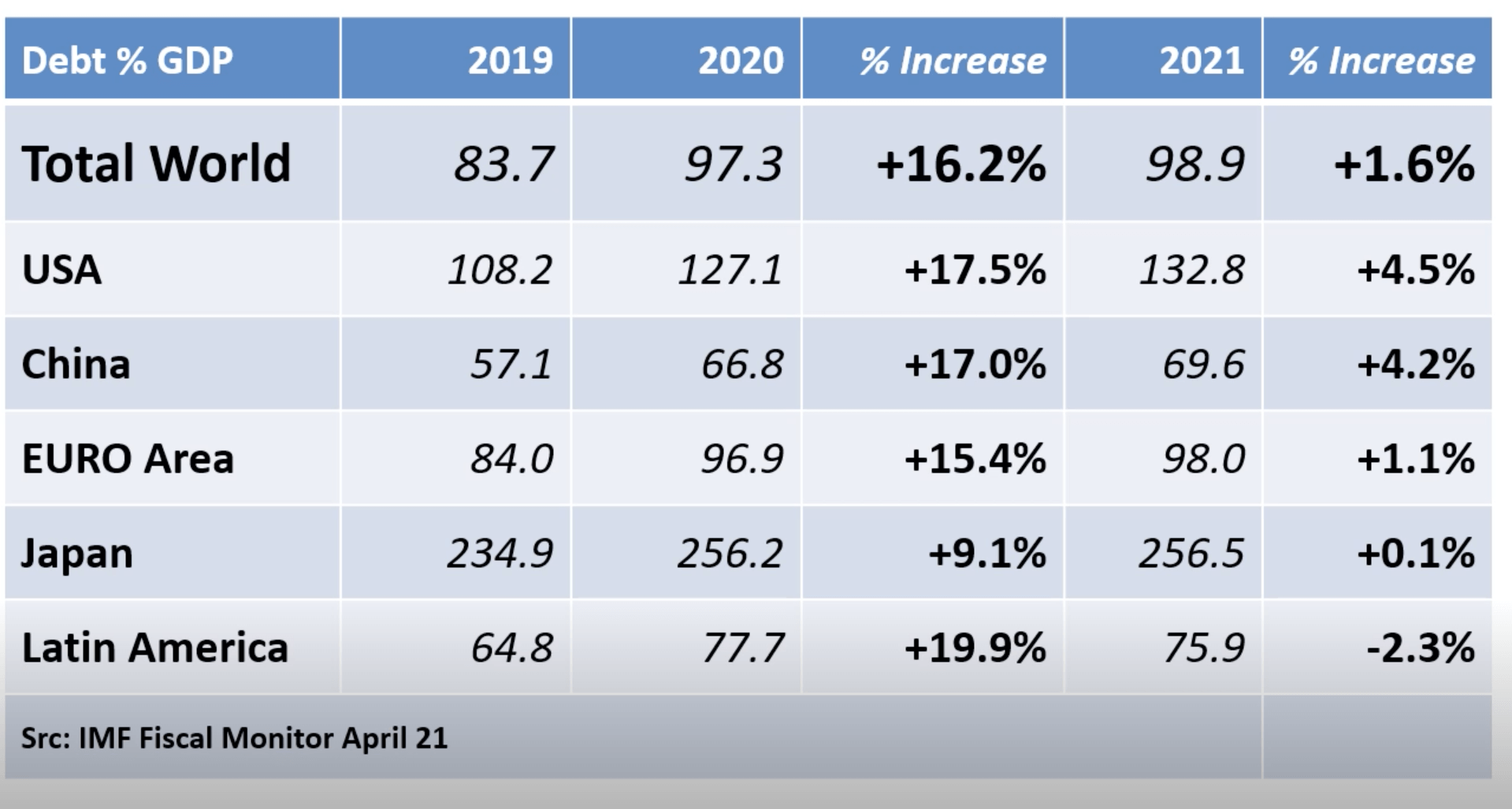

Both economists compared the decline in 2020 with the financial crisis – the good news is that the recovery has been much quicker and stronger in the US (Figure 1). This is likely a function of stronger stimulus packages that the US enacted relative to 2009 and 2010 (Figure 2).

One big difference between the two recessions is that technology is booming now, because of its importance. Technology allowed for economies to continue performing while shut down. Technology goods moved from discretionary to necessary. Overall, Meldrum’s economic outlook calls for growth for the semiconductor industry over the next four years.

Meldrum also debunked some concerns about anticipating growth for a significant period of time, based on historical cyclical periods. Although it’s safer to assume that after a surge in 2021, there will be a payback period once global economies fully re-open and people start traveling again. “Spending on technology will dip, but it’s not imminent, and it will not take us down,” he said.

External factors that could disrupt this rosy picture included too much capacity from excess optimism and the risk that if policymakers decide to rebuild full semiconductor production chains into their economies it could cause ongoing border trade problems. On the upside, the tech boom could lead to greater demand, says Meldrum.

Are We Overreacting?

Risto Puhakka, President VLSI Research Inc picked up the baton next to play Devil’s Advocate, asking if this “pandemic turbo-charged digitization” is putting us in a state of irrational exuberance? The answer is really, No. For the moment, we can’t ship equipment and chips fast enough. Utilization rates are at an all-time high, and we’ll need more equipment to meet demand in the next year.

Puhakka predicts the semiconductor equipment market to grow 30.8 percent to $USD 121 billion, and the assembly and test equipment market to grow 40.9%. He predicts a down year will come for the assembly and test equipment market in 2024.

The Impact on the Advanced Packaging Market

Jean-Christophe, Yole Développement, took the baton across the finish line with a closer look at what’s happening in the advanced packaging technology sector. He talked about how artificial intelligence and advanced nodes are driving high-performance advanced packages. The slides looked suspiciously familiar, and I realized the presentation was similar to the one that Phil Garrou had just reported on in IFTLE, which was presented at IMAPS Device Packaging Conference. So rather than me repeating the highlights, you can read them here.

Q&A Session

The benefit of attending the live version was being able to participate in the live Q&A session. Rozalia Beica, AT&S, who organized the session, joined the panel discussion to lend her expertise from the materials perspective. I captured what to me were the most interesting questions and answers below.

Q: Is there a capacity shortfall?

Risto: The shortage truly is real. We can’t spend our way out of this. We need supply to deliver components. If we’re missing one component, the car can’t be shipped, for example. It comes back to the equipment suppliers. The equipment supply chain is being stretched to its limits.

Rozalia: The materials are there for substrates. We see growth in IC substrates driven by demand from the server market, high-performance computing, and other market segments. Lead times for equipment are increasing. The supply chain is impacted by the substrate supply shortage and the demand.

Jean-Christophe: Mulitple things are working in parallel: high-end growth, lower wafer volumes, and the technology transition. The level of growth is linked to price increases and what companies can produce. For equipment, the next shipping date is July 2022, which means we can increase capacity in 2023! This is not good for mid-term activities. Everyone understands now how semiconductors are important for the whole economy. That means there will be lots of funding for R&D. Political impact is important to support this industry in the long term.

Q. Should we be concerned about double and triple ordering for parts and equipment?

Duncan: As an economist, I look at behavior and long cycles, so don’t have clear visibility of that. However, I would be surprised if (double ordering) isn’t happing in the background. We’re not at the same risk as we were in 2009. The industry is smarter and there are fewer players. So I don’t think the risk is there, but it’s something we should be cognizant of. Once people are traveling again, they’re not going to buy PCs for a while. There may be a downdraft in a year or two.

Q. Do we see padding in the supply chain?

Risto: Based on inventory data, we haven’t seen a substantial increase in inventory. The billing ratio is low. There is, however, interest in running with higher inventory levels. Just-in-time manufacturing is becoming just-in-case. This will alleviate big supply chain disruptions.

Are we entering an arms race involving technology?

Risto: The short answer is yes. It will be interesting to see if the numbers materialize. There are announcements about an R&D joint venture between TSMC and Japan. This is driven by national security concerns and geopolitical stance.

Carolyn: What is the impact of all that investment? It sets an unrealistic baseline.

Duncan: It depends on whether we can see demand for final products that we’re designing for. If the demand is driven by national security, there will be an oversupply. If it’s to satisfy demand, we’ll be glad to have it. It’s not rational based on what we would say is a reasonable final demand forecast.

What about the talent shortage and mining talent from different countries?

Risto: Between Intel and TSMC, there is going to be competition for talent in the Phoenix, Arizona region. The lack of qualified labor will be a limiting factor across major regions that produce semiconductors.

Carolyn: What we’ve learned over the past year and a half is that patterns of work can be different. Labor doesn’t have to be where a company’s headquarters is. That opens up the potential for the global labor market.

Françoise: Except, does it? The talent shortage we’re talking about involves more than just executives and chip designers. Semiconductor manufacturing technicians will be required to run the lines in those fabs. That’s the shortage to be concerned about. To learn more about that, listen to our latest 3D InCites podcast episode. (I didn’t actually say this during the discussion, because while attendees could interact through chat, it’s not possible to ask questions live – but it’s what I was thinking, and so I get to include it here.)

But wait, there’s more on the economic outlook…

To get the full experience of this session and what was discussed, I urge you to register and attend Virtual ECTC here. On-demand content is available until July 4th. Live events continue tomorrow, beginning with the ECTC Diversity Panel: Diversity Does Matter and Can Drive Enhanced Business Performance. All live events are recorded and available in their entirety. Be sure to also stop by and visit the exhibitors. They need our support! ~ FvT