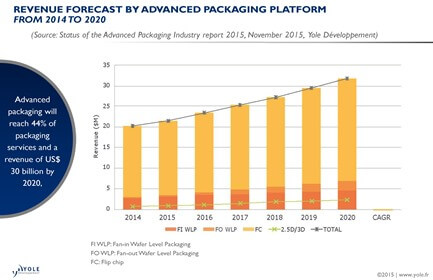

“Advanced packaging will reach 44% of packaging services and a revenue of US$ 30 billion by 2020,” announces Yole Développement (Yole). Overall, the main advanced packaging market is the mobile sector with end products such as smartphones and tablets. Other high volume applications include servers, PC, game stations, external HDD/USB and more…

According to Yole’s latest advanced packaging report entitled “Status of the Advanced Packaging Industry” (2015 Edition), emerging applications are coming from the IoT[1] world, with wearables and home appliances (connected home) solutions already penetrating the market. Other early stage IoT investments have been also made in smart cities, connected cars, industrial devices, medical applications…

In parallel, the Chinese companies play an important role in the advanced packaging market growth: “At Yole, we see an increased activity of Chinese capital in the advanced packaging industry”, explains Andrej Ivankovic, Technology & Market Analyst, Advanced Packaging & Semiconductor Manufacturing at Yole. “The objective of the semiconductor transformation in China is to decrease external dependency and set up a complete internal supply chain that can serve domestic and international customers…”

In this context, what would be the evolution of the advanced packaging industry? What will be the status of the supply chain by 2020? Which packaging technologies will be the most critical tomorrow and after? With the emergence of IoT applications, the development of local Chinese industry and numerous M&A coming from the overall semiconductor industry and the direct impact on the advanced packaging supply chain… Yole’s advanced packaging analysts offer you insight into the new advanced packaging world…

“Status of the Advanced Packaging Industry” report (2015 edition) released by Yole, the “More than Moore” market research and strategy consulting company, provides an high added-value market overview of the industrial landscape; under this new report, Yole’s advanced packaging team proposes a comprehensive analysis of the technology trends and also assesses the future development of the advanced packaging market.

This analysis confirms the market positioning of Yole Développement and highlights the knowledge and deep understanding of the company within this industrial field.

According to Yole’s estimates, advanced packaging services revenue will increase by US $9.8 billion from 2014 to 2020 at a CAGR[2] of 7%, in majority due to high volume adoption of Fan-Out WLP (FOWLP)[3], 2.5D/3D and evolution and growth of Fan-In WLP and flip-chip. Advanced packages currently account for 38% of all packaging services or US$ 20.2 billion and are expected to grow share to 44% and US$ 30 billion by 2020.

The mobile sector remains the main advanced packaging market with smartphones and tablets as end products. Other high volume applications include servers, PC, game stations, HDD/USB, WiFi hardware, base stations, TVs and set top boxes. The scent of IoT is spreading with first products already on the market in the form of wearables and smart home appliances. Further early stage IoT investments are made in sectors such as smart cities, connected cars, various industrial devices and medical applications.

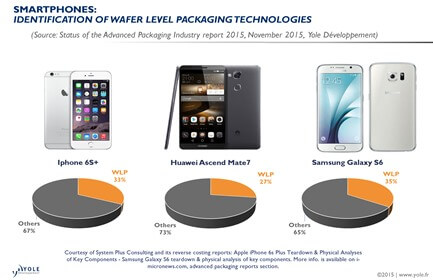

The flip-chip platform represents a large mature market and leads in packaging services revenue and wafer count. Fan-In WLP leads in unit count due to small size compared to demanded volume. Adoption of wafer level packages continues. Teardowns performed by Yole and its sister company, System Plus Consulting on 3 high end smartphones (more info on i-micronews.com, reports section or click here directly for iPhone 6+, Samsung Galaxy S6 as well as the Huawei Ascend Mate 7 analysis, that will be available soon) indicated a high penetration rate of WLP, 30% on average. Fan-Out WLP is expected to make a major breakthrough within the next year, likely led by TSMC inFO PoP and followed by other Fan-Out multi die solutions. Long term, a bright future lies ahead for wafer level packages with respect to IoT requirements as they are well position to answer related cost, form and functional integration demands. When it comes to advanced feature sizes, a competitive sub 10µm / 10µm arena is established where organic wafer level packages aggressively compete with advanced organic flip-chip substrates and 2.5D / 3D Si/glass interposers.

As WLP pin counts grow, thicknesses and overall cost decrease, the evolution of Fan-In WLP and in particular a breakthrough of FOWLP are expected to result in a takeover of a part of the flip-chip market. With the breakthrough of FOWLP, the packaging landscape might drastically change, with an IDM and foundry leading all packaging services by wafer count.

The full advanced packaging analysis is today available; in the report Yole’s analysts present revenue, wafer and unit forecasts per advanced packaging platform and production breakdown by device type such as analog/mixed signal, wireless/RF, logic and memory, CMOS image sensors, MEMS, LED and LCD display drivers… A detailed description of this analysis is available on i-micronews.com, advanced packaging reports section.

[1] IoT : Internet of Things

[2] CAGR : Compound Annual Growth Rate

[3] WLP : Wafer Level Packaging

Source: www.yole.fr