I was invited to attend Amkor’s bi-annual customer symposium, which was held in Santa Clara two weeks ago. It was a grand event, complete with rock music intros narrated by a disembodied Voice of Authority for the execs (wait, was that AC/DC’s Back in Black I heard as CEO Steve Kelley took the stage?), inspirational TED-talk like presentations, and a motivational keynote about (you guessed it!) the Internet of Things by Chad Jones, CTO of Deep Information Systems. There were some nifty door prizes (I came THIS close to winning an iPad mini and a $200 gift card to Best Buy – which would have gone toward a new Smart TV, I guarantee it), and useful swag (my new earbuds have already been broken in). But mostly, it was a day chock full of enthusiasm for the future of advanced packaging, and lots of great information on Amkor’s offerings for each segment of the market.

John Stone, EVP, worldwide sales and marketing, set the tone for the day, with the phrases, “if you can imagine it, you can connect it” and a promise that “If you can envision it, we can enable it.” It’s clear that the predictions we made at Solid State Technology (then Advanced Packaging) back in 2007 are finally coming true: Packaging Saves the World.

“Power management, content delivery, sensors, and smaller/thinner devices is what is driving new designs,” says Stone. As such, the industry is in the midst of a paradigm shift with new enabling packaging at its center.

What’s the next game changer? According to Stone, the mobile market has slowed, but the automotive market has embraced the IoT, with $520 worth of packaged content throughout each car including the chasis, power train, security, safety, comfort, control, infotainment, etc. Home automation, the smart grid, and medical are other areas of growth. “We’re just at the beginning of this, and it’s enabled by new devices.”

Stone talked about China: “It’s not about competing WITH China, it’s about competing IN China… and Amkor is one of the only companies that has the ability to do this.” He also talked about Amkor’s new leadership team, headed by CEO Steve Kelley, and the company’s “culture of YES” with the focus on solutions not problems.

Kelley laid out Amkor’s investment strategy for the future. The company was a pioneer of the OSAT concept, he said, and at over $3B in sales is now the world’s second largest OSAT. The goal is to reach over $5B in sales over the next 3-5 years by focusing on the basics of quality and execution. He broke down the company’s revenue by market:

• 56% communications

• 13% consumer products (TV set top boxes, gaming)

• 11% networking

• 11% automotive infotainment, safety and performance

• 9% computing (hard disk drives)

“Our strategy is about 2 things; meeting customer needs and filling our factories,” said Kelley. “We lead with advanced technologies, and drive sales through execution, quality, and ease of doing business.” He added that as a high fixed cost company, success is determined by filling capacity, which they do through acquisitions and strategic investments. One of those strategic partnerships is with J-Devices, a Japanese OSAT with deep connections in the Japanese automotive market, of which Amkor owns 66%.

While communications is currently the biggest market segment for Amkor, automotive is the fastest growing, and with the Japanese market showing the highest percentage of IC content per car at $950/vehicle, due to safety and environmental requirements, a partnership with J-Devices is very advantageous. “Suppliers have challenges in the Japanese automotive market,” explained Yoshio Yoshimura, Sr. Director, ATJ Sales. “Japan has the highest hurdles for product qualification, uncompromising demand for zero defect, and requires relationships and local support in Japan. We can get you connected in Japan.”

Kelley also stressed the company’s 15-year investment developing system in package (SiP), which is increasing further still, driven by smartphones and tablets, and now automotive and the IoT. Lastly, he announced the opening of th K5 factory and R&D facility near Incheon Airport, in South Korea, noting its excellent logistics, as well as advanced packaging and test capabilities.

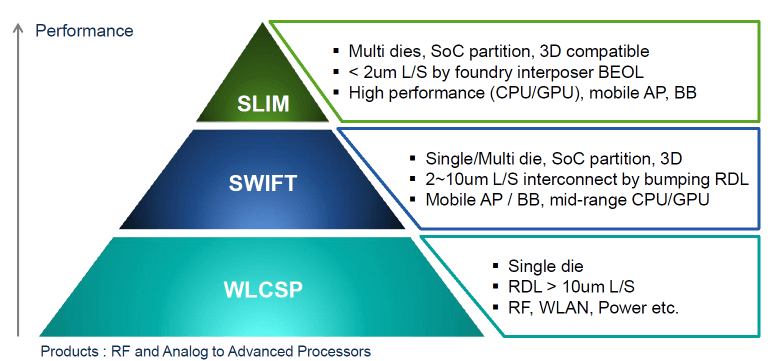

Ron Huemoeller, Senior VP, technology development and IP, provided the executive perspective for technology development in the connected world, also providing updates on interposer devices with and without through silicon vias (TSVs), and also differentiated between the companies’ wafer level packaging platforms (Figure 1).

To “humanize” how far we’ve come in the tech industry, Huemoeller talked about vacationing in the Maldives, a little island in the middle of the Indian Ocean that took five flights and a boat to reach, but had good cell and Internet service. “Internet access is increasing, and it’s all about data usage,” he said. “We’ve got 90% penetration rate in North America and Europe. 50% in China, and 25% in India. There is still opportunity for growth.” He added that the data rate is expected to double over the next five years. Big Data, driven by video streaming, such as Netflix and Youtube, is driving the infrastructure needs, network and storage. For Amkor, this translates into an increased production of FCBGA, CABGA, SCSP, QFP, QFNs, Cu pillar and…wait for it…die stacking!

He echoed Kelley and Jones’s enthusiasm for growth in the automotive market, as well as the IoT. “The IoT circle of influence is growing, from automotive, to connected homes, connected cities, medical, and the industrial IoT,” noted Huemoeller. System-in-package (SiP) is a big growth sector for this, particularly because it requires a combination of solutions such as RF, sensors, and microcontrollers. 3D WLCSP is a way to integrate more content using multi-die stacking, wafer level processes, and TSVs. “TSV will eventually come into play as we need that connectivity and can no longer be served by wire bond,” he said. “We innovate with cost in mind, not just to push technology forward.”

According to Huemoeller, Amkor has shipped more than 40K 3D assembled units to date. He said the TSV interposer business is moving beyond networking to graphics products. The company has shipped more than 25K assembled units comprising multiple logic and/or memory die on thinned interposer. And there’s more where that came from.

“The line is ready to go,” said Huemoeller, “I don’t think we’re the only ones launching more 2.5D.” The hold up, he said, was lack of a memory standard. “Now that HBM is available, more people will design it in. The bandwidth is so much more than you can get from standard memory,” he said.

Another critical factor to increasing volumes was the availability of HBM from more than one source. The quality of interposers has improved and number of suppliers has increased. Prices are dropping to half of what they were 4-5 years ago, noted Huemoeller, opening doors to new products in the high performance space.

The question is, how do we get these architectures beyond high performance into other applications? The progression goes from the high performance to what Huemoeller calls “the enthusiast market” and then the consumer mobile products.

Amkor’s path there is through its latest product offering, silicon-less integrated module (SLIM), which requires no TSVs, passivation or CMP. Both thinning and etch are simplified. Essentially, it’s a lower cost product that’s no longer tied to the TSV supply chain. Still in development, SLIM is coming in the next 3-4 years.

Huemoeller also talked about silicon wafer integrated fan-out (SWIFT), the company’s most advanced FOWLP for high-level applications. The main difference between traditional FOWLP and SWIFT is that it’s a dies first vs. dies last approach. Die first is subject to yield loss, whereas with die-last, there is less risk to the die because the expensive processes are performed first.

With regard to a technology timeline, Huemoeller said the company is production-ready for TSV, with enough capacity to serve customers. By 2016, they expect to be rolling out TSV interposer products with logic and HBM. SLIM multi-chip modules will also appear in 2016, and TSV logic-on-logic devices will make an appearance in 2017.

I purposely did not write about Chad Jones keynote here, because quite frankly, I’m still digesting his words, and it merits a post all its own. Stay tuned! You’re going to want to read that one too. ~ FvT.