It has been a tumultuous month. At the start of July, the CHIPS Act appeared to be going into a summer recess. Pat Gelsinger was playing high-stakes poker with congress, and the chip and wafer fab equipment industry was still extremely optimistic going into SEMICON West.

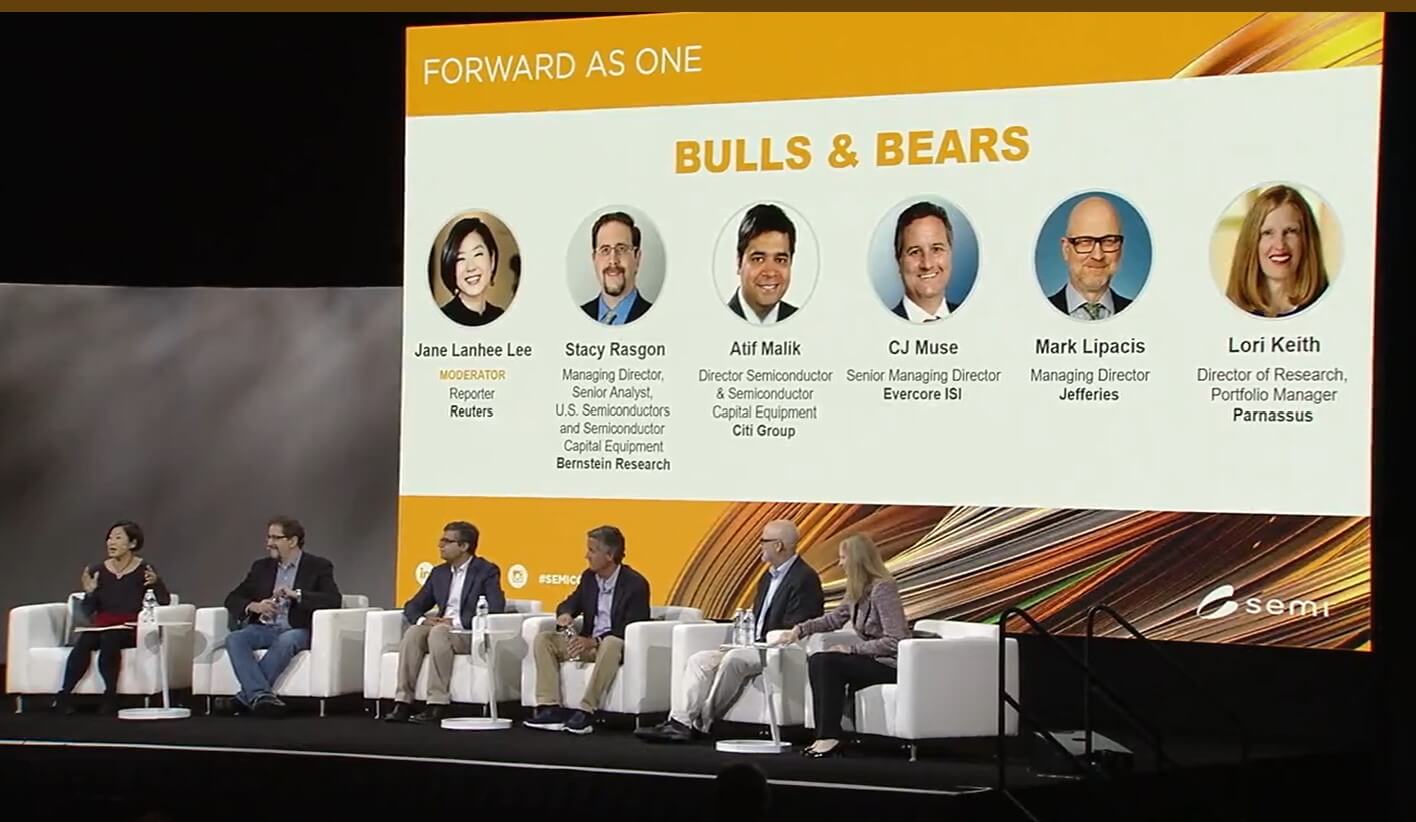

As we exit July and move into the dog days of August, the semiconductor and equipment economic outlook has changed, not significantly, but enough that we need to sit up and pay attention. Gartner cut its 2022 semiconductor forecast from 13.6% growth to 7.4% growth in 2022, with -2.5% in 2022. At SEMICON West, analysts were hedging their bets and signaling caution for the rest of 2022 and 2023 for both equipment and chips, but none of the presenters stepped out on the ledge to significantly cut 2022 but were suggesting that current 2023 numbers might be too lofty.

The industry has moved from a just in time (JIT) inventory and supply chain, to a just in case (JIC) inventory management process to insure adequate supply. I would surmise that JIC will be with us for several years, at least until the current supply chain issues smooth out, the US figures out how to deal with China more productively, and a new inventory model is introduced. This will challenge forecasters, as they will need to figure out how to work JIC into their forecasts with both end users and distributors.

At SEMICON West in Mid-July the CHIPS Act seemed dead in the water. Senator Joe Manchin and multiple Republican senators were not comfortable with many parts of the bill proposal floated in mid-July. Now two weeks later moving into August, the bill was slimmed down significantly to primarily focus on semiconductor manufacturing, research, and education, and has been signed into reality.

I’m gobsmacked, simply gobsmacked that it happened so quickly, although some last-minute political maneuvering almost killed the bill.

Chips Act Catches Analysts Off Guard

At SEMICON West at the Bulls and the Bears event, the analysts voiced that it was unlikely that the CHIPS Act would pass prior to congress going into recess, I agreed with them, so we all missed that one.

Some of the other comments made by the analysts were that the funding $52 billion is just a drop in the bucket. And it really is a rather small amount when you consider how much fabs are subsidized in Asia. One of the reasons that there are so many fabs in China, and elsewhere, are subsidized with either land or tax holidays, or in some case significant cash incentives to build a fab, and employ locals.

More than a year ago, I reported on upcoming spending, or funding by countries that were intended for the semiconductor industry. Korea is floating $450 Billion in funding over 10 years, or 45 billion each year to keep the Korean industry at home and strong. China currently has a $170 billion fund to subsidize its focus on semiconductors. The US now has a small $39 billion, over 10 years, subsidy for new manufacturing. And $11 billion for federal research and workforce development.

Subsidies happen in the United States as well, just not on the same scale as internationally. Local municipalities roll out the red carpet and provide tax incentives to get a high-tech facility located in their town. The city of Phoenix is putting in $200 million dollars of infrastructure for TSMC; in Taylor, Samsung received $27 million in incentives for moving to the neighborhood. Intel received incentives in Ohio, as well as, historically in Oregon.

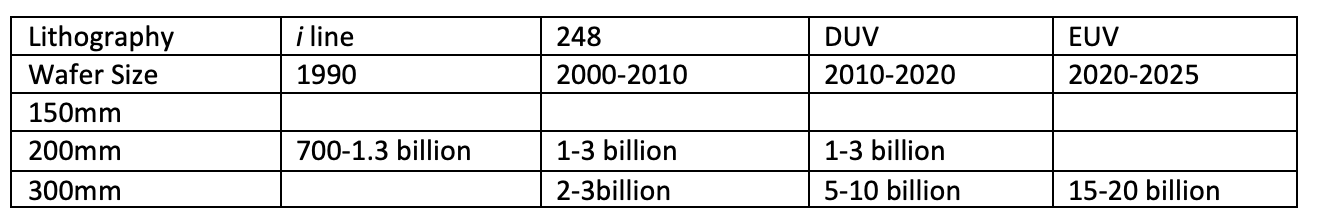

American companies also get incentives for bringing jobs to the area. Incentives are important because they help reduce capital spending and help companies achieve profitability sooner. It is important when you spend 10-20 billion dollars to get your factory up and running. So, while a drop in the bucket, the CHIPS Act can provide funding for things like basic infrastructure, land, and buildings, potentially even equipment.

It will be interesting to see how the capital funding gets distributed. SkyWater Technologies announced a partnership with Purdue University to build a new fab in Indiana, and they are depending upon the CHIPs Act to provide funding, GlobalFoundries is also hoping for funding from the CHIPS Act to expand their Malta facility in upstate New York. From my perspective, it is key that the CHIPS Act supports the Legacy portion of the industry as the margins are much less than the leading edge.

So, did Pat Geisinger’s announcement about a fab in Europe, and talk about shrinking the size of the Ohio project move the needle on the CHIPS Act? Hard to tell, it’s just nice to get it moving forward, hopefully, it will help improve the supply chain, and bring some manufacturing back on shore.

Next week in Part 2 of this blog series, we’ll look at the impact of the chip shortage on 200mm fabs. ~ DF