SEMICON West 2022 coming up next week will kick-off, at least for the time being, the back to post-COVID normal for SEMI events. SEMI will be back on its normal schedule, and as concerns regarding COVID 19 are on a slow simmer, healthy attendance should be expected. We can expect keynotes, the Market Symposium, tech talks, Bulls and Bears, smart pavilions, networking events, and revised forecasts.

One of the key side topics at the show this year will be the health and growth prospects of the semiconductor industry. The Market Symposium and the Bulls and the Bears Session will hopefully cover this topic in detail. The news of the past few weeks has given some insight into what some of the topics might be.

The last time the equipment market was this hot from a backlog perspective was in 2008, and the industry promptly crashed because of the Lehman Brothers Crisis. 2008 and 2009 were the last major industry reset with Capex declining 30% and 42% respectively. 2012 saw a 12% decline, which was more of a pause after the industry dramatically recovered in 2010 growing by 139%.

So, let’s recap some industry news as we move into SEMICON West, and see what the talking points regarding growth might be by starting with the recent TSMC announcement regarding its full-year outlook at the June shareholder’s meeting. (Feature photo credit: Digitimes).

TSMC is expecting a 30% growth in revenue in 2022, some of this from pricing increases, but mostly from demand. TSMC’s leading-edge N5 contributed 19% of the company’s income in 2021. While PC consumer and mobile applications are slowing, high-performance computing, and automotive are driving strong demand. TSMC’s CEO C.C. Wei also commented on the ability of TSMC to execute at the leading edge, which then enables companies like Qualcomm, Nvidia, and AMD to provide leading-edge chips for their customers.

According to Nikka Asia, Taiwan is on a $120 billion expansion for chip makers which include TSMC, UMC, and Nanya. So at least in Taiwan, there appears to be no slowdown in sight. Intel, on the other hand, issued a 2-week hiring freeze in its PC chip unit, as Intel is working to digest what is happening for demand in the PC space.

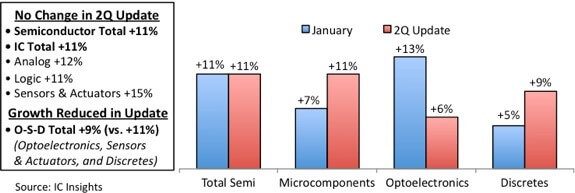

Bill McClean of IC Insights is holding to his 11% forecast for chips. His forecast is showing a slowing in the optoelectronics market, but a positive outlook in most others.

Figure 1: 2022 sales growth outlook for IC manufacturers. (Source: IC Insights)

This would support TSMC’s outlook that while there is slowing in the consumer, PC, and phone markets, there is still strength in others that is compensating for the slowdown.

However, reports out of Nanya are suggesting a slowdown in memory, and Samsung’s reports on excess mobile phone inventory are causing worry. Omdia’s recent forecast release suggests slowing and while the WSTS is still predicting 16% growth year over year, the seasonal slowdown, along with the negative reports above has some media and analysts suggesting caution.

So, at the show, we might hear about what sectors are hot, and what is slowing, as well as the release of the mid-year forecasts by the market research firms, which may add to the current uncertainty.

The Equipment Race

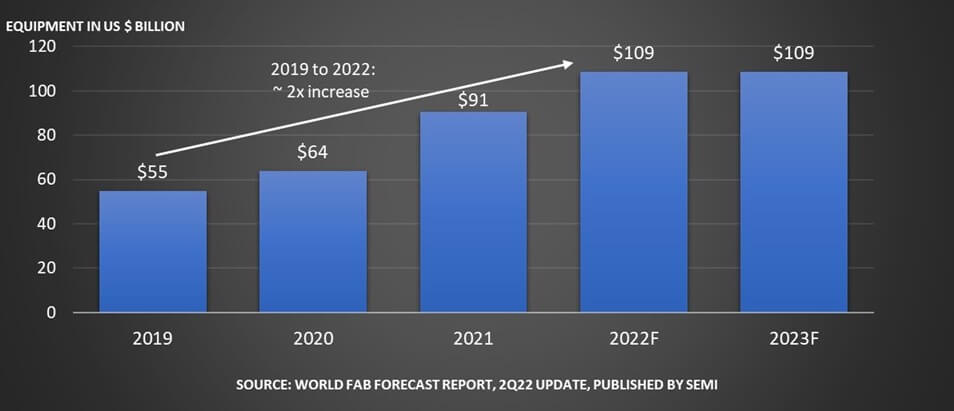

From an equipment perspective, SEMI is reporting that 2022 will grow by 20% year over year, and is predicting a flat 2023. Capacity is expected to rise by 8% in 2022, and then 6% in 2023, as a total of 15 new fabs were added to the fab database since the March report.

The equipment market itself remains much more challenging, but the constraints are not a result of a slowing end market, or semiconductor companies taking a wait-and-see shipment perspective; although this may change if there is a memory slowdown. In its Q1 earnings call, Lam Research reported on challenges with obtaining components for both leading-edge equipment, as well as supply chain issues with its reliant product line that serves trailing-edge technology nodes. These supply chain issues resulted in slightly lower earnings in the March 22 quarter than the December 21 quarter.

In the introduction to the Applied Materials Q2 earnings call, Gary Dickerson also commented on supply chain constraints that also impacted earnings. Both companies expect to have these problems resolved in the second or third calendar quarter. It appears that a considerable portion of the supply chain problems are due to shutdowns, or slowdowns of suppliers, and how quickly these can be resolved and getting equipment shipped to customers.

Thus, we should continue to hear about the challenges for the semiconductor equipment companies, and how to keep up with customer demand with the supply chain challenges they are facing. The current backlog, and supply chain issues, may mask the initial slowdown if there is one.

In most earnings calls, the presenters said that they had excellent visibility throughout the year, and significant insight into 2023 even extending into 2024. Gary Dickerson commented that Applied Materials thinks that 2023 will be better than 2022, based on chip demand and fab utilization.

ASML’s Q1 2022 call provided some interesting bullish growth information. At ASML’s investor meeting earlier in the year, the company presented plans to increase EUV production to 70 units a year and DUV to 375 units a year by 2025. Based upon customer demand, industry forecasts, and the predictions that the semiconductor industry will potentially cross the $1 trillion dollar mark in 2030, ASML now thinks it will need to be able to ship 600 DUV units and 90 EUV units each year by 2025. By comparison, ASML shipped 309 new and used systems in 2021, 42 of those being EUV. ASML is in the process of discussing how to accomplish this with its supply chain. When questioned about a potential slow down due to the current macro-economic environment, Wennink commented that at the moment he thinks he can only meet 60% of demand, so even if there is a slow down it is likely that ASML will still be operating at full capacity.

So as the comments from TSMC suggest, it appears there is slowing in some specific segments such as cell phones and PCs as we see a reset from the work-from-home build-up. Other areas such as industrial, automotive, and the 5G edge rollout continue to remain strong. This would suggest even with a wobbly macroeconomic picture and talks of the recession on the horizon, the chip demand will continue to remain stable. As Figure 2 shows, SEMI is looking at least a flat 2023 for equipment revenue.

The challenge will be what 2024 looks like, as the supply-demand picture becomes more balanced due to the impact of new fabs on supply for both the leading edge, but also for the legacy components that are in high demand. There do not appear to be any obvious gotcha’s out there, but the industry has been surprised in the past, lets’s hope in this cycle there isn’t one of them.

Many times, at SEMICON West, you see the catchphrase, “the future’s so bright we gotta wear shades”. Hopefully, this year, the industry doesn’t have blinders on.