The mobile phone industry has grown to produce more than 1.1 billion devices in 2014 (Source: Camera Module Industry report, Yole Développement, Aug. 2015). With every new model, smartphone manufacturers are trying to bring users a better experience, incredible functions, innovative design and new applications. But how are they manufacturing it? What are the real innovations at the device and module level?

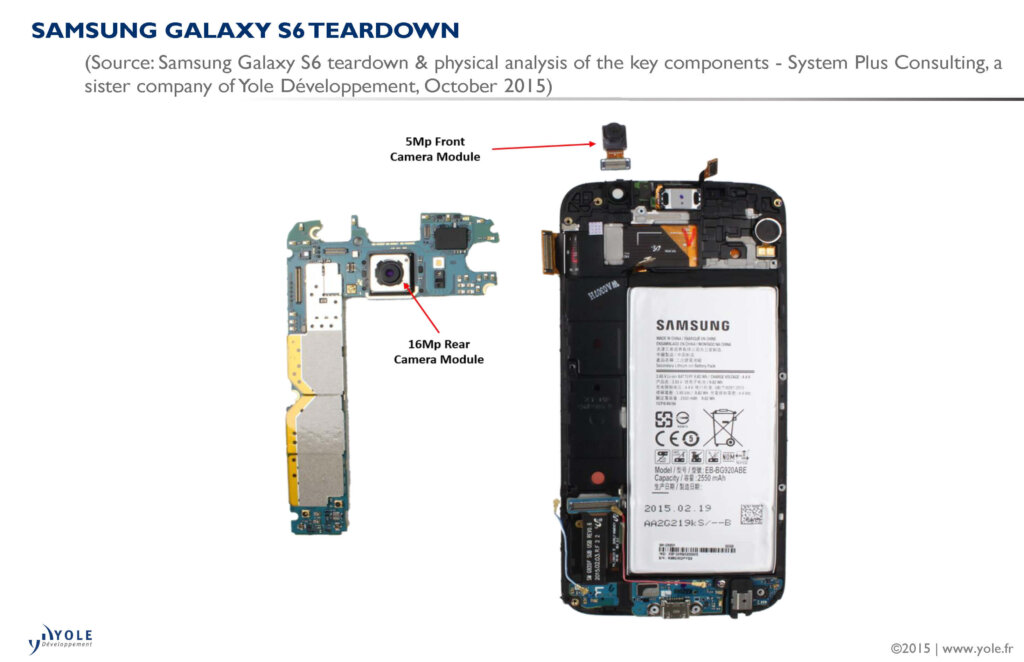

System Plus Consulting (System Plus), sister company of Yole Développement (Yole) released a new collection of reverse costing & technology analysis. With this new collection, the reverse costing company reveals the silicon-level innovation choices made by the current smartphone market leaders. The first model to be analyzed by System Plus, is the Samsung Galaxy S6™ smartphone: this new report, entitled Samsung Galaxy S6 teardown & physical analysis of key components provides a complete and accurate overview of the system. This analysis proposes a deep understanding of Samsung’s technical choices. Indeed System Plus’ analysts detail the suppliers and related technologies, as well as identify major innovations, device specifications, size and package footprint win per device maker.

With this new collection of reports mixing reverse costing approach with technology analysis, System Plus proposes to discover the detailed landscape of the most innovative devices in terms of design, packaging, supplier, and functionality for each smartphone. The objective of System Plus’ approach is to highlight the key and disruptive innovations available today in the smartphones business.

In the Samsung Galaxy S6™ analysis, System Plus’ experts selected eleven devices from advanced packaging to sensor design, imaging and wireless communication: for instance, the Samsung Exynos processor, including the optical image stabilization gyroscope, e-compass, the fingerprint sensor, and new ambient light sensing technology. For each of these devices, a technical analysis has been performed, supported by optical and scanning electronics microscope from System Plus’ laboratory. This methodology helps to get a clear understanding of the technology evolution in the smartphone market.

In parallel of the devices analysis, the reverse costing company also analyzed Samsung’s supply chain.

“For the ICs, we identified suppliers and main specifications of the device in term of size, packaging technologies and technical choices,” explains Romain Fraux, Project Manager for MEMS & Packaging at System Plus. And he adds: “Based on these first results, we were able to deeply analyze the technology evolution and the selection of suppliers. Moreover, in order to obtain an accurate picture of the real footprint of each supplier in the phone, we evaluated the surface area of silicon that they represent. This is the only way to evaluate the level of business done by the suppliers.”

For example, Samsung gets 22% of the IC slots but 59% of the surface area. Likewise, Sony has one design win out of the 11 sensors you can find in the mobile phone, but it represents 40% of the sensor surface area, compared to 3-4% for Knowles, AMS or InvenSense. This information is key to understanding the related supply chain and Samsung’s strategy in term of technology, markets penetration and business development.

This is typically the type of information System Plus provides with its new collection of reverse costing & technology analysis.

And System Plus details… The packaging solutions selected by Samsung are in line with the available technologies. The smartphone manufacturer has chosen package-on-package options for its large devices. Romain Fraux, Project Manager of Samsung Galaxy S6™ analysis comments: “At System Plus, we think that a new packaging platform will arrive soon: indeed, fan-out technologies are now ready for primetime.”

System Plus’s team is working closely with Yole Développement in order to mix technical and marketing approach and highlight the strategic choices made by the system manufacturers. Under the Samsung Galaxy S6™ analysis, it is clear that fan-out solutions will become soon an inescapable technology for the smartphone manufacturers. Fan-Out Wafer Level Packaging (FOWLP) solution is already in high-volume, explains Yole in its Fan-Out technology & market report (Source: Fan-Out and Embedded Die: Technologies & Market, Yole Développement, Feb. 2015). “The Fan-Out market will explode next year, with 55% CAGR between 2015 and 2016,” announces Jérôme Azemar, Technology & Market Analyst from Yole. And he explains: “At Yole, we have confirmed mid-September, that TSMC will begin volume production in 2016 with Apple as its first customer with its Apple A10™ processor. Other key companies such as Qualcomm, Mediatek, and other big players are eyeing this field.”

For the image sensor, Samsung is following Apple in choosing Sony as the supplier of its core image sensor, adopting its high quality module. System Plus also found out that InvenSense and Yamaha are the preferred suppliers for motion sensing. Synaptics is the supplier of choice for the fingerprint sensor, and it’s certainly waiting for the integration of this function into the display… A detailed description of this analysis is available on i-micronews.com, advanced packaging reports section.

As announced, the Samsung Galaxy S6™ report is the first step toward a complete collection that will soon be available and covering all the flagships smartphones. For each phone System Plus will track the technical choices, review the innovations and supplier choices. The company will also evaluate the footprint of each company and their business evolution as well as provide key information regarding latest innovations.