As they do every year, semiconductor industry leaders gathered in Half Moon Bay, CA in early January for SEMI ISS 2024 to take stock of the economic trends and market drivers to set their corporate strategies for 2024. Appropriately, the weather outside the Ritz-Carlton, overlooking the Pacific Ocean, matched the weather inside the conference room. Conflicting headwinds and tailwinds brought a mix of sun, clouds, and even some rain over the three days. And the wind did blow.

Perhaps anticipating what would be shared, SEMI aptly themed SEMI ISS 2024 version – Ready, Set, Ramp? Punctuation means a lot. If they had themed it Ready, Set, Ramp! we would all have expected to find out that all indicators pointed to an all-systems-go directive: and nothing but sunny skies ahead. As it was, we learned that it’s not that simple.

“The question mark acknowledges that the industry is facing headwinds to meeting the $1 trillion goal set several years ago,” noted Steve Johnston, EMD, in his opening remarks.

The main headwinds to watch include the evolving geopolitical situation, the impact of various Chips Acts, supply chain glitches, increased energy needs to power industry growth, and per and polyfluorinated alkyl substances (PFAS) legislation. On the flip side, we’ve got tailwinds such as advancements in AI, developments in chiplets, and advanced packaging that address cost and power efficiency, as well as a growing silicon carbide market.

Many hoped the question mark would be sorted out by the end of the two-and-a-half-day event. But that wasn’t the case. Rather, the economists, market analysts, and experts delivering their forecasts just reinforced the reality that this is one of those years that could go either way. And that makes it tough to strategize.

Prepare for Two Worlds

Duncan Meldrum, PhD, Chief Economist at Hilltop Economics admitted that he’s having trouble coming up with where the economy is going. He compared 2024 to 2008 in terms of macroeconomic issues.

“We’re telling ourselves that we’re going to get through this without a problem. The federal reserve will start cutting interest rates and we’ll have soft landings,” he said. But then he pointed out all the uncertainties, such as the fastest rate increases at the central banks since the 1980s, the speed of inflation, China’s weakened economy, and of course the upcoming elections.

Meldrum says all this makes him uncomfortable. The consensus is too optimistic because inflation is stickier than forecasters expect. His advice? Plan for two worlds. One based on the consensus that growth is muted, inflation comes down. But be prepared for another world where things don’t go as planned.

The Industry Analysts Reports at SEMI ISS 2024

SEMI’s Inna Skvortsova, Market Research Analyst for SEMI’s Market Intelligence Team, feels confident that after the 2023 downturn, we are on a course for recovery in 2024. She noted that geopolitics, the various Chips Acts, and supply chain resiliency initiatives will all contribute to shifts in investments. Europe and Japan are doubling their investments. China and Southeast Asia are investing heavily in 200mm equipment. The materials sector is set for healthy growth.

Despite IC sales moving into positive growth, Risto Puhakka, Tech Insights, says Wafer Fab Equipment (WFE) utilization rates are still at low levels. “The industry does not need more capacity at the moment,” he said. “It won’t be a huge year for (WFE) unless we see a high demand uptick,” Puhakka says we can expect the industry to continue being cyclical, and after two flat years (2023 and 2024) we can plan for growth in 2025 and 2026.

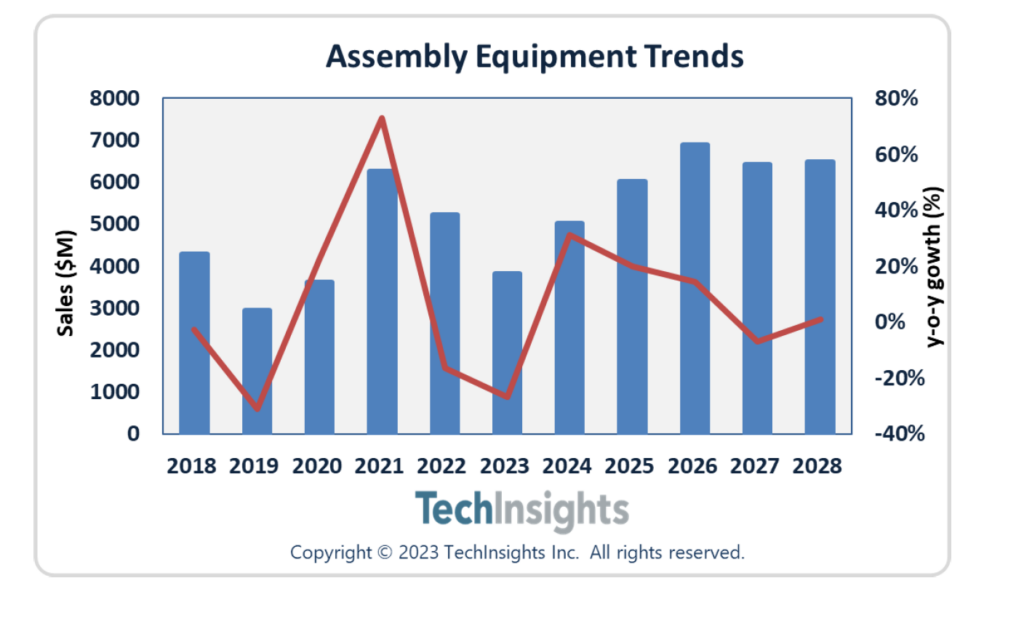

His tune was different for back-end test assembly equipment thanks to growth in the chiplet market, which will go beyond the $200B mark due to expansion in high-performance computing (HPC) (Figure 1). In fact, he predicts two years of an upturn for assembly equipment. But he also cautioned – albeit jokingly – that the assembly equipment market is hyper-cyclical, so suppliers “need to ship faster than the customers can cancel!”

Bob Johnson, of Gartner, says recovery in electronic production driven by smartphones, servers, and storage applications; and a surge in memory pricing will lead to double-digit growth in 2024-25. He explained that memory manufacturers will maintain an undersupply through 2025 to correct the oversupply, so we shouldn’t expect new investments until then.

Three “speedbumps” that Johnson said may impact growth include China’s efforts to develop indigenous semiconductor capabilities; AI’s march up (and down) the Gartner Hype Cycle; and the vast amount of energy required to support the information and communication technology (ICT) ecosystem. For example, it took 250megawtt hours to train the first run of ChatGPT. Semiconductor energy efficiency will be critical going forward to support all this.

“The trouble with this uncertainty in the market is that it keeps us guessing, which can slow down progress. We’ve already seen a lot of that in 2023. Is a recession coming? How bad will it be? When does CHIPS Act money get released?” says Martijn Pierik, Co-Founder and Chair, of Kiterocket, and co-owner of 3D InCites. “Let’s just hold off on (spending) decisions until we get more visibility. It’s that lack of visibility and confidence in the direction our economy and industry are moving that stalled or slowed down budgetary, decisions which in turn will directly or indirectly slow down progress.”

Key Takeaways and Aha Moments

In addition to the analysts’ forecasts, there was a lot to take from three days of presentations at SEMI ISS 2024. So for the rest of this blog post, I’m going to focus on key takeaways and aha moments.

Headwinds

According to Paul Triolo, Albright Stonebridge Group, 2024 will be a tough year for geopolitical headwinds because of China, Taiwan, and the US elections. However, understanding how technology and politics interact is key to avoiding risks and capturing opportunities.

He described the Chips and Science Act as a “carrots and sticks approach to semiconductors.” He explained that while the Chips Act is aimed at boosting domestic manufacturing, R&D, and technical skills, there are strings attached.

An aha moment: Regarding US/China relations, Triolo predicts fewer headwinds and more constructive engagements if the Biden Administration continues. It’s hard to predict what a second Trump Administration will do.

I had the opportunity to interview Triolo for the 3D InCites Podcast, so stay tuned for that episode in the coming weeks.

The Global Semiconductor Ecosystem and the Role of Sustainability

Two things that stood out to me from New Hope Energy’s Ron Nussle was his proposition that

“Chips are the ball bearings of the 21st-century information economy.” The reference is to the Allied Forces bombing ball-bearing factories in Germany during World War II because they were critical to tanks, trucks, planes, engines, etc.

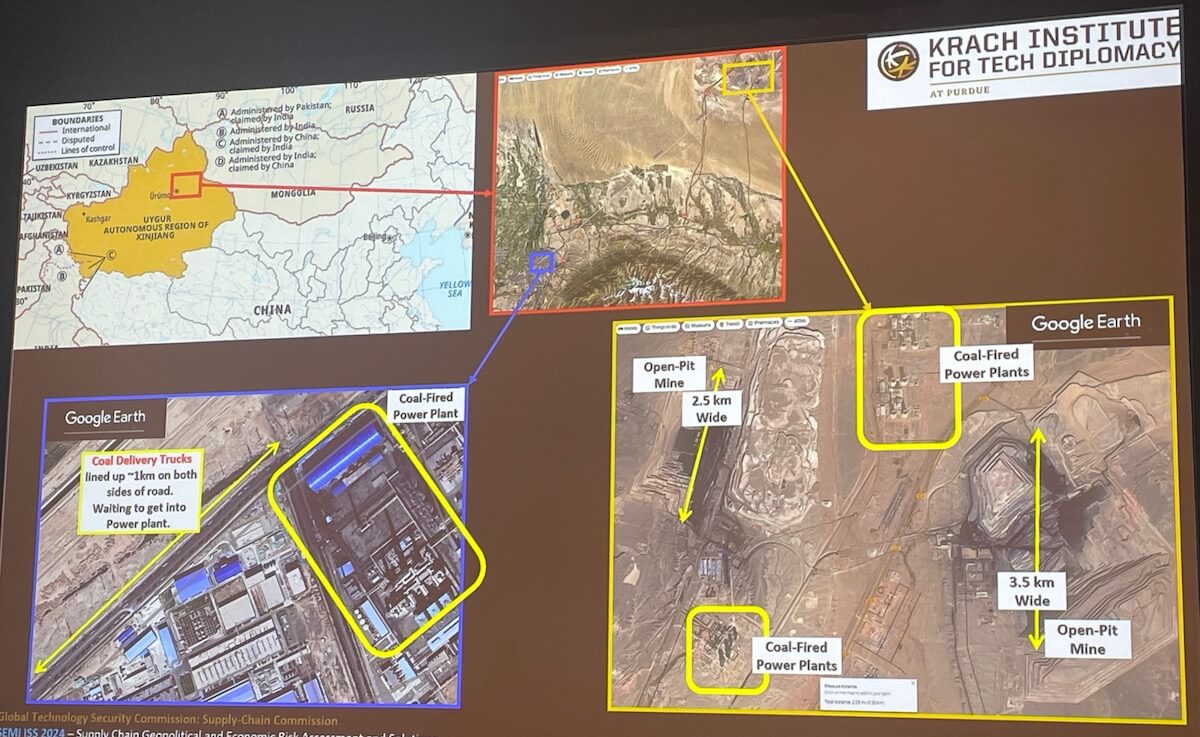

He also proposed that supply chain resilience is about mitigating risks at chokepoints, and everyone should be doing risk assessment. Through New Hope’s work with the Krach Institute for Tech Diplomacy at Purdue, they’ve developed a nine-step approach to help companies ensure their technology security strategy. (Figure XX)

An aha moment: Nussel explained that Polysilicon ingots, used in manufacturing solar panels require vast amounts of energy to produce. In China, where 90% of the world’s polysilicon is manufactured, a leading polysilicon manufacturer is sited by a large open-pit coal mine. A queue of trucks over a mile long is lined up to deliver coal to provide power to grow the polysilicon ingots needed to manufacture solar panels needed to make the world a greener place (Figure 2).

This validated a point by Scotten Jones, Tech Insights, that renewable does not equal carbon-free. He also noted that 84% of renewable energy use reported in corporate ESG reports can be attributed to Renewable Energy Certificates. “That’s greenwashing,” he said.

Intel’s Jackie Sturm cited talent, trade policy, and the strain on the earth’s natural resources as concerns on the path to $1Trillion. What keeps her up at night is concern for the concentration of ores around the world. “To achieve the kind of growth we’re predicting, we will consume all the tungsten in the world. We need to refine it, and that takes tremendous energy,” she said. “If we’re going to have growth to hit a terabuck we need to take a very careful approach and work together to make real solutions,” she said, citing the SEMI Climate Consortium as an example of how the industry is pulling together.

The anticipated crunch in the availability of electric power was a concerning bit of news for Dick Otte of 3D InCites Member, QP Technologies. “There is more power needed for well-known requirements, along with new demand. As dirty power sources (coal) shut down, wind and solar may not provide enough to backfill. We will need nuclear power soon and in quantity,” he told me, noting that emerging small nuclear reactors may be a solution.

Say PFAAS, not PFOOS

Per and polyfluorinated alkyl substances (PFAS) continue to be top of mind for all, and Entegris’s David Mederios’ talk helped dispel fears that a total industry shutdown is imminent if PFAS is banned from use.

After making sure we all pronounced the acronym correctly—PFOS is one PFAS chemical that was determined hazardous long ago and has been since phased out— Mederios brought us up-to-date.

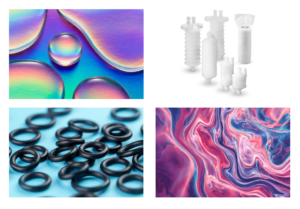

The same features that make PFAS so useful in many ways (waterproof, flame retardant, etc.) also make them resistant to breaking down. They are bio-cumulative, which means they can get into biological systems and never leave.

Despite their ubiquity in semiconductor manufacturing, of the 40-50K different chemicals classified as PFAS, semiconductors make up a small percentage of global PFAS applications (Figure 3). Additionally, there is significant control over abatement and waste streams.

Five European nations have called for bans on PFAS, while the US’s EPA is taking a more pragmatic approach, noted Mederios.

“If there were outright bans, it would make it impossible to manufacture semiconductors,” he said. “The overall impact of bans is not fully comprehended by those who are implementing them.”

The good news is that the semiconductor industry is taking action. The Semiconductor Industry Association (SIA) set up a PFAS consortium of seven teams with volunteer subject matter experts who have created over 700 pages of content explaining PFAS uses and socio-economic implications. SEMI and SEMI Europe have established working groups that are working closely together to delineate different classes of PFAS, prioritizing those that pose the biggest risk. IMEC is evaluating alternatives to PFAS chemistries for semiconductor manufacturing.

Is Your Data Safe?

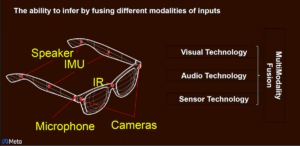

Matt Colburn, of Meta Reality Labs, said that by merging the real world with virtual content Meta’s AR glasses will create such an immersive experience that they will transform how people interact with computing. Everything Meta needs from the semiconductor community is customized, and they are looking for world leaders to partner with them.

When I asked the question, of how Meta plans to use the user data it gathers from the wearer, Colburn said, “We take security and privacy very seriously. The devices are designed for security, and the information is intended to be private, encrypted, and secure.”

I am skeptical about this because Meta is first and foremost an information company, not a device manufacturer. While Colburn said the global consumer population is Meta’s customer, I caution you to remember that the global population is actually Meta’s audience. The customers are those who will pay for information from the gathered data. Also, remember that Facebook is also part of Meta. And we know well how it operates. The first lesson I learned in Mass Communications 101 is: When it’s free, YOU are the product.

Meg Conkling, of 3D InCites member company, Veeco, said she was also concerned about misuse of data.

“AI technology’s potential to change the world is mind-blowing. It is going to change the way we work, write, learn, manufacture, receive health care, create new realities, and relate to each other,” she said. “My main concern is the data ethics and how will humanity prevent it from getting into the wrong hands and being used in the wrong ways. All our data is being captured/manipulated by Amazon, Meta, etc. companies and we have no control of what is done with it in the end.”

The Golden Age of AI Needs Chiplets

Keynote speaker Sumit Sadana, Micron, classified AI into three categories: Artificial Narrow Intelligence (ANI), Artificial General Intelligence (AGI), and Artificial Super Intelligence (ASI).

ANI, what we currently see in abundance, is limited to a specific field goal, such as Netflix recommendations, facial recognition, machine learning, and even early forms of generative AI he called “Transformer AI”. AGI is ten years away and will demonstrate broad, human-like intelligence. ASI, which is 20 years away, will surpass human intelligence.

“The AI revolution is gaining critical mass,” he said, calling it the Golden Age of AI. Moreover, he declared that AI is the most important trend for memory, technology, and humanity.

Sadana’s key takeaways: Generative AI needs advanced memory technology because diverse memory solutions are needed to enable complex training models. We also need to address power consumption issues. This, he says, is a job for chiplets.

Advanced Packaging and Chiplets Will Rule the World

From Sadana’s keynote to the final tailwinds talk by Jan Vardaman, Techsearch International, almost all the speakers mentioned chiplets as areas of growth and promise.

Jean-Christophe Eloy, Yole Group, boldly stated that advanced packaging and chiplets will rule the world. What counts as a chiplet? According to Eloy, it’s the disaggregation of a monolithic system on a chip (SoC) into functional parts, so that they can be manufactured separately at the most optimal node, and then reaggregated into the same package. It’s also duplication. Two or more monolithic SoCs are interconnected in the same package to form a bigger SoC.

The advantages of chiplets are cost savings and energy efficiency. In her presentation, Vardaman showed how hybrid bonding as the form of interconnect reduces the interconnect length to reduce energy consumption.

The Global Chips Acts

In his look at Chips Acts around the globe, The Honorable Ian Steff President/CEO at mySilicon Compass, noted that despite the seemingly slow rollout of the US CHIPS Act, there’s been a lot behind-the-scenes activity in 2023 that will result in substantial announcements, some of which may surprise us.

Of the EU Chips Act, Steff said he’s never seen something go from conception to implementation so quickly to reach its 20% market share goal. “It’s remarkable to see what they’ve accomplished in a short amount of time,” he said.

Aha moment: Steff noted that the biggest risk of all this added capacity will be the workforce. “If you can’t find the workforce promptly, the CHIPS Act will not be successful and will not be prolonged beyond the five-year commitment. He gave kudos to SEMI Foundation’s Shari Liss saying, “A round of applause for Shari Liss, who has done more for the workforce in her tenure than took place in the last 10 years,.’’

One of my concerns is how we avoid the oversupply that could come from various chip acts focused on creating regional ecosystems. SEMI Europe’s Laith Altimime explained to me that if each region focuses on developing the supply chain to support its core competencies – like Europe is doing in automotive – we can avoid the over-supply issue. It’s all about collaboration.

SEMI Women in Semiconductors at SEMI ISS 2024

Saving the best for last, everyone agreed that one of the highlights of SEMI ISS 2024 was the first-ever SEMI WiS Reception, organized by SEMI Foundations’s Shari Liss and Margaret Kindling. The event was packed with women and men who gathered to celebrate the importance of allyship in the industry.

“Women in Semiconductors (WiS) was a highlight on the ISS agenda, and DSV was proud to be a sponsor of the event,” said Spencer Wall, of 3D InCites member company, DSV-IMS. “We believe that a diverse workforce and an inclusive culture are essential for creating a dynamic workplace and promoting tremendous growth in the industry.”

“ISS WIS’s largest gathering ever was great to witness and participate in,” noted Meg Conkling. Veeco. “Women are moving up the ranks in SEMI companies and making a positive difference in our industry!”

Should We Still Be on the Trillion-Dollar Path?

“To reach the $1T milestone, it is not enough to simply build new fabs or manufacturing facilities. The entire supply chain must also be expanded and optimized, to ensure that production can keep up with demand. This is especially crucial in today’s world, where disruptions can occur at any moment and cause significant delays in the supply chain, Therefore, it is important to focus not only on the physical infrastructure of the semiconductor industry but also on the processes and systems that support it.” said Matt Ritchie, of 3D InCites member company, DSV-IMS.

In a side conversation, Dan Hutchison, VLSI Research, explained that reaching $1 trillion by 2030 is a matter of market inertia. That number considers inflation and asking selling price (ASP) increases of semiconductor devices. Ironically, he says if we can’t increase the volumes of devices due to the stumbling blocks mentioned today, we can still reach the $T goal because prices of devices will go up – it’s simple supply/demand economics.

During the Bulls and Bears Panel, Dave Duley, Steelhead Securities, said AI is going to drive our industry to $ 1 trillion sooner than we think. But Claire McAdams, Headgate Partners, reminded us that some of that $Trillion will be for China, by China, made in China.

My concern is not so much whether we are still on the path to achieving semiconductor sales of $1 Trillion by 2030, but rather, should we be? Market drivers like artificial intelligence (AI), automotive electronics, high-performance computing (HPC), and data storage indicate that the demand, and the potential, are there. But if we can’t do it responsibly and sustainably, does it matter if we don’t reach $1 Trillion until 2035 or beyond? We need to put sustainability first so that when we DO reach $1Trillion, we can maintain it and still have a world in which to enjoy the fruits of our labors. ~ FvT