“Although the inflated excitement has started to plunge after few years of hype, Fan-Out technologies are still very well established in low-end and high-end applications”, asserts Favier Shoo, Technology & Market Analyst at Yole Développement (Yole). “It has proven benefits in terms of form factor with no IC substrates, performances with increased I/O density and reliability with die protection. So, without doubts, interest remains high within the industry to extend Fan-Out packaging into new applications.”

In this new era of digitalization, manufacturers are expected to have a faster time-to-market and reliable capabilities to integrate more functionalities. Fan-Out packaging is so well-positioned to meet new demands due to its nature of the process being able to integrate dies coming from different wafer size and source…

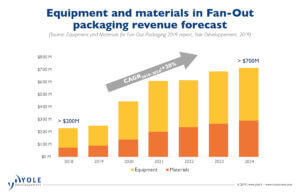

Yole announces a comfortable 25% CAGR[1] between 2018 and 2024[2].

The entire supply chain is fully impacted by this enthusiasm and equipment and materials companies are part of the playground. The market research & strategy consulting company Yole releases this week a dedicated report, Equipment & Materials for Fan-Out Packaging. Under this 2019 edition, the company deepens its investigations and proposes a relevant overview of the equipment and materials markets for Fan-Out applications. Based on new sales, made from incremental production volumes, the equipment and materials revenue for Fan-Out packaging is expected to grow from more than US$200 million in 2018 to more than US$700 million in 2024. This industry is showing a 20% CAGR during this period.

“With production players slashing growth projections in 2019, suppliers of Fan-Out packaging are now anticipating a smaller CapEx[3] investment in 2019,” explains Favier Shoo from Yole. “Nevertheless, equipment and materials suppliers are well-positioned in the Fan-Out packaging supply chain to gain business from long-term growth.”

Megatrend-driven demands, in the long run, are expected to provide the impetus to push for an inflection in the equipment and materials revenue…

In this new equipment & materials report, the market is sized based on processes that reflect the characteristics and relevance of Fan-Out packaging. These include carrier, debonding, pick-and-place, molding compound deposition, RDL[4] passivation, RDL patterning, RDL barrier-seed layers and RDL plating. The equipment market value is significantly higher than the materials market for Fan-Out packaging, with an ASP[5] of equipment per wafer generally higher than the ASP of materials per wafer. Also, certain key processes do not need any materials, for example pick-and-place.

Although Fan-Out packaging is still a relatively small market amongst other popular packaging platforms, it can cover high-end HD[6] Fan-Out and low-end Core Fan-Out applications. Historically, Fan-Out packaging is essential to applications such as PMICs[7], RF[8] transceivers, connectivity modules, audio/codec modules and radar modules and sensors. It was, however, the adoption by Apple’s APE[9] of TSMC’s inFO-PoP[10] platform that started to fuel its popularity and made HD Fan-Out possible.

Now, there is no doubt the industry is no longer as overexcited about Fan-Out packaging as it was during the TSMC/Apple buzz. However, in HD Fan-Out, TSMC being the sole leader is not only utilizing inFO for APE but also extending it into new exciting technologies like inFO-AiP[11] for 5G wireless communication, and inFO-on-Substrate (oS) for HPC[12].

So, Fan-Out packaging is still maintaining its centrality as a popular option for megatrend driven applications like AiP, HPC and SiPs[13]. FO WLP[14] capacity expansion is therefore expected moving forward. SEMCO and PTI have been catching up aggressively, with a different strategy, since 2016:

- A new milestone was achieved by SEMCO in 2018, with the latest release of a FOPLP[15] APE-PMIC in the Samsung Galaxy Smartwatch.

Santosh Kumar, Director & Principal Analyst, Yole Korea had the opportunity to interview Richard (KwangWook) Bae, Vice President, Head of Corporate Strategy & Planning Team, Samsung Electromechanics (SEMCO) few weeks ago. During this discussion, Richard Bae revealed the recent FOPLP developments at SEMCO and presented their vision and perspectives on future of FOPLP business. This interview is available on i-Micronews.com.

- In addition, PTI had gone into FOPLP production for MediaTek’s PMIC and audio transceiver.

Moving forward, investments by manufacturers will be modest in the short term and strong in the long term. Regardless, a new high volume application is anticipated to fuel another tremendous growth in the Fan-Out packaging market space.

Yole’s advanced packaging team is publishing an impressive collection of dedicated technology & market reports all year long. These analyses are a smart combination of their technical expertise and industry knowledge. The advanced packaging & semiconductor manufacturing team managed by Emilie Jolivet, Director, Semiconductor & Software activities at Yole, is showing a strong commitment within the industry. They are daily discussing with leading companies to analyze the market and technology trends and identify disruptions. They regularly present their results during key trade shows & conferences. SEMICON Taiwan is one of the key conferences selected by Yole’s analysts to reveal this year again, their vision of the industry. On September 17:

- During the SiP Global Summit 2019 – Heterogeneous Integration NOW & FUTURE – Day 1

- Advanced semiconductor packaging dynamic ecosystem: Technology & Market trends at 9:10 AM

- Panel Discussion: Advanced Packaging Techniques and Challenges for 5G and AI Applications at 11:20 AM

Speaker: Santosh Kumar, Principal Analyst & Director Packaging, Assembly & Substrates, Yole Korea

- MEMS for Automotive: Technology and Market Trends – On September 17 2019, at 4:15PM during the MEMS & Sensors Forum

Speaker: Mario Ibrahim, Technology & Analyst, Package Assembly Substrate

Presentations will be available soon on i-Micronews.com, presentations section. And make sure to get a clear view of Yole’s activities with i-Micronews.com.

Stay tuned!

Source: www.yole.fr