How to start what is potentially my final blog for 3D InCites: Memories, So Long, Farewell, (that one might get me in trouble), or Back to the Future?

I started this venture at SEMICON West in 2019, where I helped Françoise cover the show and wrote my first 3D InCites blog discussing IMEC’s SEMICON ITF and where the industry was headed with transistors and packaging moving into the third dimension. We also discussed how AI was going to drive growth in 3D packaging. A few months later, I was asked to become a regular contributor, commenting on technology, geopolitics, and industry outlook. Over the past six years, the blog has evolved to encompass the ongoing work in environment, social, and governance (ESG) efforts within the semiconductor industry.

From a technology perspective, my December or January blog typically covers the IEDM conference. The IEDM conference is not usually the first place you think of 3D; however, I used to perform process work in the early 80s for papers that discussed 3D trench capacitors. I sometimes needed to convince Françoise that our community would find interest in the heterogeneous integration for 3D transistor architecture. However, IEDM came to my rescue, with papers on the advances in chiplets and 3D packaging needed for advanced compute and High Bandwidth Memory (HBM).

The 2025 conference had some great papers on 3D integration in both the transistor and for chiplets. The overarching theme was “100 Years of Field-Effect Transistor (FET) Shaping the Future of Device Innovation. There were 295 presentations, not including a few late papers of interest that were added. There was a strong focus on the 3D aspect of technology, in part, as it is needed for high-performance compute (HPC) and to keep “Moore’s Law” moving upwards.

One of the four focus sessions: Efficient AI Solutions: Advances in Architecture, Circuit, Device & 3D Integration covered that topic. The papers discussed multiple aspects of 3D, from packaging to how to embed memory into the chip architecture, as well as power management for the AI system. This year at IEDM, there were no standalone advanced packaging sessions, but sessions 33 | ALT | BEOL-Compatible Devices and Interconnect Technology, and 38 | ALT | System Optimization and Process Innovation both included papers that highlighted advanced 3D packaging.

An example of 3D integration also appeared in session 36, where a GaN chiplet is integrated onto a silicon wafer. This technology will enable high-performance, high-density, efficient power electronics and high-speed/RF electronics, which is needed for future data centers, as well as edge AI.

Semiconductor Industry Outlook

During my tenure, Françoise has allowed me to provide commentary on the industry outlook. 2025 has been an interesting year to forecast, given the hype surrounding AI. AI data center capex for infrastructure has been blowing through forecasts since the middle of 2024 (Figure 2). The “Big Four” spent in the range of $243 billion in capex in 2024. As of Q3 2025, they are estimated to spend $380 billion for the year on infrastructure, mostly for AI. McKinsey has predicted numbers as high as $6.7 trillion in spending by 2030, with 5.2 trillion of that focused on AI.

This gold rush has provided strong support for the semiconductor chip and equipment industry in 2024, 2025 and will continue into 2026. The December release of the World Semiconductor Trade Statistics (WSTS) forecasts $772 billion for 2025, and $975 billion for semiconductors in 2026, which is only $25 billion short of the elusive $1 trillion semiconductor mark. The WSTS is projecting the market will surpass the trillion-dollar mark in 2027. While memory and logic for HPC are still the key drivers, the WSTS has microcontrollers and analog both forecast to be growing above 7% in 2026. Thus, a rising AI tide floats all boats.

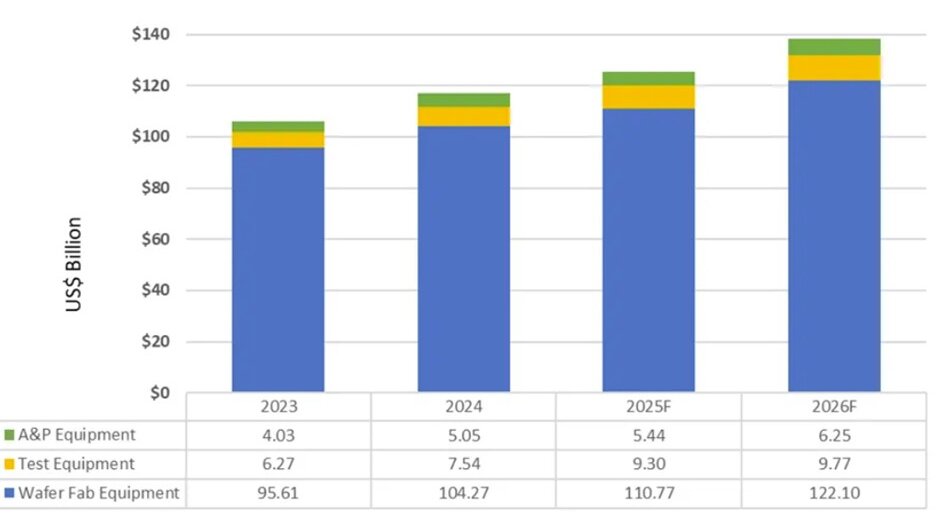

At SEMICON West 2025, Wafer fab equipment (WFE) was being forecast in the $120 billion range by SEMI and Techinsights. SEMI just released its Q3 WFE numbers on December 1, which have the total semiconductor equipment market at $98 billion through the first three quarters. Another $30+ billion in revenue is very likely for calendar Q4, pushing the total equipment market over $130 billion for 2025.

The growth of the equipment segment in 2025 has primarily been driven by AI and China. China has accounted for approximately 33% of the top five semiconductor equipment companies’ revenue in 2025 as of the third quarter and is expected to be approximately 40% of Worldwide WFE in 2025 according to SEMI. In 2026, China is expected to be digesting the equipment purchased in 2025 throughout 2026. The top five equipment companies expect the need for DRAM and the growth of AI logic to be the key drivers making up for the loss of China revenue. With Micron and Hynix HBM expected to be sold out in 2026, the memory companies need to add capacity; however, they are managing capacity in such a way that DRAM pricing is expected to remain strong through 2026. This, in part, leads to the strong chip forecast, as well as an equipment forecast that should see high single-digit growth.

The wild cards in the 2026 forecast boil down to what happens in the world of AI. Do the energy requirements for hyperscale data centers and the lack of qualified construction workers slow down the build-out of the data centers? Does the shortage of DRAM and the production limitations of 3D packaging reduce the number of AI processing systems that can be manufactured in 2026? And lastly, will the slower economy or the concerns of a bubble cause a pullback in AI investment? While companies are looking to get the infrastructure in place, better models are emerging that could reduce the massive amounts of compute that are forecast to be needed.

2026 looks to be a pivotal year in the life and direction of AI, so hold on, as the ride isn’t over yet. However, at the moment, 2026 looks to be another record-setting year for chips and equipment.

As I close out my time at 3D InCites, hopefully, this isn’t Auf Wiedersehen, goodbye, but it’s Auf Wiedersehen, bis später. Look for my occasional posts on LinkedIn.