As Benjimen Franklin said, shortly after the US Constitution was written, “In this world, nothing can be said to be certain, except death and taxes.” I’ll add one comment to that: Change. Change is constant.

Over the past year, there has been a significant amount of change in the semiconductor industry, fortunately, for the positive. One of the major changes this year was the relocation of SEMICON West to Phoenix and changing the timing from July to October. There has been some good press coverage on SEMICON West and the move to Phoenix. Whether the move to Phoenix stimulated the increase in attendance and greater industry participation, or the upturn in the industry that is being driven by AI, is anyone’s guess. But the result was a strong showing in Phoenix. The new venue provided considerable energy for the show. From my perspective, one disadvantage of the change was that the timing was out of cycle with the forecasts, so there were only a few updates on the industry forecast. With the US show remaining in October for the foreseeable future, I guess I’ll have to get used to it.

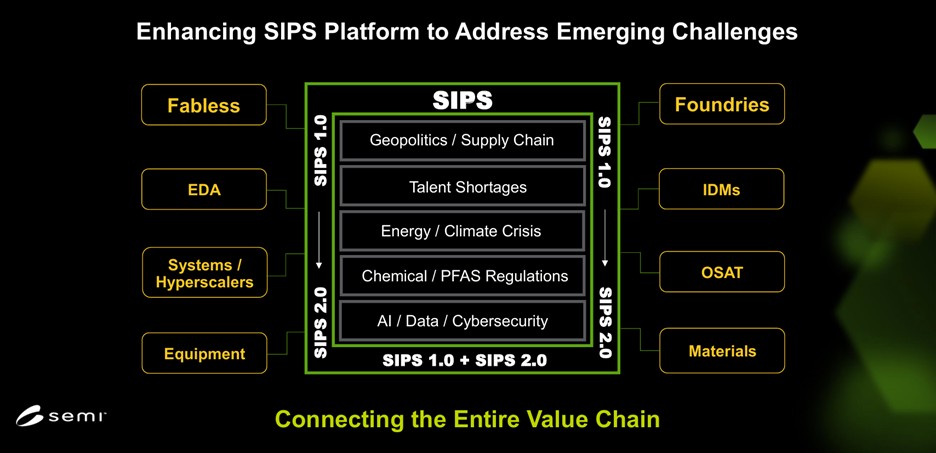

One of the positive changes was that the structure of the Keynote talks changed this year. They were scheduled for the morning and finished by 11:00 AM so that you could get to the show floor. Joe Stockunas and Ajit Manocha kicked off the keynotes, highlighting the theme: Stronger Together. Ajit also highlighted the key issues that the industry is facing and working on, including Sustainability, Workforce, PFA’s and energy shortages, just to name a few. The word of the conference was collaboration, and bringing together not just the semiconductor and semiconductor materials and manufacturing companies together, but also the end users, such as Google, to help solve these major challenges facing the industry.

While Tuesday is the official kickoff of SEMICON, the Market Symposium Monday afternoon starts the show for me.

Francoise and Jillian have written about their views on the trade and policy talks at the market symposium. My key takeaways from those talks are the uncertainty that the trade and geopolitical discussions are creating in the industry. If you look at the Q3 earnings, China was above 40% of revenue for several companies after being in the low 30% of revenue in Q2. Applied Materials pre-announced that its earnings would be lower in its Q4 2025 due to a pullback in China. So, at least for the moment, the energy that China has given the market in 2025 appears to be dissipating.

Clark Tseng both moderated the symposium and gave the forecast data, as mentioned above; most of the data was from SEMI’s Q2 release. Some of the key points were that the worldwide GDP is slowing, and it is expected to rebound to above 3% growth in 2027. The Capex for the Big 4 for AI investment is growing, after Q3 earnings estimates are that Alphabet, Amazon, Meta, and Microsoft will be spending above $360 billion in 2025. That number is expected to grow in 2026.

A comment by Tim Archer, CEO of Lam Research, during its earnings call, was that every $100 billion in Capex for AI equated to about $8 billion in wafer front end equipment (WFE). That would suggest that by the end of 2025, about $32 billion of WFE is targeted for AI. According to SEMI, the additional spending on AI will boost the 2025 forecast for WFE to between 120-125 billion. China is the other big WFE booster for the year, and AI will need to take up the slack in 2026. Clark pointed out that the AI surge will take the chip side of the industry to over the $1 trillion market by 2030. If the recent wafer forecasts by OpenAI are correct, and Tesla opens up a few mega fabs to support its AI efforts, the industry could be looking at up to an additional 2 million wafer starts by 2030. This would definitely push the industry over the $1T mark by 2030.

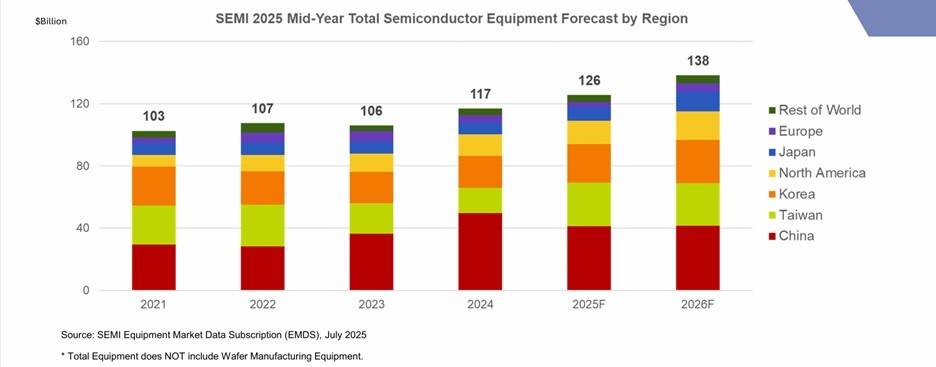

With 2025 seeing an increase on the WFE front, 2026 spending is now less certain. While the chart from mid-year gives a 10% growth outlook, due to the normalization in China, the outlook for 2026 has now softened to the low single digits. However, positive growth is always good news.

Post-market symposium, I had a discussion with Risto Puhakka, Vice President of TechInsights, and we spoke briefly on the forecast outlook. For now, it looks like 2025 will come in as SEMI has predicted in the $120 billion range for WFE, and 2026 will see low single-digit growth. The 2026 growth is predicated on China normalizing, and that AI picks up the slack. The specialty node, 28nm +, also needs to see steady WFE growth. The latest earnings call has me a bit concerned that growth might be slower than expected for the 28nm + in 2026.

A bit of news that Risto shared with me is that TechInsights has released a roadmap of technical and market analysis that one can access without having a TechInsights subscription. This gives a good high-level overview of the market. The detailed numbers are not there, but they give you trends and assumptions of what is driving the market outlook, and help you figure out at least a bit of what the future looks like.

A Yogi Berra once said, it’s tough to make predictions, especially about the future. December will be here soon, and we will see what the next set of predictions look like.