Also STEAMPIPE winners and are Japan’s semiconductor materials companies acquisition targets?

Arizona talks packaging with TSMC

Ever since TSMC announced it was putting an advanced chip fab in Arizona, IFTLE has been screaming to anyone who would listen that this did not make any sense if the chips had to then be shipped back to Taiwan to be packaged, and indeed such chips would require advanced packaging and assembly that is simply not available in the US.

This could all be resolved if TSMC would agree to put capability for its advanced chip packaging in the US site as well. That was and is the only solution that makes sense, so IFTLE was not shocked when the headlines hit that Arizona Governor Katie Hobbs stated that she was in talks with TSMC about advanced chip packaging, “… which are crucial for the manufacturing of artificial intelligence (AI) chips.”

“Part of our efforts at building the semiconductor ecosystem is focusing on advanced packaging, so we have several things in the works around that right now,” Hobbs said at the US Business Day investment forum at the Taipei International Convention.

Let us be clear that as of yet,TSMC, has not announced plans to build facilities for advanced chip packaging in the US.

TSMC counts US-based Apple Inc. and Nvidia Corp. among its major clients. If Apple and Nvidia are agreeing to pay a premium for US-based chip production from TSMC, why would they then be OK to ship those chips back to Taiwan for packaging? It makes no business sense!

The US government needs to jump in right now to back the discussions of Gov Hobbs because it’s the right thing to do.

At the same event, Cadence Design Systems Inc. CEO Anirudh Devgan said that packaging would be the key battleground for nations seeking to establish technology leadership.

STEAMPIPE Winners Announced

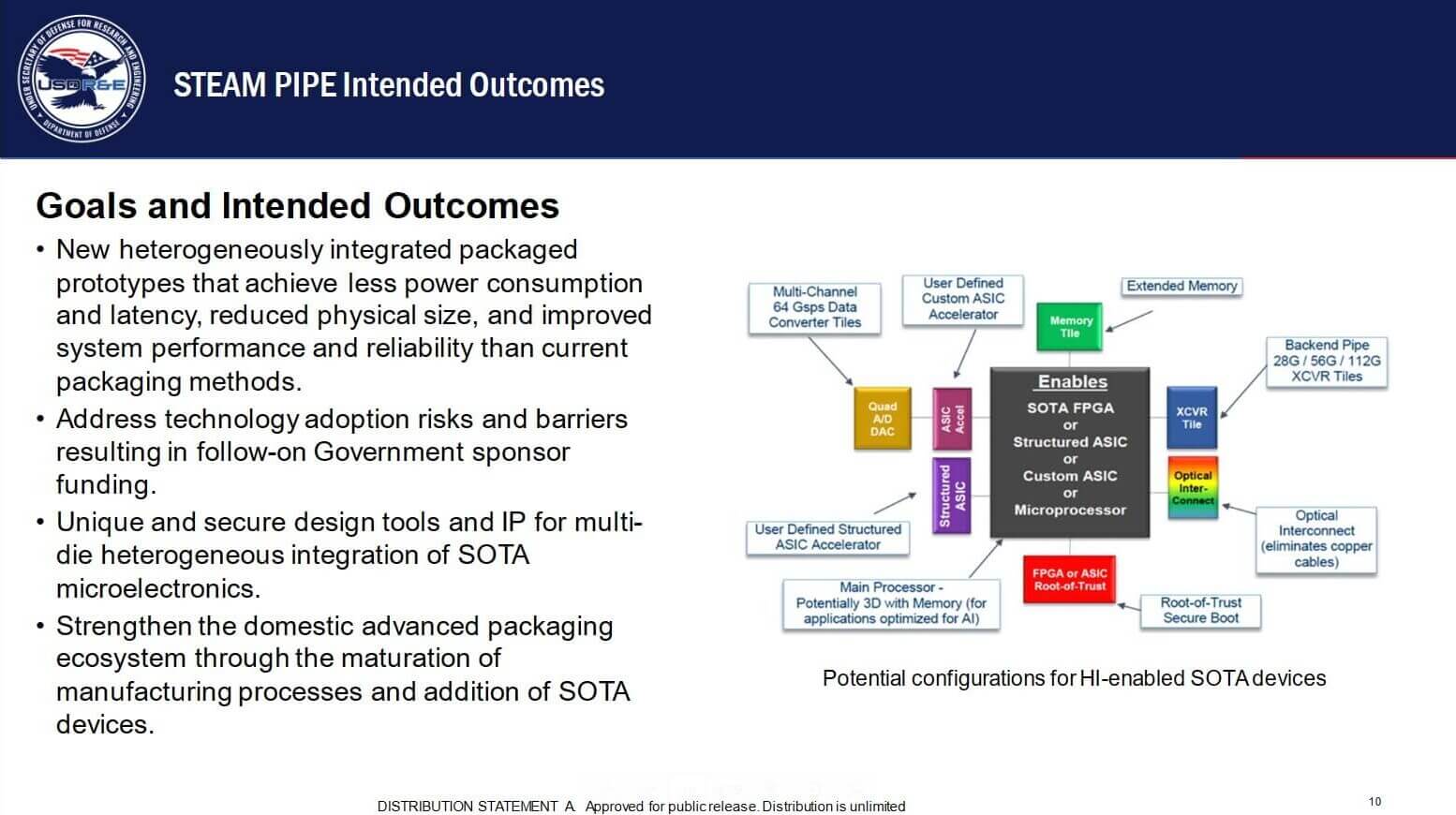

The DoD SHIP program looks to bring in new players in 2023 (beyond current participants Intel, Qorvo, and Mercury Systems). They will do this through their new program, STEAM PIPE. STEAM PIPE stands for Strategic Transition of Microelectronics to Accelerate Modernization by Prototyping and Innovating in the Packaging Ecosystem (Figure 1).

Steampipe program winners are:

- BAE: DSP chiplet

- Lockheed Martin: secure chiplet

- Marvell: GPS chiplet

- Northrup Grumman: Mixed-signal MCP

- Raytheon: MCP w/ FPGA chiplet

- Raytheon: MCP w/ RAMP chiplet

- AMD: FPGA chiplet

Are Japan’s Chip Materials Companies Acquisition Targets?

Nikkei Japan reports that Japanese makers of semiconductor materials, owners of a combined 50% share of the global market, are facing a wave of industrial consolidation.

Many Japanese electronic materials suppliers are targets for foreign takeover, but Japan Inc. covets them for their potential to bolster the rebuilding of the nation’s semiconductor industry.

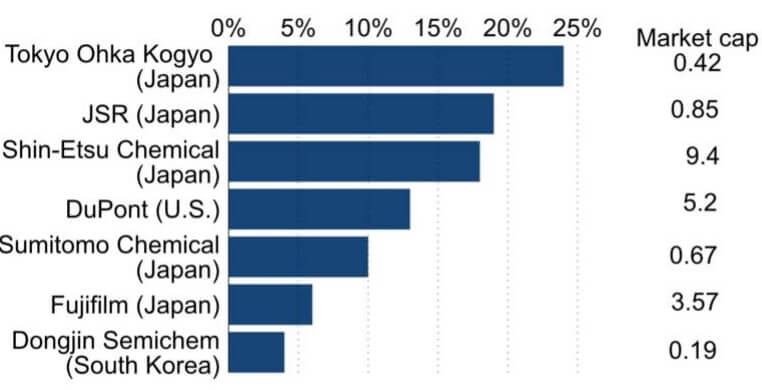

In June, JSR, a major chipmaking materials producer with a market cap of $5.75 B announced it would accept a takeover bid from the government-backed Japan Investment Corp. JSR has about a 20% share of the global market for photoresists as shown in Figure 2.

Many Japanese chip materials producers have price-to-book ratios below 1. As of June 30, Sumitomo Chemical had a PBR of 0.6, Resonac’s was at 0.8 and Kanto Denka’s at 0.9. These low ratios can make it easier for big investors to swoop in and take over companies.

Japanese companies such as NEC and Hitachi dominated the global semiconductor industry in the 1980s. They had a combined market share of 50% in the peak year of 1988 but then began to be overtaken by South Korean and other rivals. By last year, their combined share of the global chip market was 9%, according to Omdia.

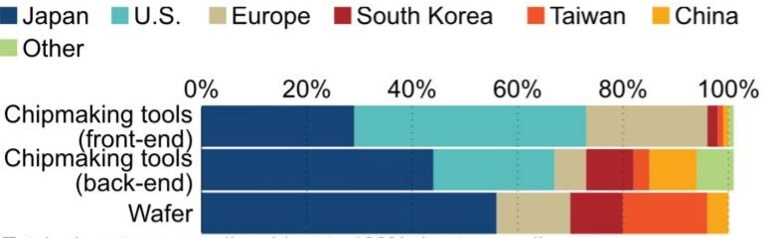

The markets for chipmaking materials and equipment are another matter. There, Japanese companies have shares ranging from 30% to 60%, according to the Center for Security and Emerging Technology at Georgetown University of the U.S. Materials for chip production are becoming increasingly important amid the U.S.-China conflict (Figure 3).

Data from Omdia also shows that Japan has a 48% share of the market for semiconductor materials, followed by Taiwan at 17% and South Korea at 13%. As market competition points toward consolidation, Japan’s chip materials must have a strategy to avoid being acquired.

For all the latest in Advanced Packaging stay linked to IFTLE…………………………………….

Feature Photo: Arizona Governor Katie Hobbs speaks at the US Business Day forum in Taipei yesterday.

Photo Credit: Carlos Garcia Rawlins, Reuters