SEMI held its annual Industry Strategy Symposium (ISS 2019) at the Ritz Carlton in Halfmoon Bay, CA January 6-9, 2019. Many high-level executives represented key areas of the electronic products supply chain. Former government officials emphasized that our country’s leaders recognize the strategic importance of semiconductors.

The theme of ISS 2019 was: “The Golden Age of Semiconductors: Enabling the Next Industrial Revolution.” While several presenters questioned if the first half of 2019, with rapidly declining memory prices and geopolitical uncertainties, will qualify as “golden”, every speaker agreed that artificial intelligence (AI), 5G, the internet of things (IoT) advanced driver assist systems (ADAS), augmented and virtual reality (AR/VR) and other new applications will give the semiconductor industry plenty of growth opportunities – if we accept the emerging challenges.

The big picture

Ann Kelleher, senior VP, and GM of Intel’s technology and manufacturing group gave the first keynote. Her first slide quoted Darwin: “It’s not the strongest of a species, nor the most intelligent, that survives, but the most adaptable to change”. This quote was a great summary of her presentation and the entire conference.

New growth drivers demand (sub)system-level solutions, not component-level ICs. Remember, at the turn of the millennium, some semiconductor vendors suffered big declines, because they didn’t transition fast enough from the ASIC business model to application-specific ICs (ASSPs). Now, heterogeneous functions, combined in advanced IC packages, are becoming key enablers for another big step towards application-specific and system-level solutions. Intel’s recent announcement of a 3D-IC design showed this corporations commitment to heterogeneous integration. Kelleher also emphasized that attracting new college grads, driving materials innovation and expanding cooperation between domain experts are important success criteria for our industry.

After this keynote Ajit Manocha, SEMI’s president and CEO took the stage and announced that he just signed a memorandum of understanding (MoU) with the Belgian research institute, imec, to jointly drive roadmaps and innovation.

Session 1 focused on economic trends and how they are likely to impact the semiconductor industry. R. Nicholas Burns, retired ambassador and professor at Harvard’s Kennedy School of Government, conveyed his view of strategic global trends, (Figure 1).

Superimposing these megatrends on the semiconductor industry, well known for rapid technology and requirement changes, suggests keeping Darwin’s quote above in mind.

A closer look at industry specifics

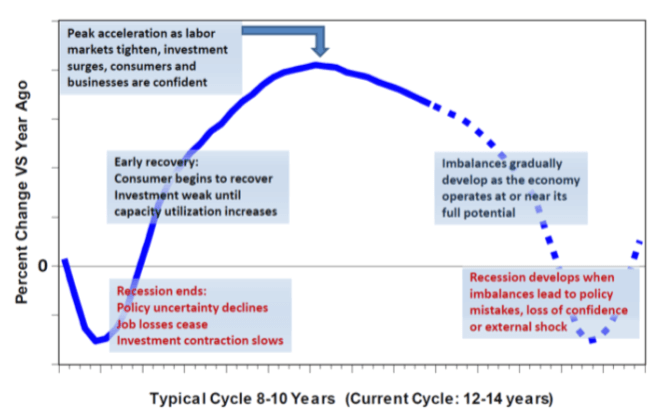

Duncan Meldrum, Founder of Hilltop Economics, focused his talk on the semiconductor business cycle and pointed out: The current cycle is unusually long, capacity utilization is high, rising short-term interest rates may contribute to a slowing economy (Figure 2).

Meldrum is optimistic that new applications, like AI, 5G, IoT, ADAS, AR/VR will help to extend the current cycle. He also shared that Jay Powell’s main reason for recent rises in interest rates was the Federal Reserve’s objective to create some room to lower rates if/when the economy weakens.

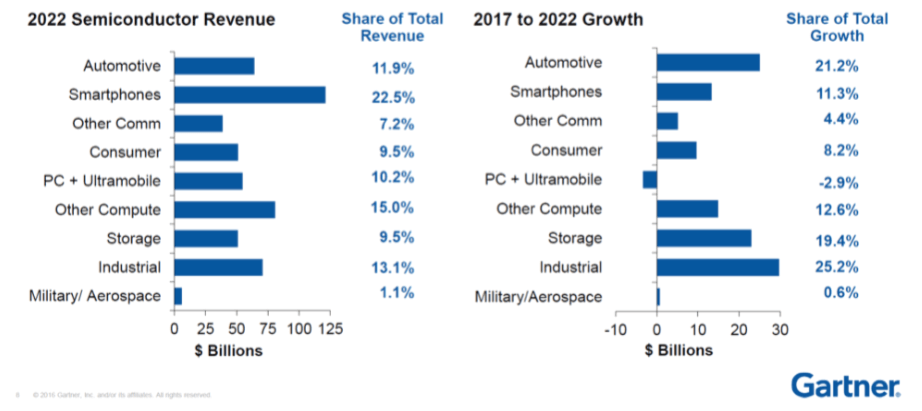

Gartner’s VP, Bob Johnson, gave an outlook for key segments of the semiconductor industry and emphasized: Change is in the air! He confirmed softness, at least for the first half of 2019, and projected significant long-term growth for semiconductors. Figure 3 below also shows a shift away from consumer to industrial, automotive and storage applications.

Johnson predicted rising average selling prices (ASPs), due to the increasing complexity of ICs and heterogeneous (sub)systems. Even memories will enjoy higher ASPs, compared to current prices, as they’ll pack many more bits into every chip.

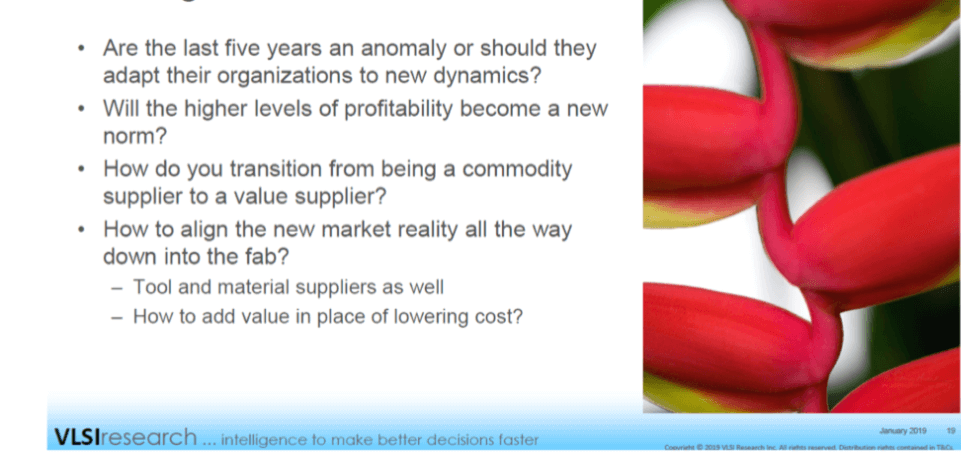

Andrea Lati represented the more manufacturing-focused VLSI Research Inc. He highlighted that CapEx per unit of bit-growth is rapidly increasing and explained that in future product value (a.k.a. fit for a specific application) will drive margins, not cost reduction efforts (Figure 4).

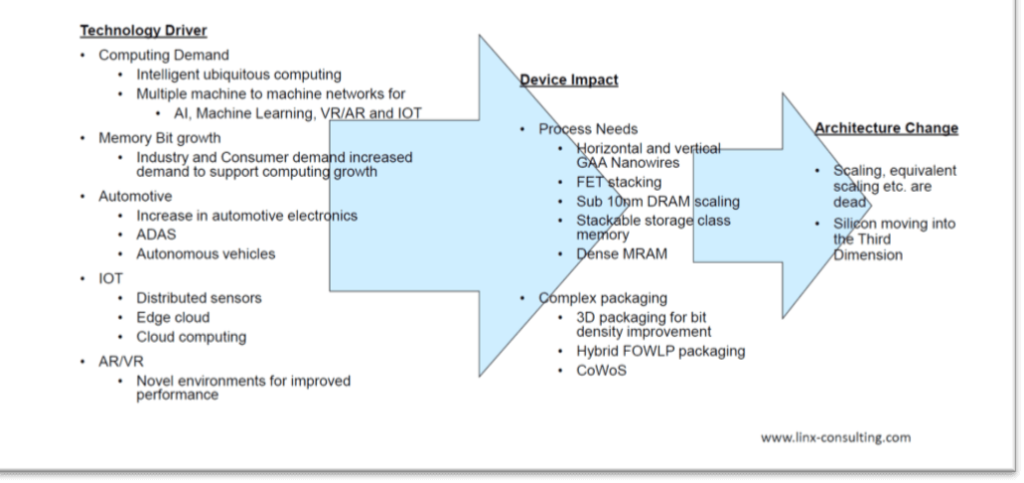

Michael Corbett, managing partner and co-founder of Linx Consulting, talked about wafer fab materials in the era of 3D scaling. He explained that today wafers are 50% of the materials value input for ICs and suggested that silicon wafer prices need to go up, to encourage more investment in wafer fab capacity and capability. Like other presenters, Corbett also predicted change on multiple fronts (Figure 5).

Perspectives of key players at our customers

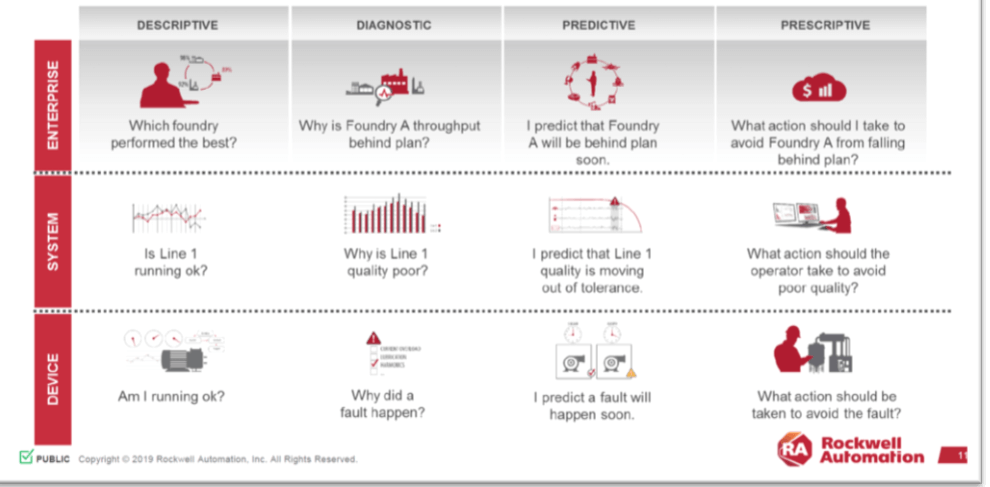

Sujeet Chand, senior VP and CTO at Rockwell Automation, highlighted the value of Big Data and analytics to maintain/improve a factory’s performance (Figure 6). Chand also pointed out that the worldwide growing middle class represents a large market for low/medium volumes of personalized products and requires flexible manufacturing environments. He called for more standards and encouraged compliance, to make factory modifications easier to initiate, more impactful and rewarding. Chand called for domain experts to structure Big Data analysis, to make it scalable and efficient in creating business value.

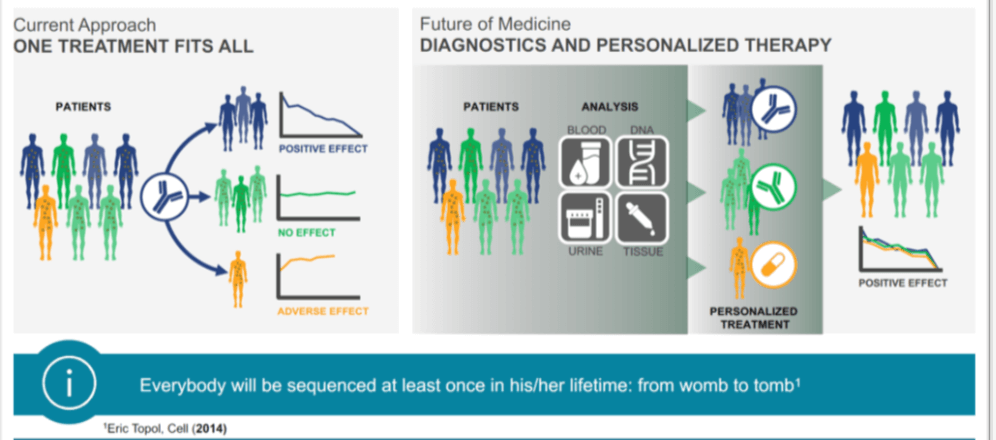

Selexis’ CEO, Igor Fisch, explained that increased computing power – enabled by semiconductors – has lowered the cost of genome sequencing from $ 2.7B in 2003 to $ 100 today. This enables the development of personalized, highly effective drugs (Figure 7).

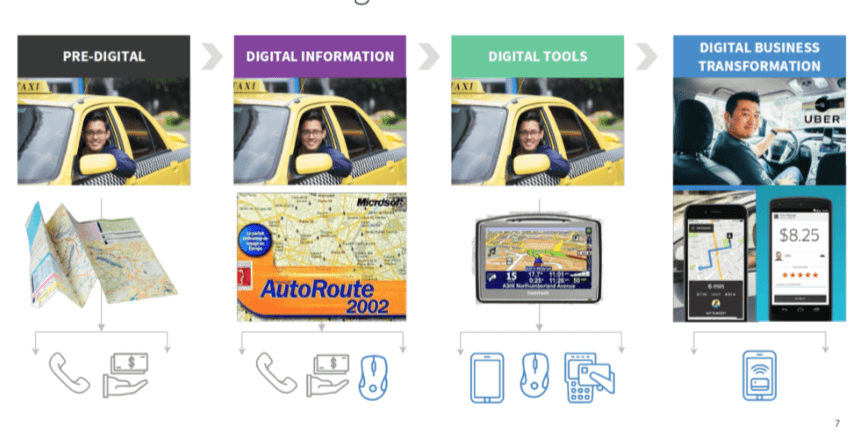

Eric Jones, CEO of Enthought, presented a great example of what “Digital Transformation” means and how it can contribute significantly to enhancing our lives (Figure 8).

Jones explained how AI can be utilized to enhance metrology and image analysis, e.g. to improve factory productivity. He pointed out that it takes a company’s top management support for domain experts to construct a digital twin and improve operations. Machine-readable and properly structured data (not a mix of Xcell, pdf, Word,… files) is also needed to succeed.

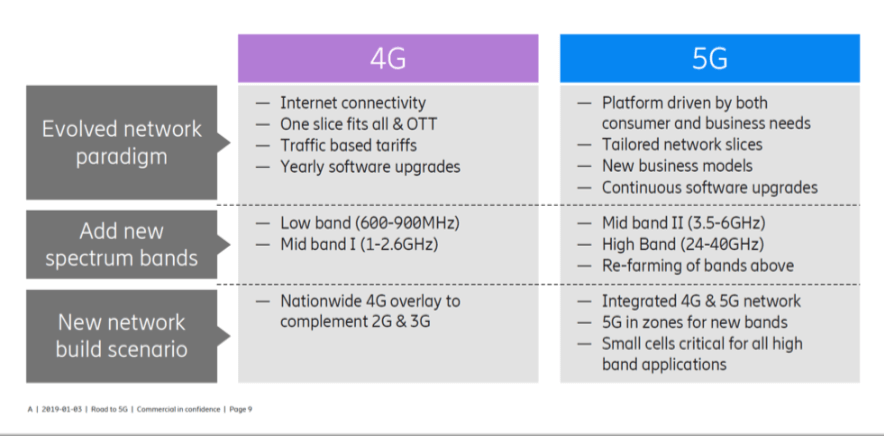

Sree Koratola, Head of Cloud and Digital Services at Ericsson, talked about the road to 5G and demystified 4G versus 5G (Figure 9).

Koratola explained that many IoT applications will need much shorter latency and higher bandwidth of 5G to provide practical value. She also pointed out that the significantly higher frequencies (see above) require new semiconductor material and metrology/test techniques to ensure high performance per Watt as well as reliable products and systems.

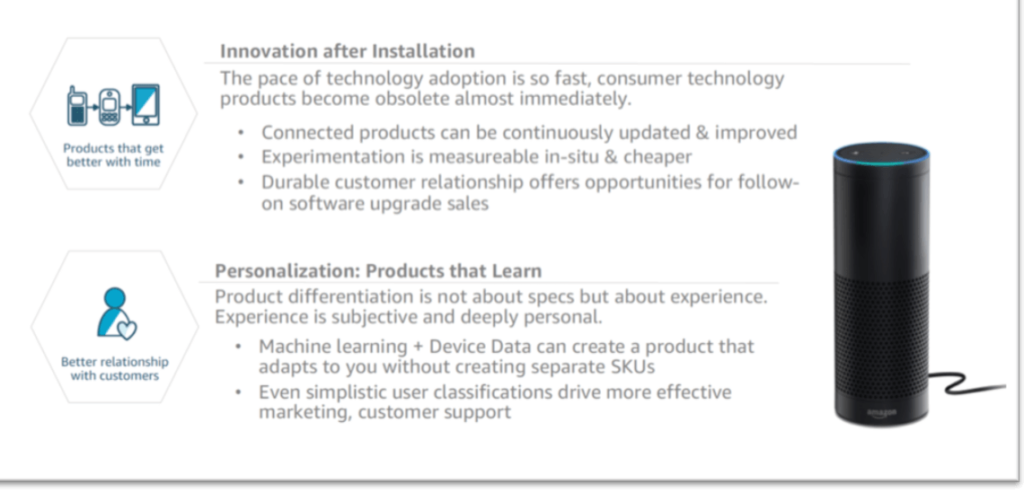

Sarah Cooper, GM IoT Analytics and Solutions at Amazon Web Services (AWS) confirmed that data processing at the IoT edge nodes is increasing significantly to reduce network load and minimize response times. She gave several examples of how image sensors are being deployed in factories, public buildings, even in the agriculture industry to monitor assets, animals, and persons. Over-the-air software updates can keep these edge nodes current and productive (Figure 10).

Day 1 of ISS 2019, my first such symposium, clearly confirmed that the only thing constant in our industry is change. The best news – in my perspective – was the confirmation that the U.S. government is supporting our industry to compete against heavily subsidized companies in other countries. It also confirmed that semiconductors are very important to maintain the U.S. strengths and ability to influence worldwide trends, even when others prefer to prioritize the government support needed for our hard-working soybean farmers.

Thanks for following ISS 2019 Day 1 with me. Highlights from Days 2 and 3 follow shortly………..~ Herb