“Fan-out packaging is now a must-have in the portfolio to stay competitive,” asserts Favier Shoo, Technology & Market Analyst and part of the Semiconductor & Software team at Yole Développement (Yole). “New milestones are achieved by SEMCO and PTI with fan-out panel level packaging (FOPLP) technology. Both companies have invested and developed FOPLP for production successfully in 2018.” Under this dynamic context, advanced packaging companies are re-defining strategies to improve their market positioning or maintain their leadership. As a consequence, the supply chain is directly impacted and business models are thereby evolving. The fan-out packaging landscape of today is more fragmented than ever…

Yole Group of Companies including Yole and System Plus Consulting pursue its investigations towards the advanced packaging technologies and propose a significant collection of reports dedicated to fan-out. More than a simple description, reports performed by both partners are comprehensive analyses of the industry evolution, market trends, and technology challenges.

Fan-Out Packaging: Technologies and Market Trends report and Advanced Packaging Technology in the Apple Watch Series 4 are the latest reports related to the fan-out technologies and proposed by the Yole Group of Companies.

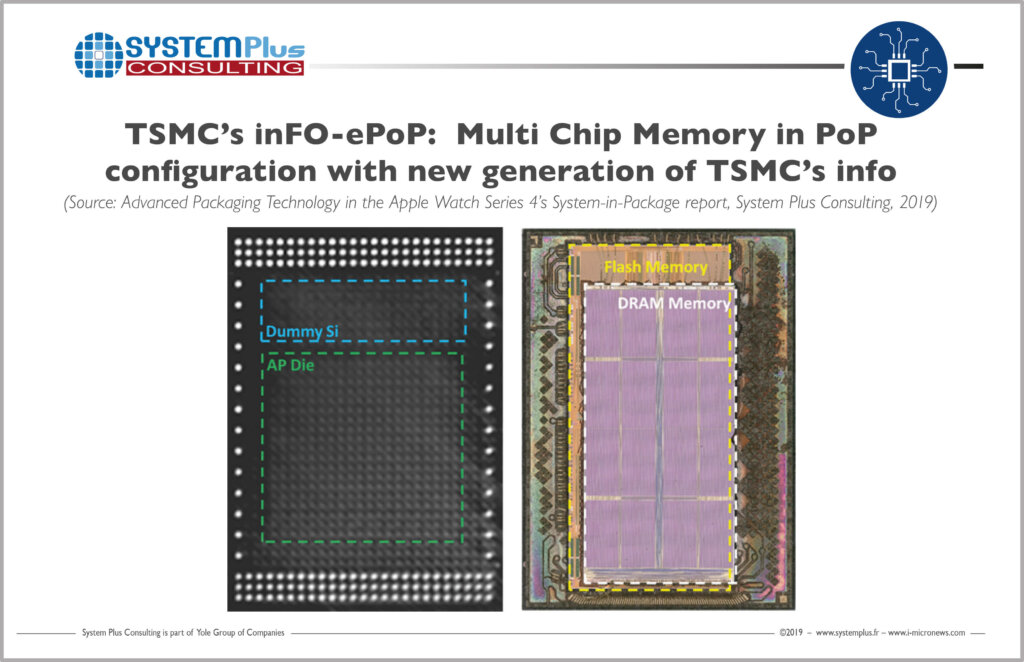

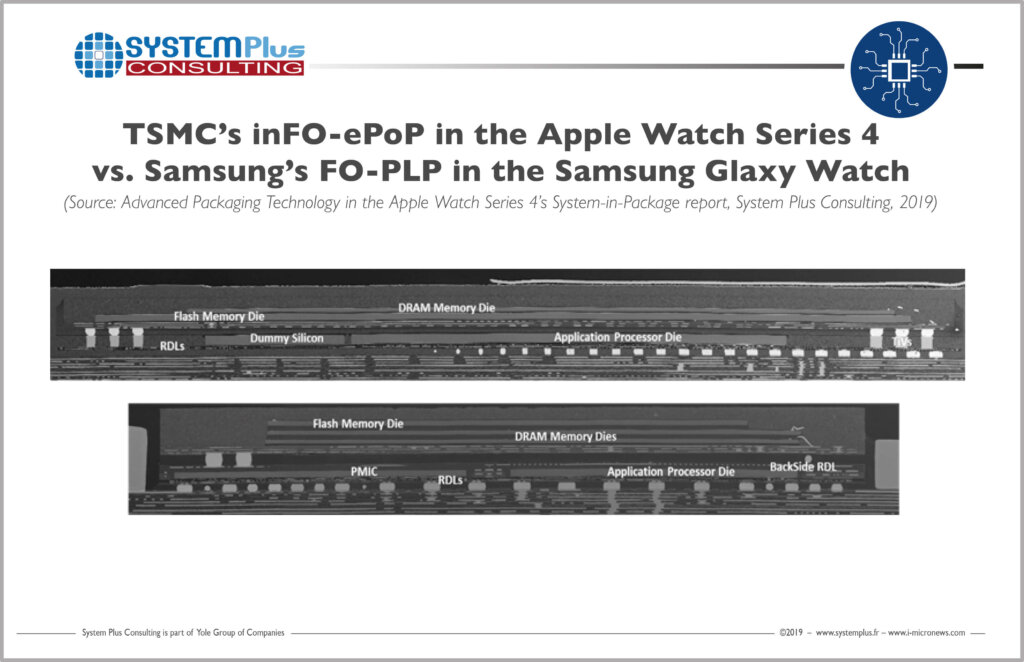

Stéphane Elisabeth, Ph.D., expert cost analyst at System Plus Consulting comments: “With the Apple Watch Series 4, the leading company has chosen to collaborate with many innovative partners including TSMC. Therefore, the application processor (AP) packaging is based on TSMC’s integrated fan-out (inFO) technology in the last version, called inFO-ePoP coupling Multi-Chip Memory with the AP.”

With these new reports, Yole Group updates the business status of fan-out technologies markets with forecasts and roadmaps definition, competitive landscape, reverse engineering and costing analyses… and points out the technical challenges and impact on the supply chain. A detailed description of the advanced packaging reports is available on i-micronews.com, advanced packaging reports section.

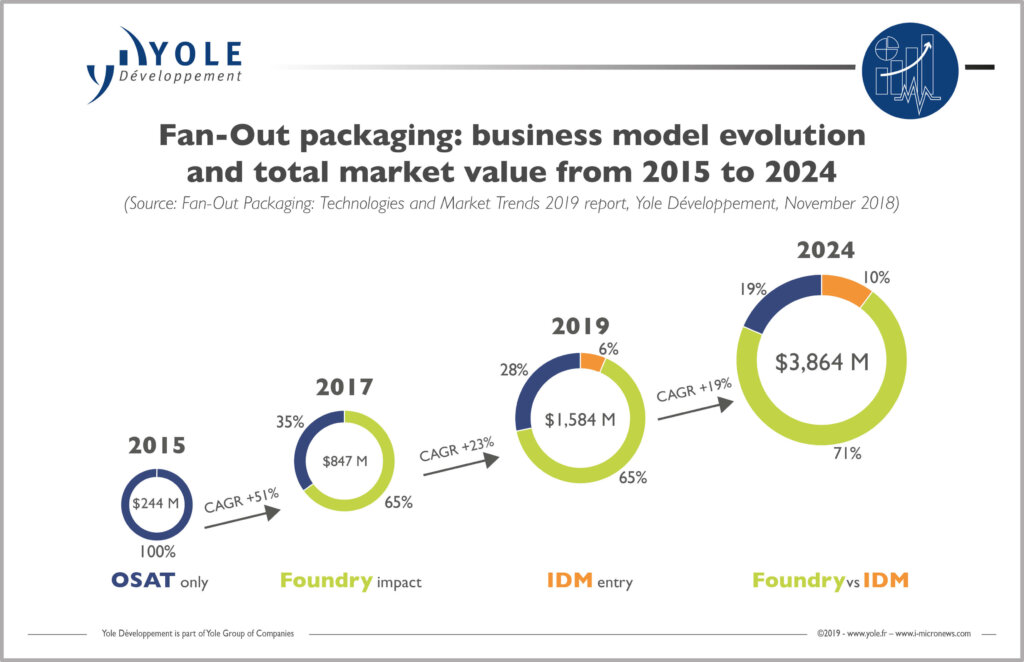

In 2015, the fan-out market was small and consisted mostly of standard devices like baseband, RF, and PMUs. But after TSMC’s 2016 game-changer with inFO for Apple’s iPhone APE, market value increased 3.5x by 2017. Thus the high-density Fan-Out market segment was created, reducing the market-share ratio of OSATs.

Since then, SEMCO/Samsung has joined the fan-out packaging market as a new entrant and expanded it into the consumer market.

Moving forward, TSMC is betting on inFO to secure new high-end packaging projects in mobile, high-performance computing, and networking. While SEMCO/Samsung continues to gain ground on TSMC in the HD fan-out market and generate value in core fan-out, OSATs will keep competing for business – but under price pressure from fabless. In this scenario, PTI may emerge as a fan-out packaging leader due to FOPLP’s cost-effectiveness and a possible HD FOPLP breakthrough for multi-die with logic + memory, etc.

The fan-out packaging market value is expected to grow at a 19% CAGR between 2019 and 2024, reaching a market size of US$3.8 billion. Meanwhile, the love-hate relationships and politics surrounding OSATs, IDMs, and foundries will continue to unfold. Any big change in fan-out strategy will have a ripple effect on the entire supply chain.

The fan-out packaging market value is expected to grow at a 19% CAGR between 2019 and 2024, reaching a market size of US$3.8 billion. Meanwhile, the love-hate relationships and politics surrounding OSATs, IDMs, and foundries will continue to unfold. Any big change in fan-out strategy will have a ripple effect on the entire supply chain.

Currently, all key OSAT/foundry/IDM players have fan-out packaging solutions in the market. The fan-out landscape remains dynamic, with more opportunities to maximize performance at a lower cost – hence the adoption of Fan-Out by various business models. In a mega-trends-driven era, Fan-Out platforms are increasingly viewed as one of the top options amongst leading package technologies.

“More OSAT players are getting even more involved in fan-out packaging,” says Favier Shoo from Yole. “They are the main contributors for Core Fan-Out and are all targeting volume production with different status in their development”.

In parallel, many IDMs are pushing for fan-out development and embedding of their dies through R&D and small series in collaboration with OSATs or for internal use only.

Under its new fan-out report, the consulting company Yole details the status of the fan-out technologies, their adoption for volume production and the evolution of the business models – See the image enclosed: business evolution between 2015 and 2024.

Under its new fan-out report, the consulting company Yole details the status of the fan-out technologies, their adoption for volume production and the evolution of the business models – See the image enclosed: business evolution between 2015 and 2024.

Analysts point out key advanced packaging players, their business models and their technical positioning:

- SEMCO/Samsung (IDM) and PTI (OSAT) focus their activities on core fan-out with FOPLP.

- The foundry TSMC is developing high-density fan-out-based solutions.

- NXP as an IDM is part of the Core fan-out playground. In addition to NXP, Yole also lists the following OSATs: ASE, Amkor Technology with Nanium, JCET (Stats ChipPac and JCAP), Deca and Nepes.

Moreover, other companies that are pursuing fan-out packaging capabilities are OSATs. The list includes Amkor Technology in Korea, ASE/Deca, in Huatian and SPIL…

Yole and System Plus Consulting will present their vision of the advanced packaging industry, its evolution, the competitive landscape and forecasts all year long during key conferences and trade shows. To discover 2019, visit i-micronews.com website.

Sources: www.yole.fr – www.systemplus.fr