SEMI Investment Act Tax Credit to Include Materials Suppliers

SEMI, the industry association, has announced support for the introduction of the Strengthening Essential Manufacturing and Industrial Investment Act (the SEMI Investment Act) which would extend the Advanced Manufacturing Investment Tax Credit established under the U.S. CHIPS and Science Act through 2031 and clarify that critical materials suppliers are eligible for the tax credit.

SEMI representatives offered that “Ensuring a strong and secure domestic semiconductor ecosystem in the United States requires sustained investment across the entire semiconductor supply chain…. The SEMI Investment Act extends the tax credit beyond 2026 and expands it to materials manufacturing projects …”

The SEMI Investment Act would not only extend this tax credit vital to the expansion of domestic semiconductor manufacturing by an additional five years but also expand it to help fortify the supply of fundamental semiconductor materials. “By expanding the credit to upstream suppliers, we secure every link of the semiconductor ecosystem, strengthen our resilience, reduce dependence on China, and give American manufacturers the certainty they need to compete, innovate, and lead,”

Key Provisions of the SEMI Investment Act

- Expands the CHIPS Act tax credit to include upstream materials essential to semiconductor production.

- Provides clear statutory definitions for direct and indirect production materials, reducing uncertainty for industry planning and investment.

- Requires annual materials qualification lists from Treasury and Commerce, with an expedited review pathway for emerging technologies.

- Extends the Advanced Manufacturing Investment Credit through 2031, aligning federal incentives with long-horizon capital investments.

This Legislation Claims it is Urgently Needed Because:

- China controls up to 85% of global processing of rare earth elements and key semiconductor inputs.

- These materials underpin America’s defense systems, AI computing, clean energy technologies, medical devices, and the broader innovation economy.

- Without domestic materials production, CHIPS-funded fabs remain vulnerable to supply shocks, export controls, and strategic coercion from the Chinese Communist Party.

Amkor – Advanced Packaging for Next Gen Vehicles

Recently Amkor took a look at what’s coming for next generation vehicle Advanced packaging.

In the past, the automotive industry has been slow to adopt the latest semiconductor technologies due to reliability concerns and lack of SOTA needs. That’s now changing, for instance NXP announced the development of 5 nm automotive processors in 2020 and TSMC announced its “Auto Early” 3 nm processes in 2023.

Of course, IFTLE readers all know that the use of advanced node devices requires the use of advanced packaging as we have seen for HPC and AI applications.

The multiple cameras, radar, lidar and ultrasonic sensors etc. feed data into the automotive compute units. Processing this data require specialized functional blocks on the processor. As more functional blocks are introduced, the chip size and complexity will continue to increase. Instead of a single, monolithic silicon chip, a chiplet approach with separate functional blocks that allows intellectual property (IP) reuse along with optimal process nodes for each functional block, may be required.

Current advanced driver-assistance systems (ADAS) applications require a DRAM bandwidth of less than 60GB/s, which can be supported with standard double data rate (DDR) and LPDDR solutions. However, ADAS Level 4 and Level 5 will need up to 1024 GB/s memory bandwidth, which will require the use of solutions such as Graphic DDR (GDDR) or High Bandwidth Memory (HBM).

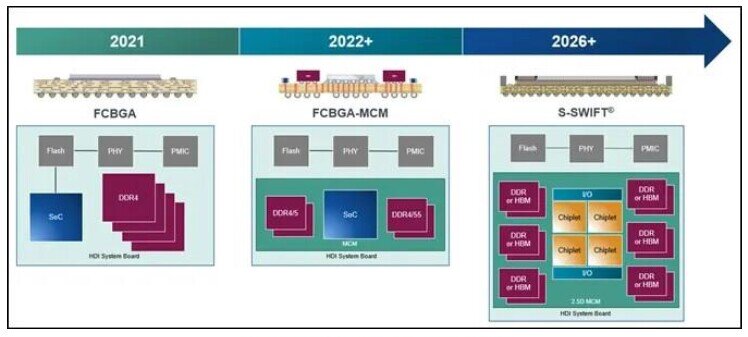

As cars move to a central computing architecture, Amkor sees SoCs becoming more complex and running into size and cost challenges. They envision splitting these SoCs into chiplets and packaging these chiplets using fan-out or 2.5D silicon packages will become necessary. Thus Amkor predicts “Just as FCBGA and MCMs transitioned into automotive from non-automotive applications, so will fan-out and 2.5D packaging for automotive compute processors.”

They also predict that we will see the use of MCM increase, i.e. “The use of MCMs is likely to increase in automotive compute to enable components like the SoC, DRAM and power management integrated circuit (PMIC) to communicate with each other without sending signals off-package”.

For all the latest in Advanced Packaging stay linked to IFTLE………………………..