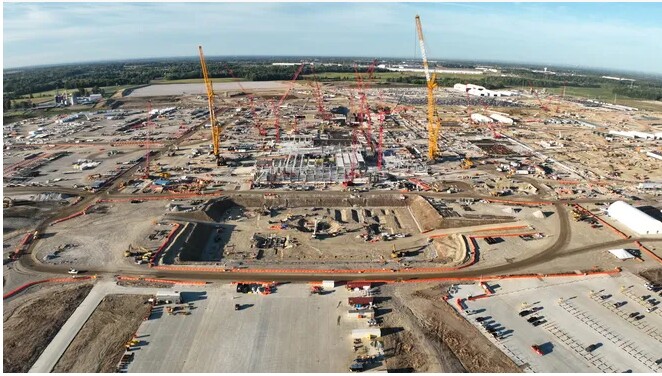

Intel Ohio is started, but when will it be finished?

The Columbus Ohio Dispatch has just reported that Intel is still committed to its proposed Ohio production facility, but it will “further slow down” construction at its future Ohio microchip factory. Intel announced this slowdown July 24 during its second quarter earnings report. Intel’s first Ohio factory was supposed to begin operating in 2025, but the company told The Dispatch earlier this year that it had delayed the opening of its Ohio fabs until at least 2030 or 2031. The Columbus Dispatch also reported that Intel will continue construction work such as pouring concrete, steel framing, and groundwork and that company plans to invest over $1 billion in the project in 2025 alone.

While It’s unclear how this announcement will further delay Intel’s opening date in Ohio, it leaves no doubt that it will be further delayed. Intel is required to provide state officials an annual status report and an updated timeline each year and the next one is due in March 2026.

At the earnings report last week, Intel said it must secure external customers for its next-gen 14A node — or risk halting all work at its massive Ohio site. The 14A node isn’t expected to launch until 2027+, so this gives Intel time to find the partners it needs to proceed.

Trend Force reports that abandoning the $28 billion Ohio plant would come at a steep cost.

If the project stalls, they warn Intel could face billions in repayment obligations—refunding government incentives from both Ohio and the federal level tied to the project.

Intel was awarded $7.865 billion under the CHIPS Act, with at least $1.5 billion earmarked for the Ohio plant. The state also pledged $300 million per fab in grants — but only if construction is completed by the end of 2028.

Intel had originally planned to open its first Ohio factory in 2025. However, the timeline has already been pushed back by at least five to six years, with the new expected opening around 2030 or 2031. The second Ohio factory is slated for completion in 2031, with operations beginning in 2032. The overall timetable, as CEO Lip-Bu Tan hinted at the earnings call last week, could be further delayed.

Intel has yet to receive the full funding promised under the CHIPS Act. To date, the company has received $2.2 billion—all of which was disbursed before President Trump took office. Between April and July, Intel has reportedly submitted invoices totaling $850 MM, but has not received any reimbursement yet.

Note: This is surely affected by the government’s 10% Intel aquisition- Read on for more.

US Government Acquires 10% Stake in Intel

It was announced Aug 22nd that the U.S. government has secured a 10% stake in financially struggling Intel making it their largest stakeholder.

The deal is likely to need approval by Intel’s board of directors and could also face a challenge from shareholders or others in the industry concerned about its legality.

The U.S. government’s stake in Intel coincides with the US push to bring chip production back onshore. By lessening the US dependence on chips manufactured overseas, it is believed the U.S. will be better positioned to lead in technologies such as artificial intelligence.

A 10% stake in Intel is worth nearly $10.5 billion at the company’s current valuation, according to Bloomberg. The U.S. government is getting the stake through the conversion of $11.1 billion in previously issued funds and pledges. All told, the government is getting 433.3 million shares of non-voting stock. The government can’t vote with its shares and won’t have a seat on Intel’s board of directors.

Intel, one of the biggest beneficiaries of the Chips and Science Act, secured $10.9 billion in federal grants for building new semiconductor fabs in the United States. About $7.8 billion had been pledged to Intel under the incentives program, but only $2.2 billion had been funded so far. Another $3.2 billion of the government investment is coming through the funds from another program called “Secure Enclave” (a multibillion-dollar contract to make semiconductors for the Defense Department).

The company is in the process of terminating more than 20,000 workers as part of its attempt to bounce back from several years of significant financial losses, i.e. losing more than $22B since the end of 2023.

Intel’s market value currently stands at about $108 billion – a fraction of the current chip kingpin, Nvidia, which is valued at $4.3 trillion.

Although rare, such a move by the government is not unprecedented. In 2008 the government injected ~ $50B into General Motors in return for a roughly 60% stake in the automaker at a time it was on the verge of bankruptcy. The government ended up with a roughly $10 billion loss after it later sold its stock in GM.

Even before taking the 10% stake in Intel, the government announced that it is requiring Nvidia and AMD to pay a 15% commission on their sales of AI chips in China in exchange for export licenses.

It’s unclear how a government ownership in Intel would solve the company’s problems other than propping it up financially. Intel has publicly stated that its manufacturing business is struggling to find customers. There is worry that in order to make this investment work, the government would need to lean on companies like Apple, Nvidia and Qualcomm, to buy Intel chips.

For all the latest on Advanced Packaging stay linked to IFTLE………………………..