The song, Happiness is Lubbock Texas in My Review Mirror, has a special meaning for me, as due to a Texas ice storm, a day trip to Lubbock, TX was extended. Thanks to a determined Southwest Airlines team, a group of us managed to get home only a day later, as opposed to potentially spending the weekend in Lubbock in the snow and ice.

As the semiconductor industry moves into 2022, I can’t help but wonder if any executives are thinking: “happiness is 2021 in the review mirror”. Perhaps they have mixed feelings about a year riddled with ice storms in the southwest of the United States that shut semiconductor plants down, as well as droughts in Taiwan, a factory fire in Japan, shipping and supply chain issues for material, equipment, and semiconductor manufacturers, a hybrid work environment increasing manufacturing challenges, and a talent shortage. This has all contributed to the widely highlighted chip shortage. That, paired with unprecedented demand due to what could be called a paradigm shift in the electronics industry due to electric vehicles (EV), 5G, smart everything, and edge computing, is making things interesting, to say the least.

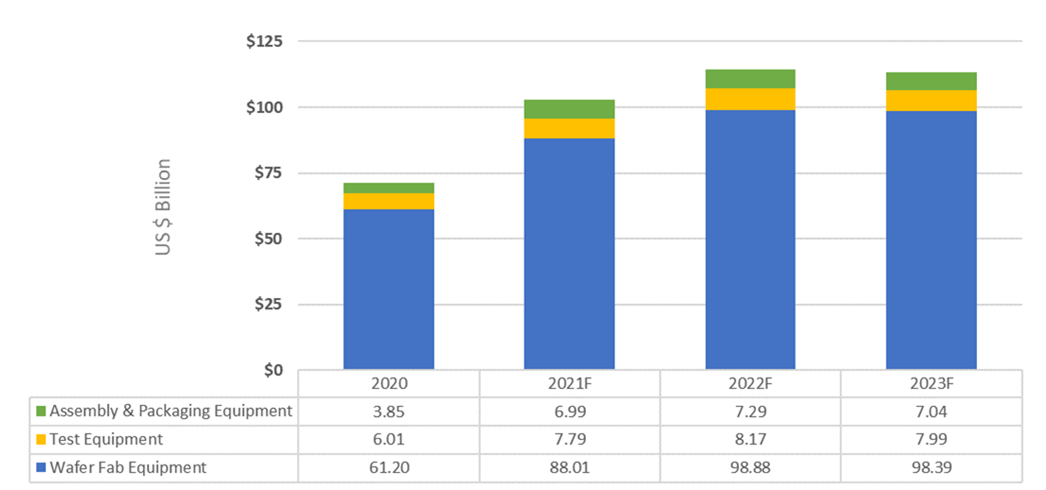

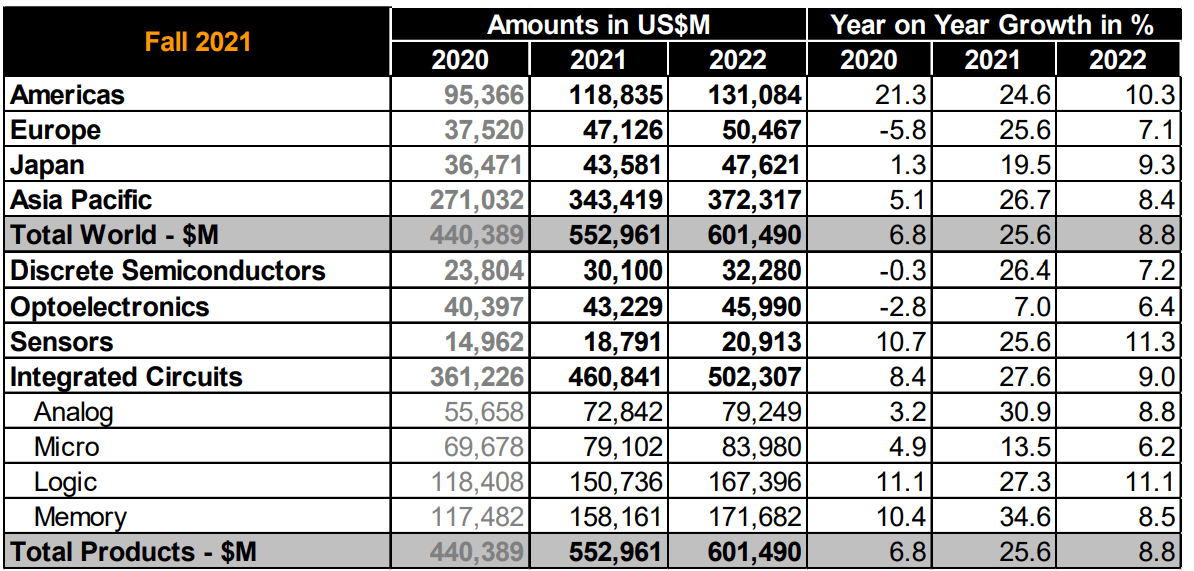

However, even with all the challenges, this has been a banner year for the microelectronics industry. From a chip perspective, the Semiconductor Industry Association (SIAs) fall forecast has the industry ending 2021 at 25.6% growth. This equates to $553 billion in growth for 2021, the strongest growth year since 2010. From an equipment and materials perspective 2021, according to a recent press release by SEMI, total equipment is expected to reach a historical high of $103 billion, 44% year over year growth, with WFE reaching 88 billion, and the assembly and packaging sector just shy of $7 billion, and test at $8 billion.

IC Insights estimates that total Capex will reach $152 billion; also a historical high. The market research firm says these strong growth rates have been driven mostly by logic and analog expansion. The top four equipment companies — Applied Materials (AMAT), ASML, Lam Research, and TEL — all look like they will top the $10 billion mark for equipment sales, and ASML looks like it has close to a 12-month backlog going into 2022 (Figure 1).

As the industry moves into 2022, most CEOs seem to be cautiously optimistic on their quarterly calls, but as this industry has learned over time, the outlook can change in the blink of an eye. The last time I remember ASML having a 12-month backlog, the outlook changed very quickly as I’ll discuss below.

What Will 2022 Bring for Semiconductor Expansion?

What does this mean for 2022? At first look; good news. In its December press release, the SIA is forecasting an 8.8% growth in semiconductors. IC Insights is predicting 11% growth. So, from a chip perspective, the growth will continue. The growth in part is being driven by the extended chip shortage.

Many articles written on the shortage have the tightness or shortages extending through at least the first half of 2022 and possibly longer. However, this pertains mostly to logic and particularly automotive, due to the increasing demand for electronics in automobiles. The SIA forecast shows fairly even revenue growth across all sectors for 2022, perhaps suggesting that supply and demand will come further into balance in 2022, and the shortage will start to dissipate (Figure 2).

On the Equipment Side

From an equipment perspective, SEMI is predicting 11% growth in 2022 after a staggering 44% growth in 2021. The 11% for equipment growth for 2022 seems to be close to the consensus from the earnings calls from the “Big Four” equipment companies. In 2023, SEMI is predicting a very slight downturn. This is where it gets a bit interesting. Ajit Manocha, President, and CEO of SEMI presented the following at SEMICON West:

Between 2020 and 2024 a significant number of fabs will be built. Twenty-five 200mm fabs and 60 300mm fabs. This accounts for 18% capacity growth for 200mm and 48% growth for 300mm in the 2020–2024-time frame. For 200 mm 14 of those 25 fabs are in China, two in Taiwan, and three in Japan. For the 300mm fabs, 15 are in China and 15 are in Taiwan. Six are targeted for the United States, and Europe and Israel are seeing a significant increase in activity as 10 are targeted for Europe and the Middle East. This suggests the potential for strong growth in the foreseeable future. Especially since it appears that China will continue to build no matter what the environment.

Another positive out of the above fab forecast is that there is little to no inventory for 8-inch used equipment. This means that unless that 200mm fab has a source for 200mm equipment, they will be buying new equipment which will then have a significant impact on margins due to paying off that newer equipment. I suspect this might slow the start-up of some 200mm fabs, but also be extremely beneficial to 200mm equipment suppliers.

So, What Could Go Wrong?

Chip demand is currently extremely strong. Consumers in the United States are fueling electronics demand. The automotive industry needs to catch up and build inventory. 5G is rolling out, as is WiFi6, and the industry is digitizing, which strengthens the demand for cloud computing, and artificial intelligence (AI).

What can slow the industry down?

There are the usual suspects. Covid 19, a talent shortage, trade issues. To me, these are minor bumps in the road and, except for the trade issue, can be resolved with some creative thinking, such as training programs, which used to exist when I entered the industry. My concerns are something bigger on the horizon.

The first is what instigated the last major downturn in the industry. In 2008 and 2009 wafer fab equipment (WFE) declined 32% and 46% respectively due to the Lehman Brothers financial crisis. Going into SEMICON West 2008, equipment backlogs were 6-12 months, the future looked very bright. and then three months later the industry was scrambling. According to the Chip History website, analysts were not aware of the impending crisis. Some analysts were concerned, but the hot electronics market and the huge WFE backlogs made it difficult to send a message of doom and gloom.

So, what does the Lehman crisis have to do with today’s market? While in the western world the financial markets are in pretty good shape. In China, multiple bankruptcies are in progress. Evergrande real estate, and The Tsinghua Unigroup, parent of YMCT, are both struggling financially and are working to restructure. While the total debt of both companies is well under 500 billion, there are some thoughts that this could cause a significant financial crisis in China. If Evergrande fails and does not get bailed out, it is likely there will be a slowing of investment in new projects. If YMCT goes under, there would probably be a limited impact on the NAND business but, there could be a shock wave for the equipment industry, as there could be a pullback on those 29 new fabs scheduled to start-up in the next two years. It is a challenging situation to predict. Beijing may help to avoid any crisis, but it is also possible Beijing will let the companies fail. It happened in the LED industry when it was overbuilt in China a while back, so it could also happen in this situation. Currently, it is a wait-and-see situation.

The US/China trade issues also cloud the future of the equipment outlook. From my perspective, the US Government trying to stop China’s chip and electronics expansion are a bit like trying to put the toothpaste back in the tube, since previous administrations encouraged electronics growth in China. There is always the outside chance the commerce department will prohibit the sales of US semiconductor equipment to any fab in China, and pressure U.S. allies to follow suit. In the near term this would make the semiconductor shortage even worse, and in the long term have the potential of US or European companies reshoring parts of that chip business. However, this transition would take at a minimum, 4-6 years, and it would need significant government financing, significantly more than the current, hopefully, by the time you read this passed, CHIPS act is proposing.

In the short term, it would reduce the semiconductor equipment sales by approximately 25% until that chip business was relocated. It would also potentially create the opportunity for the Chinese equipment makers to up their game and develop competitive products for the Chinese market.

The other upcoming challenge for the industry is the inevitable oversupply of chips that will be created by all of these new fabs. Economics has driven the chip industry. Economics has driven the fabless model and made TSMC the success it is today. I don’t remember the source, and I probably have written it in these blogs before, but “Happiness is a fully loaded Fab”. The oversupply probably won’t happen in 2022, but maybe that’s why SEMI has a flat forecast predicted for 2023.

So, while at the moment, the future of the semiconductor chip, packaging, and equipment industry looks very bright, I’m making sure I’m wearing my polarized lenses so I can hopefully see the contrasts as they come down the road.

This article originally appeared in the 2022 3D InCites Yearbook. Read the full issue here.