As Silicon Valley Bank (SVB) and Signature Bank failures were happening, I read a Facebook post that commented, 1929 again? I then started thinking about the number of bank and industry crashes that have taken place over time, and closer to home during my career.

1929 sticks with many of us. At my age, my family was impacted by it, and I was told about it many times, as we lost the farm. I was often told my paternal grandmother could actually make a silk purse out of a sow’s ear.

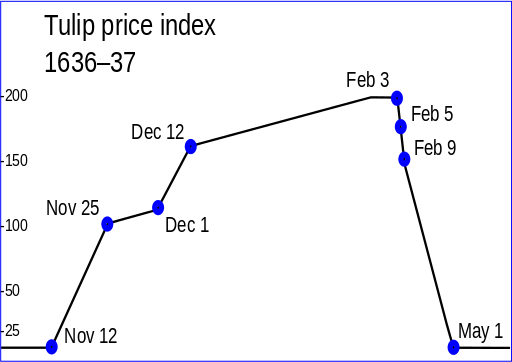

From a financial aspect, multiple banks went into failure in the years following the stock market crash as there were runs on the banks due to the financial uncertainty, and poor investments of the time. One of my favorite historical crashes is the tulip mania in the late 1630s.

According to Wikipedia, tulip mania is thought to be the first recorded speculative bubble in history. In 1634 in Holland, contract prices for fashionable tulip bulbs shot up, only to dramatically crash in February of 1637. (Figure 1)

1929 may have been one of the worst financial crises in modern history; however, several others have impacted the high-tech industry. The 1987 savings and loan crisis. 1990’s the Japanese real estate bubble, 1996 the Asian financial crisis, 2001 the dotcom bust, 2007-09 the subprime mortgage crisis, and now the collapse of the Silicon Valley Bank, which has precipitated the failing and restructuring of several other banks. Fortunately, at least at the moment, the banks have closed ranks and the national banks have lent money to keep things solvent for the time being.

Each of these crashes was different, but most were typically caused by a bank being over-leveraged and under-scrutinized. Yes, SVB and others were overleveraged, but SVB likely wouldn’t have failed if the VC and start-up community hadn’t pulled out their money, almost overnight; an old-fashioned run on the bank. But thanks to digital banking, it wasn’t nearly as dramatic as in the movie It’s A Wonderful Life.

One also needs to start questioning the capability of KPMG and other accounting firms when they perform audits giving the thumbs up, and not considering an outlying event that could potentially cause failure just a few weeks after the audit.

In my other job, I managed to connect with a Silicon Valley VC, an entrepreneur who was impacted by the bank failure, and someone from a west coast private equity company. When I asked if they were impacted by the SVB failure, the VC commented “Who wasn’t?” The entrepreneur commented that the whole valley was unsettled due to the number of tech and other companies that did business with SVB.

In private equity, they were scrambling to help companies make payroll and make sure their money was safe. For the most part, companies were trying to figure out how to meet payroll and pay the immediate bills. Fortunately, VCs and others stepped in to help out companies in the short term, or companies that had requested and received their cash and moved it to another financial institution, were able to make payroll.

Thanks to the US Government stepping in and insuring all deposits, in the short term it appears that no one is worse for the wear. However, there is the sentiment that Silicon Valley is now changed forever. Across the world, funding startups is becoming a challenge.

In the long term, as with other financial crises, there will be some fallout. According to what I have seen in the press, SVB was a bit unique in how it did business. According to reports, SVB understood the startup culture very well and had close relationships with the VCs who provide seed funding to the startups, but also to the founders and companies themselves. A repeated comment was “They understood us and our business the way a larger bank could not.” It has also been revealed that SVB, while not making it required, suggested that any startup doing business with them place all of their financial assets with SVB. The Wall Street Journal reported that SVB made some very favorable loans to founders, as well as being patient when a startup was struggling to meet loan payments, thus ensuring loyalty and return clients when they moved on to a new startup.

“SVB failed because the bank’s management did not effectively manage its interest rate and liquidity risk, and the bank then suffered a devastating and unexpected run by its uninsured depositors.” — Michael Barr, the Federal Reserve’s vice chairman for supervision, in written testimony leading up to an appearance Tuesday before the Senate Banking Committee. (Source: Wall Street Journal)

The SVB failure’s fallout is not just in Silicon Valley and not just high tech. SVB had significant investments in climate work. It had invested in more than 1550 companies in green tech providing billions in loans, according to the Green Era newsletter of March 16th. Some of these were international. This excerpt from the Wall Street Journal summarizes the situation:

“But investors and executives say SVB stood out for lending to very early-stage companies, and they expect the collapse to slow the pace of funding. What will happen to SVB’s U.S. loan book, and whether its lending strategy will continue, isn’t clear.”

The fallout from SVB and other banks that have consolidated will be in some ways similar to previous banking crises. The money supply will tighten, not just for start-ups and companies seeking loans for capital improvements. Money has appeared to tighten across all aspects of personal and business finance, including VC investment. Start-ups in pre-revenue situations will likely need to hunker down for the long hall. To paraphrase Leonard Lee of Next-Curve. “If they were worth anything or had conceptual merit, they will make it somehow. Statistically most were and are not. “

I foresee a major reset for startups. Those that VCs see as really viable will find funding or go slower to reduce their cash burn. Those less viable will need to make decisions about how to move forward, or close shop until funding becomes available in the future. This is probably not as big a reset as the 2001 dot-com bust, but there will be a significant impact.

From a broader industry perspective, it’s going to be harder to get financing for projects; especially, until governments and banks figure out how healthy they are. And the Government will re-institute regulations, and create new ones to hopefully prevent this type of banking crisis from occurring again. But as we’ve seen from history, someone will come up with a new way of creating a crisis in the future. ~ D.F.