Most semiconductor equipment companies have been focused on sustainability programs longer than most other industries. In part, some of the focus is probably due to customers, such as Intel and ST Microelectronics, that have had sustainability or environmental programs of some sort since 1993. In 2019, at the last face-to-face SEMICON West, SEMI put together a day of presentations that focused on sustainability. Applied Materials took the opportunity at that time to publicly lay out its sustainability efforts. Other companies have done so more quietly. This month’s blog will look at the top five semiconductor equipment sustainability efforts based on the companies’ Environmental, Social, and Governance (ESG) reports.

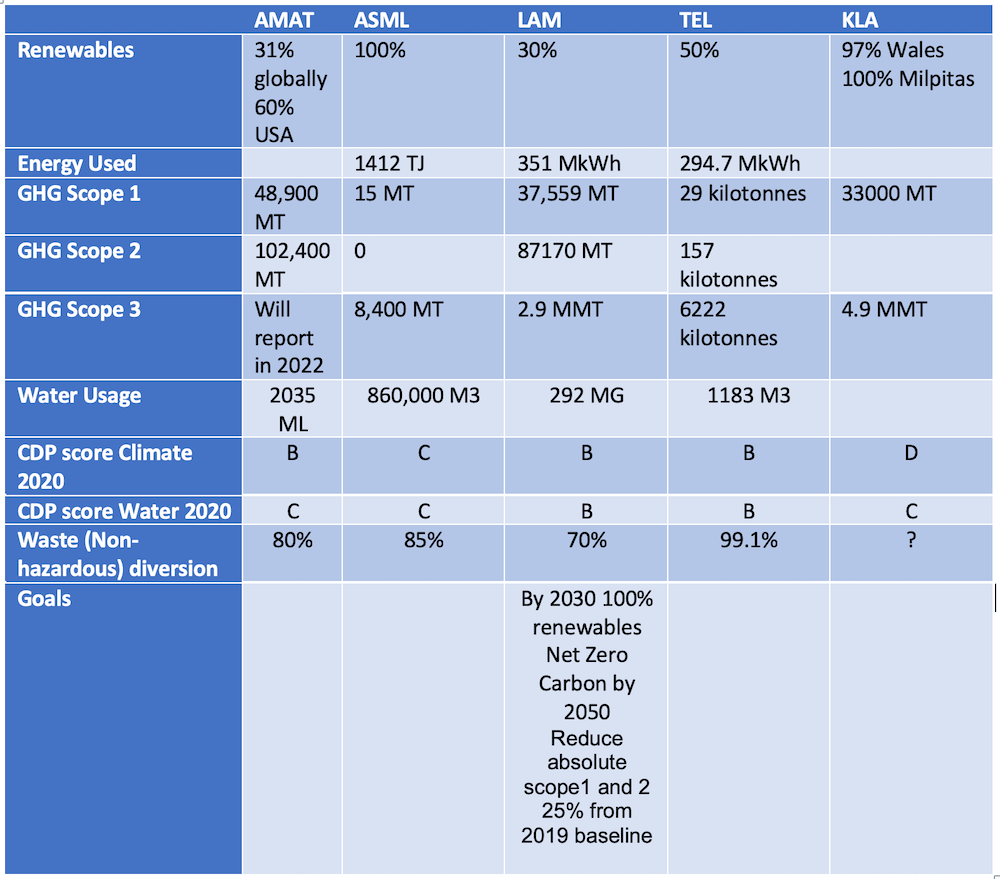

One of the biggest challenges with researching and reporting on sustainability is that no two companies report the numbers the same way. While Scope 1, Definition, and Scope 2, Emissions, are fairly straightforward, Scope 3 is a bit more challenging as a company needs to understand its upstream and downstream emissions and waste — sometimes called the circular economy — which will likely be one of the biggest challenges for companies on the sustainability outlook as the challenge is how far upstream or downstream do you look or take credit for carbon emissions. I’ll refer you to Julia Goldstein’s earlier article on sustainability definitions.

The Wall Street Journal (WSJ) recently ran an article titled, “How Much Carbon Comes from a Liter of Coke? Companies Grapple with Climate Change Math”. The article explains that the SEC is driving towards climate change reporting in a company’s financial results and tying it into management compensation. Surprisingly, only one of the top five semiconductor equipment company’s reports ESG in their 10k: ASML. THE WSJ article also discusses the complexity of trying to decipher sustainability scores performed by ESG rating companies, each of which has slightly different scoring systems or focus. So, a company might score well on a survey that looks at renewables but may score poorly on a survey that looks at energy conservation. For this report, the CDP ratings will be used as they focus on both climate change and water. The Dow Jones Sustainability Index (DSJI) is also a good source to see how companies are performing.

Not surprisingly, Europe already requires ESG disclosure in a company’s 10k and ASML has long-term compensation tied into meeting its sustainability goals. Applied Materials mentions sustainability in the introduction to its 10k, but no published financial incentives that I could find. It did not appear that any of the top five equipment companies, other than ASML, had executive compensation tied to meeting sustainability goals.

Top Five Equipment Companies ESG Reports

Reviewing reports from the top five revenue-producing equipment companies was a bit eye-opening. All the companies have had some form of environmental focus for a significant period. KLA mentioned its first report in 1999. And based upon my time in the industry, the equipment companies have had some form of environmental focus, because their clients had an environmental focus. One of the disappointing parts in reviewing the data was that there was a broad spectrum in the reporting process, and some companies still need to improve on their quantitative analysis of their data (Table 1).

The goals of the top five equipment companies are pretty consistent with each other and the Paris Climate Accord. Some are still working on defining goals and trying to get a better understanding of Scope 3 emissions.

Applied Materials

- Renewables: 100% US-based by 2022 100% global by 2030

- Greenhouse Gas GHG: 50% reduction by 2030 from 2019 baseline

- 50% reduction in Scope 1 and Scope 2 CO2 emissions by 2030, from 2019 baseline

Applied Materials also has its 3×30 program where the goal is to reduce energy consumption by 30% for semiconductor products, reduce chemical consumption by 30%, reduce tool footprint by 30% sqm/wph, and reduce process tool emissions by 30%.

ASML

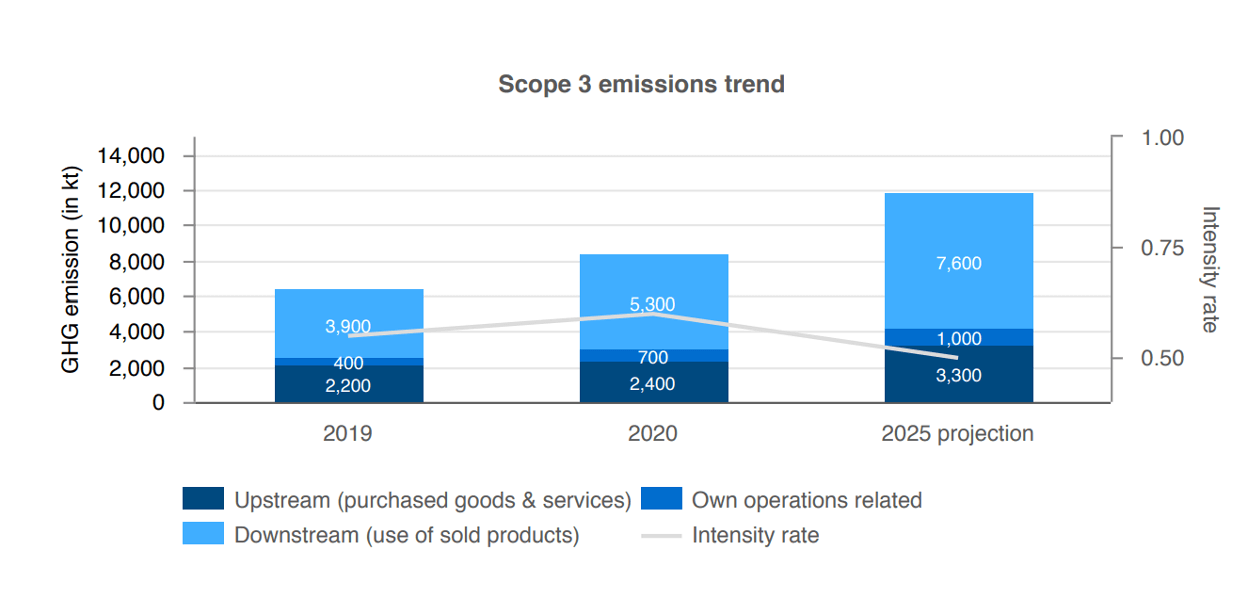

- Scopes 1 and 2 30% reduction

- ASML has a strong focus on reducing the power consumed per wafer on the EUV systems that were highlighted last month. ASML has done a good job of increasing the wafers/hour and lowering the energy consumption or the EUV systems. Figure 1 shows the projected intensity ratio – Power/Wafer.

Lam Research

- Energy Consumed: 12 MkWh in total savings from 2019 baseline by 2025

- Renewables: 100% by 2030

- Scope 1 and 2 emissions: Reduce absolute Scope 1 and 2 25% from the 2019 baseline

- Net Zero Carbon emissions by 2050

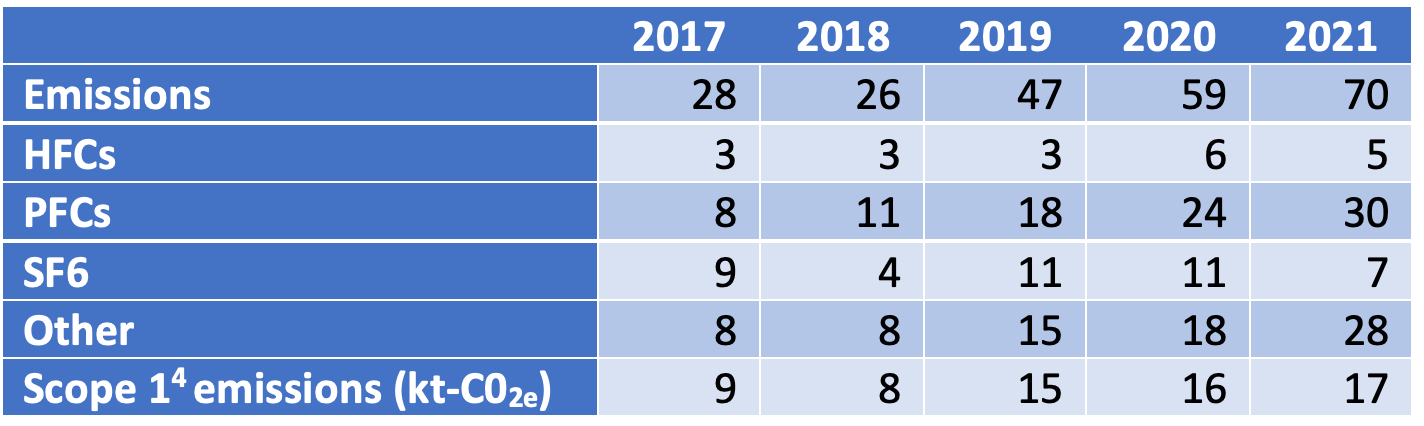

TEL

- 30% reduction in emissions

- Office 70% reduction in emissions by 2030.

TEL also presented on gases that impact process gases that impact GHG emissions, which is an important part of an equipment companies’ Scope 3 emissions.

KLA:

- Companywide GHG emissions goal in 2022

One concern regarding the 100% renewable goals for KLA is whether there will be enough renewable energy to go around? 100% renewable is not only a goal for the semiconductor industry by 2030, but it is also a goal for many industries, and there is starting to be some pushback, as well as some regulatory issues that may impede growth in the short term.

Brownie Points

Most of the equipment companies participate in the responsible business alliance (RBA), which lays the groundwork for improving the circular economy on emissions and other ESG standards. Lam Research has taken its efforts one step further by recently engaging in a $1.5 billion revolving credit that is linked to Lam meeting their sustainability goals, which puts some teeth into their sustainability effort as there are financial incentives for meeting their goals.

In summary, as the chart details some companies have further to go than others in scoping out GHG emissions and setting the path forward on how to reduce both energy consumption and reducing GHG emissions. The silver lining is that the leaders have a good start on reaching admirable reductions by 2030, and hopefully as they already have in their current efforts, they will exceed those goals.