The semiconductor shortage written about last month seems to have expanded, or at least the panic behind it has expanded, as there will be a major impact on the automotive sector, which then trickles down to multiple businesses worldwide. The only automotive maker that does not seem to be significantly impacted is Toyota, because they broke their, Just in Time (JIT) rule. Based on previous experience, Toyota and its suppliers chose to stockpile inventory, and according to multiple articles written about them, they seem to be managing better than most automotive companies at the moment.

However, how did the semiconductor industry and its customers arrive at a worldwide shortage of parts, and why is everyone so anxious to bring semiconductor manufacturing back to the United States? Part of the story regarding the re-onshoring is somewhat convoluted and goes back to the 1980s. The other part: The semiconductor shortages or tightness in the supply chain is relatively common, it just hasn’t been as big an issue in recent history.

Supply and Demand

Starting with the supply and demand issue. Semiconductor units grow relatively steadily over time. According to IC Insights, the 43-year compound annual growth rate is 8.6%. 2021 is expected to see 13% growth after a decline of 6.7% in 2019 and 2.6% growth in 2020. So, growth is not always smooth and can be very cyclical.

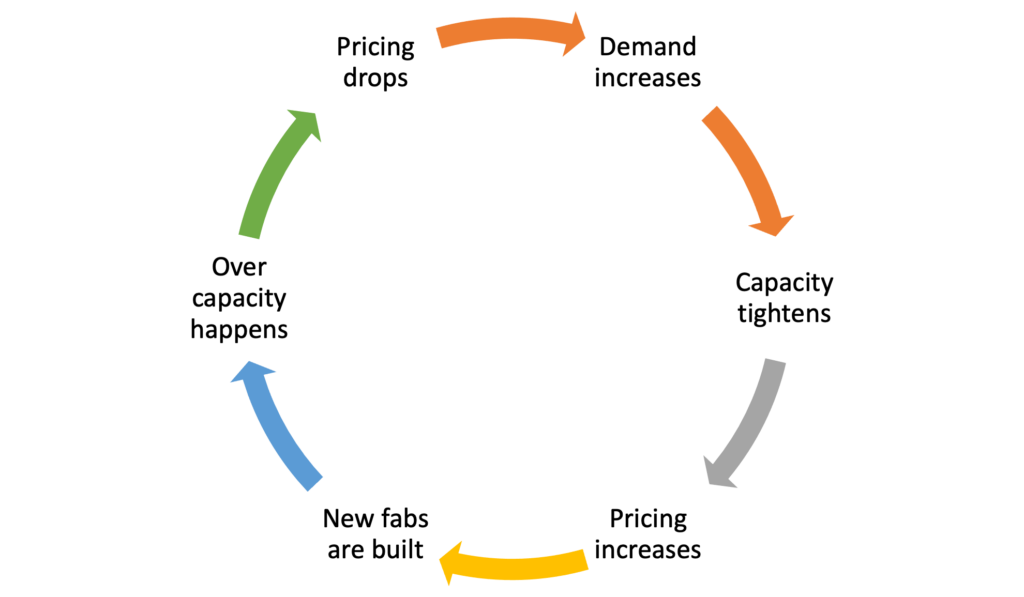

Historically, cyclicality has been driven by memory. Mostly because it’s not easy to build a small memory fab. Bill McClean, the CEO of IC Insights developed a market cycle model which most of the industry understands well:

If a company can manage the cyclicality well, such as ramping a new fab to meet market demand it is likely they will be more profitable.

Happiness is a fully loaded fab with paying customers, is an industry saying. The challenge is keeping the fab fully loaded and having paying customers. The other challenge when there are shortages is customers double ordering, and then when that customer has enough chips to meet their demand then canceling orders. This is especially a challenge if the chips are specific to an industry and cannot be used for other applications.

Short-term Semiconductor Shortage or A Capacity Inflection?

It appears that at least for the moment capacity across the industry is tight. The real question is, is this a short-term phenomenon due to the pandemic and lack of foresight on manufacturers that depend upon semiconductors, such as the automotive industry? Or is the industry at a capacity inflection point due to the IoT and edge computing, AI, 5G, renewables, and the electrification of cars and an industry that needs more chips than it can currently produce? The answer in part depends upon who you speak to.

200mm capacity is tight and will continue to be tight due to limited 200mm equipment, silicon wafers, and new 200mm capacity being added. If you look at the industry spending behavior, it appears that leading-edge chip manufacturers think capacity will be tight. TSMC is spending $100 billion over 3 years, Intel recently committed to $20 billion to kick start its US-based manufacturing and foundry business. Samsung is expected to spend in the $28 billion range in 2021, close to what they spent in 2020.

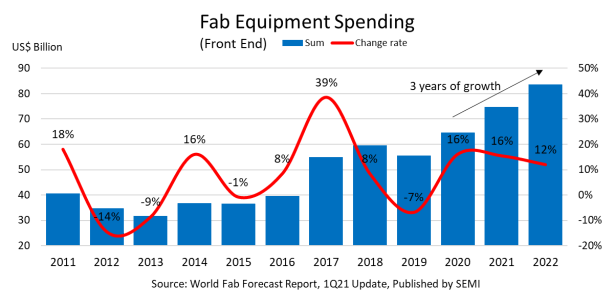

SEMI published its Q1 Global equipment spending report and is projecting three years of growth from 2020-2022 with the spending reaching 83 billion in 2022.

Three years of consecutive growth is unusual; Three years of double-digit growth historical. So, if you follow the money, the answer would be, Yes! the industry appears to be at a growth inflection point.

However, TSMC Chairman Mark Liu recently called the semiconductor boost in the US and EU unrealistic, and that the shortage is a result of double booking. On Semiconductor CEO Hassane El-Khoury believes his company will be able to meet demand in the second half of the year.

So is the current semiconductor shortage a result of poor production and inventory planning as a result of the pandemic, the US-China trade spat, and a few unfortunate Fab shutdowns? Probably, but time will tell.

Big Spending by the Big Three

Then there is the question of Capex spending by the Big Three. TSMC and Intel are the easiest to break down. Intel will build one foundry fab and another fab for 7nm and below. This will be Intel’s first new Fab’s since Fab 42, which started construction in 2011 but began running wafers in 2020. These new fabs will also require extreme ultraviolet (EUV) lithography, which takes a slightly different fab structure for the EUV equipment. The $20 billion will be a start on construction for the new fabs. Intel has invested $23 billion in fab 42, so there is a lot more to be spent to get the next two into production. (See feature photo, source: Intel).

TSMC’s $100 billion will likely build three fabs, two likely in Taiwan, and the one in the United States. The Fabs will likely support the 5nm and below processes that are in early manufacturing and development.

It appears that Samsung’s Capex will be split between Austin and Korea. The Austin fab will likely manufacture logic devices, while the Korean Capex will support DRAM and NAND.

From an analyst’s perspective, this looks more like business as usual rather than battling a chip shortage, with the exception of TSMC finally building a fab in the US; but there are likely political reasons behind that fab, so it will probably go forward especially with the current administrations focus on regaining the upper hand in technology.

The good news behind all this spending is that for the first time in a while, a significant amount of Capex is being spent in the United States to build four new state-of-the-art fabs. While this only goes part of the way to re-onshoring semiconductor technology. It’s a really good start. ~ Dean