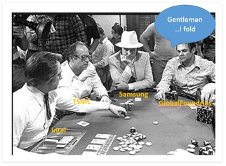

Back in the late summer of 2018 IFTLE unleashed one of its more sarcastic cartoons to note that GlobalFoundries had just announced it would no longer try to compete at the latest node. (See IFTLE 395 “And Then There Were 3…”)

Is Intel Next?

Well, the remaining three mega players continued their game of Texas Hold ‘Em into the night, and now the last US-based player in the logic game, i.e. Intel, has made an announcement of its own. At Intel’s earning call the end of the 2nd quarter CEO Bob Swan stated that “The company’s 7nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel’s 7nm process, which based on recent data, is now trending approximately twelve months behind the company’s internal target……We now expect to see initial production shipments of our first Intel-based 7nm product, a client CPU in late 2022 or early 2023“. By comparison, TSMC plans to be on the 3nm node in the same time frame as Intel’s new schedule for 7nm (a 2-node difference).

According to Swan Intel has identified a “defect mode” in its 7nm process that caused “yield issues”. He added that the company would be using external foundries for its forthcoming 7nm Ponte Vecchio GPU graphics chips. So, Ponte Vecchio, a chiplet-based design, apparently will have some of its chiplets outsourced. Intel’s announced 7nm server CPUs (Granite Rapids) will now be scheduled to arrive in 2023. Swan further stated that Intel could use third-party foundries for entire chip designs in the future. Intel has used outside fabs, for low-margin, non-CPU products built on trailing-edge nodes. But never for its state of the art (SOTA) products.

The announced 7nm delay is added on to the back of a company (Intel) that is still struggling to overcome the embarrassment of its multi-year delay issues at 10nm. The industry is still awaiting Intel’s first 10nm desktop CPUs, which are now not scheduled to arrive in late 2021.

Intel has allowed competitors, like AMD, to take the process node leadership position for the first time in the company’s history. Apple has also recently announced that it is transitioning from Intel’s chips to its own ARM-based 7nm silicon. Did Apple have advanced notice that Intel would make this announcement?

Some are questioning whether this 7nm delay is simply the beginning of another series of delays like we saw for 10nm. Further, will the 7NM slippage push Intel into a “fab lite” mode? That would make both Intel and AMD dependent upon TSMC. Will Intel really turn its leading-edge manufacturing over to TSMC? At the proposed TSMC AZ fab perhaps?

I may be wrong, but I don’t think there is enough proposed capacity being planned there to supply US company needs.

How does this announcement affect the recent Chips for America Act? [see IFTLE 455 “Advanced Microelectronic Coming Home”]

It has also become clearer that Intel’s capability of using advanced packaging to mix and match die/chiplets in a system-in-package (SiP) has become even more important. But even there, Intel was in catch-up mode. Let’s watch out for those who will try to change historical facts. Bryan Black and AMD drove chiplet technology, not Intel.

If Intel does lean more on its packaging technology to try to maintain equivalence to those using more advanced nodes, the competition, will such production be done by Intel in the US?

And on the Memory Front…

So, while the US now appears significantly behind on SOTA logic nodes, what about memory? There are only three major players left at the poker table in memory – Samsung, SK Hynix, and Micron. In 2011 Micron placed a major bet on the “Hybrid Memory Cube” or HMC as it was to be called. They created a large consortium (which included Intel) to develop this memory technology which featured a low-width bus and extremely high data rates to offer memory bandwidth that exceeded that of then standard DDR3. While HMC did see some minor usage in the market it ultimately, it lost the battle against high bandwidth memory (HBM/HBM2), which were supported by SK Hynix and Samsung, and Micron finally folded the project in 2018. This has put them several years behind the memory eight ball since that time. In April of 2020 IFTLE reviewed the status of memory technology in IFTLE 447 “Micron and Rambus Readying HBM2 3D Stacked Memory Products”

At the end of Q1 2020 Sanjay Mehrotra, president and CEO of Micron stated: “In Q2, we began sampling 1Z-based DDR5 modules and are on track to introduce high-bandwidth memory in calendar 2020 ” We are currently only in the 3rd quarter so…..we’ll see.

So, playing catch up in both logic and memory, it will be interesting to see how this plays out against the US announcing its desire to bring SOTA chip production back onshore. We better have a well thought out plan and the right people in place to ensure said plan is carried out. This might very well be our last chance to bring the leading edge of this ultra-important industry back home.

Does anyone out there really think money and/or tax breaks is what Intel requires to regain the technology lead over TSMC?? Think this through and don’t screw this up, Washington bureaucrats.

For all the latest on Advanced packaging stay linked to IFTLE………………….