Last week, I caught IC Insights’ Bill McClean’s talk at the IMAPS Arizona luncheon. In addition to predicting a steady growth trend for the semiconductor industry that will reach double digits by 2016, followed by a cyclical downturn to -1%in 2017, McClean also discussed some major trends he expects will shape the future of the IC industry worldwide.

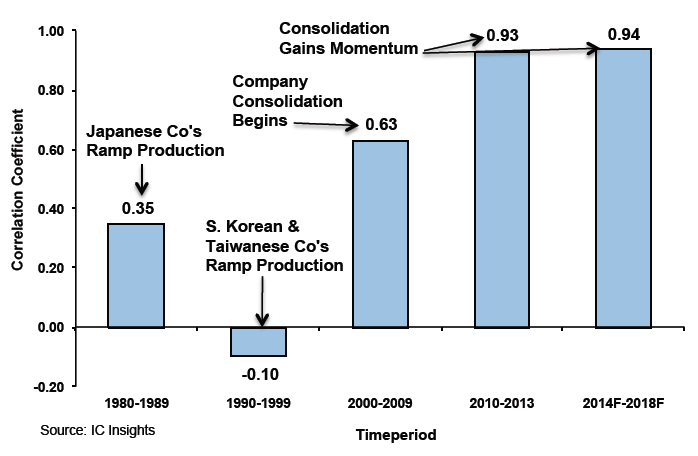

While worldwide electronic systems production represents only 2% of the worldwide GDP, the interdependence between them is on the rise as the IC industry shifts from a bottom-up business model driven by capacity and capital spending, to a top-down model driven by consumer spending. McClean came to this conclusion by comparing the correlation coefficient between the Worldwide GDP and IC market since the ‘80s and forecasted out to 2018 (Figure 1).

In the 80s, the correlation coefficient was 35% as Japanese semiconductor companies ramped to production. In the ‘90’s, the coefficient dropped to -1% due to worldwide overcapacity in the semiconductor market as Korean and Taiwanese companies ramped to production. While the world GDP was up, the IC market dropped. Between 2000-2009, companies began to consolidate and there was a shift to the fab-lite model. As a result, the correlation coefficient climbed to 63%. As consolidation gains momentum, McClean predicts the correlation coefficient will increase to 94% by 2018.

“The IC market now depends on what the worldwide economy is doing,” noted McClean, “Do people have the money to buy electronics?” He cited as an example, the fiasco of Intel’s Fab 42, in Chandler, AZ, which was built to accommodate an expected need for increased capacity, and to ramp production of 14nm node technology. But then “the PC market tanked,” said McClean, “and they didn’t need all that capacity. So they moth-balled the project.” Speculation about what the fab will be used for has spanned from deals with Altera Apple, and Panasonic earlier this year, to becoming one location for Intel’s Custom Foundry customers.

Another trend that has had an enormous impact on the IC market is the unexpected growth of tablets and smartphones. While this adversely affected PC sales, it was good for the overall IC market and can be credited with the rapid rise of companies like Samsung, TSMC, and Qualcomm, who invested early in the mobile market. Intel missed that train, as did the Japanese semiconductor industry. In fact, while Intel still leads the market in semiconductor sales, TSMC has surpassed Intel in “final market sales”, assuming a 57% gross margin for TSMC’s customers. “TSMC has more impact on the IC market than Intel,” said McClean. “They’re the giant right now in the foundry industry, which is why they are increasing capex.”

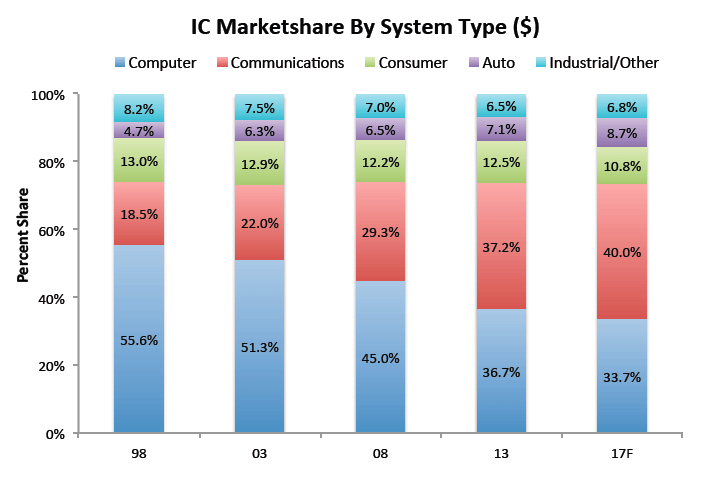

According to McClean, last year communications systems consumed more market share than computers, but together these markets have held steady on their combined market share since 1998 (Figure 2). Consumer products, automobile and industrial products have remained fairly steady, although consumer and industrial are expected to drop slightly by 2017. While automotive is growing, McClean says it’s too small to drive the market in a big way. There would need to be a surge in the marketplace. “We need a healthy communications and computer industry to drive the IC market,” he noted.

He also said he didn’t expect wearable devices like Google Glass and the recently released Apple Watch to impact the market significantly. He went so far as to speculate if the smart watch concept would really take off at all. “Do we need it to tell time? Our phone does that. Do we need it to tell us a call is coming in? Our phone does that!” he said. His remarks were met with nods of agreement, and most in the room agreed that these novel devices are attractive to the younger generation, but aren’t destined to create the “need” factor that smartphones have established across the general population.

On the topic of the transition to 450mm, McClean said he’d changed his position from previous years. “Three or 4 years ago, I was 100% certain that 450mm would happen. Now it’s more like 70-80%. There’s room for doubt,” he said, adding that the latest talk pushes it out to 2019.

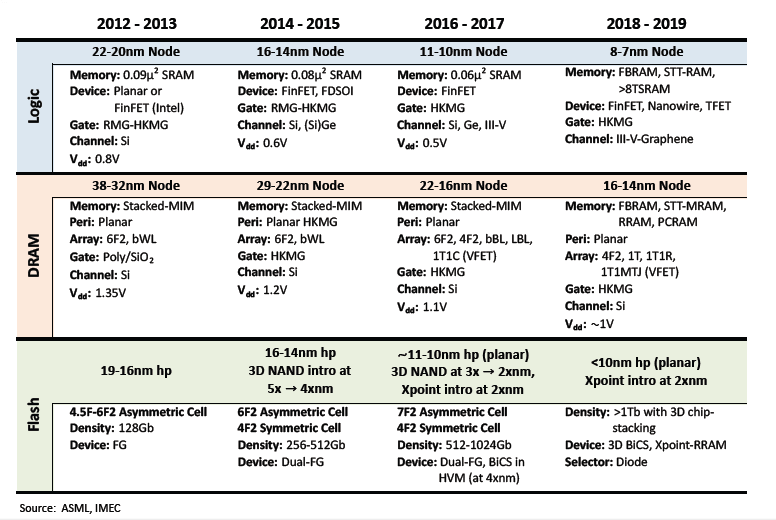

Originally, it was thought that early adopters would be Intel, Samsung, TSMC and GlobalFoundries, with “fast followers” being Toshiba, SK hynix, and Micron/Inotera, ad UMC and SMIC identified as “long shot” fab owners. But rumor has it that the memory manufacturers aren’t interested in 450. Why not? Because of the device scaling roadmap (Figure 3). By the time 450mm enters volume production, there will be new memory architectures being implemented and its unlikely the memory manufacturers will transition to 450 at the same time. Out of 9 potential adopters of 450, 3 are memory manufacturers. If they don’t come along, is there enough for business to support the market?

McClean wrapped up his talk with a summary of supply base changes that he says are spurring IC market maturity. First of all, with no entry point opportunities, the IC market is closed to new major IC marketing start-ups. Chinese companies were the last group of newcomers. This situation will moderate fab over-investment. Second, he said the movement to the fab-lite business model means less capacity overspending. Capex as a ratio of sales budgets is forecast to decline to 15-16% in this decade, versus 25% of the 90’s. Lastly, the consolidation trend has greatly reduced the number of IC manufacturers, which will lessen oversupply.

These supply base changes combined with the need for microcontrollers to power what IBM calls the “Fog” (versus the Cloud), where more individual local servers handle the data, will keep the ASP from dropping too much. “The Fog is good for the IC industry,” he said. “We can look forward to at least 6% growth in terms of units,” he said. “Pricing is going to change because of supply base change. And the IC market is expected to show better growth overall.”

Best news I’ve heard in a long time. ~ F.v.T.