How the Commerce Department Will Hamstring the US-based Semiconductor Industry

Over the past year, the electronics industry has been dealing with tariffs on goods coming out of China, and a great deal of uncertainty regarding Huawei. Semiconductor companies have had to, or are in the process of, renewing licenses that allow them to ship semiconductors to Huawei, as the US government attempts to limit the amount of chip technology that Huawei receives.

In April 2020, in an effort to impact Huawei’s business, it appears that the commerce department has enlarged the net to potentially ensnare semiconductor equipment companies based in the US, and possibly one European semiconductor equipment company, ASML. Requiring a license to use US-built equipment to manufacture semiconductors headed to China, and the possibility that the US government could prohibit companies like TSMC from using such equipment to manufacture leading-edge semiconductors to be shipped to China, has significant implications not only for the American fabless semiconductor chip companies that rely on TSMC, but even more-so American based semiconductor equipment companies.1

The Potential Economic Fallout to the US Semiconductor industry

According to Statistica, in 2019 China purchased $143 billion worth of semiconductors, 34.7% of the $412 billion worldwide sales reported by the SIA.2 Gartner reports Huawei purchased $21 billion in semiconductors, which accounts for approximately 5% of the worldwide semiconductor business.3

According to Intel’s annual report, they shipped $20 billion of semiconductors into China in 2019, whereas, TSMC sold $6.7 billion USD of semiconductors to Chinese clients in 2019. It is also likely that TSMC’s other clients also shipped a considerable number of semiconductors into China for assembly. According to CNBC, smaller semiconductor companies such as Qorvo and Lumentum have 18% and 15% of revenues coming from China, respectively.4 These figures would suggest that a significant number of US semiconductor companies could have up to 20% or more of their revenues coming out of China. Losing that revenue would have a considerable impact on those companies’ bottom line, and potentially their business future. Xilinx reported in a Politico article that they are laying off 7% of their workforce due to the trade issues.5

If the commerce department’s actions only target Huawei, then the financial damage is in the $20 billion range, and there are a few companies, such as Qorvo or Lumentum, that will take a significant revenue hit; however, a 15% revenue loss is enough in some cases to put a company out of business, especially if the world is in a recession. If the commerce department is expanding the scope of the penalties, then the damage to US-based companies will be much broader, and as a result, there could be a shift in which technology gets developed and the US could continue to lose its edge in semiconductor competitiveness.

Semiconductor Equipment Companies could see Significant Damage

In 2020 China is targeted to spend $12 billion on equipment, which usually includes Samsung and Hynix Memory fabs located in China. In their 2020 annual report, SMIC reported $3.1 billion CapEx for 300mm expansion and starting their 10nm (or N+1, as they call it) production line. If the commerce department licensing expands to include those memory fabs, then approximately $9 billion in leading-edge equipment sales could be at stake for US-based companies. If the licensing only includes SMIC, then $3.1 billion is at stake for the US equipment companies.

The real question is how much will the commerce department tighten the screws on SMIC? The technology of utmost concern begins at the 7nm technology node and beyond. SMIC is currently at 14nm in production. Its planned expansion, as previously stated, targets 10nm process technology. If this is the case, then SMIC’s spending should not be impacted with the exception of the ASML EUV equipment that is currently on hold awaiting the awarding of an export license, which is entirely another story. However, if the commerce department wants to impact all sales and production of semiconductors going to Huawei and subsequently China, then $3.1 billion is at risk in 2020, and perhaps more in future years as SMIC expands to meet Huawei’s requirements and demands. Unfortunately, if the US commerce department targets TSMC then significantly more revenue loss is at risk, as is US technology leadership.

What about TSMC

The worldwide equipment spend, according to SEMI, is $57 billion, which gives TSMC 27% of the worldwide spend.

In 2020 TSMC has reported a CapEx budget of $16 billion to fill out 7nm production lines and initiating 5nm production. In 2019, according to TSMC’s annual report, Sub 16nm accounted for 50% of TSMC’s revenue, but sub 16nm likely accounts for nearly all of TSMC’s 2020 equipment spend. If the United States commerce department requires licenses, prohibits TSMC from purchasing US semiconductor equipment, or limits the use of EUV, it will have a significant impact on US equipment companies and ASML.

In 2019 based upon financial filings, both Lam Research and Applied Materials saw about 20% of their business in Taiwan, while KLA had 25% of revenues in Taiwan. ASML report 51% of revenues coming from Taiwan during 2019. These four companies accounted for over $9 billion in semiconductor sales in 2019. Losing any part of that revenue in 2020 or 2021 would not only have an impact on these companies’ financial health, but a significant number of layoffs would likely occur in the US and worldwide, as a result of the commerce department’s actions. Depending upon how the sanctions fall out, limiting TSMC’s production at 7nm and 5nm would also impact a multitude of US fabless semiconductor companies such as AMD, Xilinx, Microsoft, not to mention other international companies that do business with TSMC. If the commerce department restricts equipment sales to all of Taiwan, not just TSMC, then there is the potential for some fall out at Micron as well, as they have significant memory manufacturing capabilities in Taiwan.

Longer Term Implications

In the short and long term, there are significant financial and technology implications to both US semiconductor and semiconductor equipment companies. If the changes do go into effect short term, Huawei will need to pivot quickly and make changes to their supply chain, which appears to already be in progress. In a recent Huawei smartphone teardown report by the Financial Times, the processor is designed by Huawei, and the NAND is built by Samsung, not Micron, which is a shift from the previous generation teardown.

The April 8 Digitimes commented that Samsung is looking forward to Huawei 5G orders.7 If Huawei pivots extremely fast, in a matter of months they could possibly shift $20 billion in semiconductor revenue from US companies to both Huawei and other vendors that will not be impacted by the US commerce department actions.

In fact, the shift is already happening. As a result of the commerce department’s actions, Digitimes reported on April 14, that SMIC received 14nm orders from HiSilicon, Huawei’s design arm.8 It is difficult to tell if this is just a natural progression as SMIC is 14nm fully qualified and it will be less expensive to have them manufacture the devices, or if this is a tactical move to start moving semiconductor manufacturing into China.

Conservatively, there would be $30 to $40 billion lost revenue annually to US-based companies, depending upon the direction of the commerce department’s actions. This would impact both semiconductor and semiconductor equipment companies.

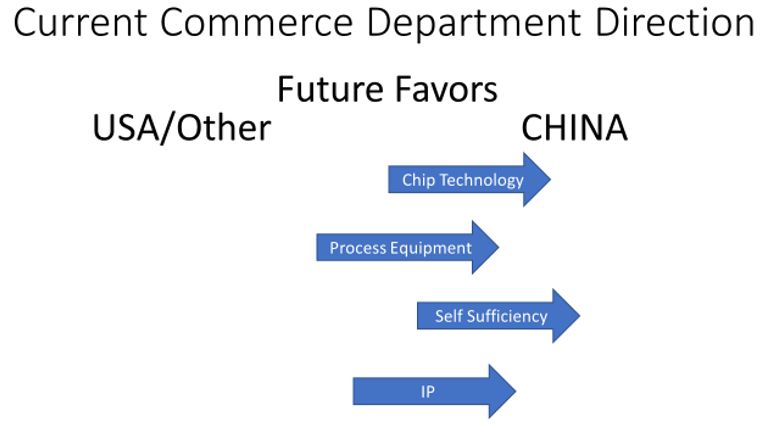

In the long term, the actions will drive China’s semiconductor to self-sufficiency much faster than would have happened otherwise. China will continue to develop semiconductor chip technology, develop IP, improve manufacturing to state of the art, and develop a stronger equipment industry as a result of the commerce department decisions. They will also leverage non-US equipment companies in Korea, Japan, and Europe that are not constrained by the commerce department’s actions. The end result of this is that the strength of the US equipment companies will weaken financially and technically as others gain strength. There are multiple equipment companies in Korea, Japan, and China that have the potential to replace the front-runners from the US. Additional funding from China could speed that development up considerably.

Potential Replacements

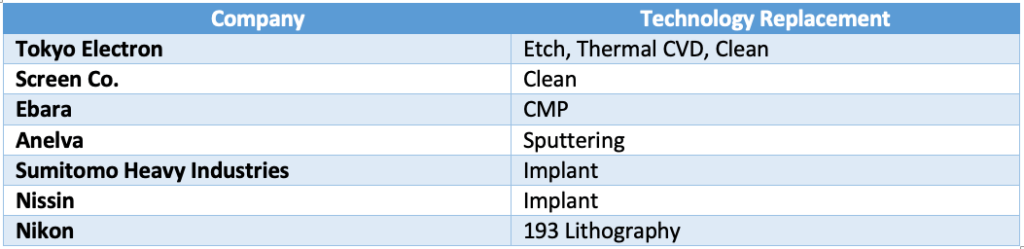

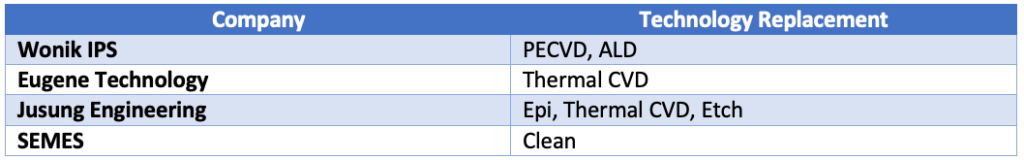

AMAT and Lam Research are especially vulnerable in China and Taiwan, as they are worldwide market leaders in most etch and deposition processes. There are multiple companies in Japan that would see a considerable boost to their equipment sales if AMAT and Lam Research are not prohibited to sell into China and Taiwan. The success of Japanese equipment companies depends upon their governments’ actions if the US commerce department strongly suggests Japan supports the US actions against the Chinese semiconductor industry (Table 1).

Korean equipment companies could also benefit from the commerce department’s actions. The Korean government and semiconductor companies have been slowly building capability and trying to develop independence in semiconductor technology. The equipment industry in Korea is still fairly small, and mostly memory focused, but the commerce department’s actions could give it a jump start. And Samsung’s foundry business could help it to grow a stronger logic product line. There is also the question, will the commerce department’s actions extend far enough to impact Samsung and Hynix? If they do the Chinese memory business could get a boost, if Samsung and Hynix are prevented from selling memory to the Chinese semiconductor industry (Table 2).

What role do European companies play in this drama? Currently, ASML has applied for a license to provide SMIC with an EUV system. The commerce department is discussing the topic with the Netherlands Government. Does the commerce department prohibit the shipping of 193i systems, which are capable of manufacturing, albeit complicated, 7nm technology?

Will other European companies, such as SPTS Technologies and ASM International, need special licenses to ship into TSMC, or Chinese semiconductor manufactures? It could be too early to tell. It will also depend on how favorably other countries feel about the commerce department’s requests to slow down the Chinese semiconductor development, and how it will impact their economies and employment.

The Rise of the Chinese Equipment Industry

The real blow to the worldwide semiconductor manufacturing community will be if the commerce department actions ignite the Chinese semiconductor equipment industry to action. Currently, the semiconductor equipment industry in China is small. Most of the companies have focused on 100mm to 200mm wafer technology; 300mm has been left mostly to companies outside of China. Companies, such as Seven Star Group, have been supporting 200mm fabs and below since the local industry’s inception. More recently, AMEC has emerged as a player in the etch and MOCVD space at 300mm and is capable of producing etch technology that can compete with AMAT, Lam Research, and TEL. The $15 billion question is: How long would it take for the other equipment players in China to rise up and become competitive? It really depends on how advanced they are at this moment and what resources will be made available by the Chinese industry and government.

Lithography and IP

The Achilles heel for China, and the world at the moment, is IP and lithography. If ASML is prohibited from selling EUV to China, it would mean China would need to develop the EUV technology internally — a lengthy undertaking at best. China is faced with a similar problem with IP. Most semiconductor IP is developed by ARM, a UK company, or US companies such as Cadence and Synopsys. At the moment ARM reports that they are able to sell IP to Huawei, If that changes China will need to quickly develop IP internally to address the need. This could be a minor setback to both Huawei and China’s aspirations to have advanced chipmaking in the near term.

The Crux of the Matter

One statement I have read that in part started the discussion above that I’m still trying to understand is the following comment from the April 7th Reuters article: “The US government is concerned that China will obtain advanced US technology for commercial purposes and divert it to military use”.9 At the moment, a considerable amount of the PCs manufactured in the world come out of China. Much of the gaming stations are manufactured in China. A large number of smartphones are manufactured in China.

All of these electronic devices use the latest in semiconductor technology, so if semiconductor manufacturers are shipping in state-of-the-art semiconductors to electronic good manufactures such as Foxconn, Lenovo, and others, doesn’t China already have access to advanced US technology, and the horse is already out of the barn?

It’s possible that the statement was not placed in context in the article, or that I have taken it out of context, but it seems that the Chinese government already has access to the technology that the commerce is trying to deny them.

Having started my career working for a company that had a large military presence, and also having a security clearance, I am sensitive to the needs of national security. However, after also observing the growth and globalization of the electronics industry over the past 38 years, I think electronics technology will continue to expand globally, whether we want it to or not. This happened in Japan, Korea, Taiwan, and now China.

From my perspective, the bottom line in all of this sabre-rattling is that if the commerce department prohibits the selling if US chips to Huawei and somehow prohibits TSMC from manufacturing chips for Huawei and others, there is a significant financial and possibly technological impact on the US semiconductor industry and the semiconductor equipment industry. The actions in the long term will speed up China’s goal of independence in semiconductor manufacturing and will weaken the US industry in the long term at a time when the industry can ill afford it.

References

- K. Freifeld, Exclusive: U.S. Prepares Crackdown on Huawei’s Global Chip Supply – Sources, US News and World Report, March 26, 2020 https://www.usnews.com/news/top-news/articles/2020-03-26/exclusive-us-nears-rule-change-to-restrict-huaweis-global-chip-supply-sources

- A. Holst, Monthly Semiconductor Sales in China 2015-2019, Statista, February 2020, https://www.statista.com/statistics/1086441/semiconductor-sales-china/

- Gartner Says Worldwide Semiconductor Spending Declined in 2019 Due to Slowing Macroeconomy and Falling Memory Prices, February 5, 2020 https://www.gartner.com/en/newsroom/press-releases/2020-02-05-gartner-says-worldwide-semiconductor-spending-declined-in-2019-due-to-slowing-macroeconomy-and-falling-memory-prices

- A. Lucas, Trump Administration is Reportedly Weighing Limits to China’s Access to Chip Technology, February 17, 2020, CNBC.Com https://www.cnbc.com/2020/02/17/trump-administration-is-reportedly-weighing-limits-to-chinas-access-to-chip-technology.html

- A. Behsudi, U.S. Chip Firms Fear Trump’s Screws on Huawei is Bad for Business. February 10, 2020, Politico, https://www.politico.com/news/2020/02/10/us-chip-firms-fear-trumps-screws-on-huawei-is-bad-for-business-113222

- Huawei’s P40 Phone Contains US Parts Despite Blacklisting, Financial Times, https://www.ft.com/content/3716c4bb-de27-4920-ab87-46a8a2758ddf

- C. Chao; J.Shen MediaTek, Samsung eyeing 5G mobile chip orders from Huawei, April 7, 2020 Digitimes, https://www.digitimes.com/news/a20200408PD201.html?mod=2

- M.Chen, J. Shen, HiSilicon places 14nm chip orders with SMIC, April 14, Digitimes https://www.digitimes.com/news/a20200414PD203.html

- K. Freifeld, U.S. Chipmaking Industry Pushes Back on Proposed Export Rule Changes Reuters, April 7, 2020 Reuters https://www.reuters.com/article/us-usa-china-chipmakers/u-s-chipmaking-industry-pushes-back-on-proposed-export-rule-changes-idUSKBN21O2YU