Why DID you miss your 2014 3D Stacked DRAM equipment shipment forecast? And what’s different about the outlook for 3D Stacked DRAM equipment shipments in 2015? Briefly, as presented in Part 1 of this thread, significant structural problems existed in the DRAM industry, present from the very beginning of 2012, that impeded the roll-out and adoption of 3D Stacked DRAM as a commercial product.

Three of those significant structural problems were these: there was an overall, and significant, DRAM market contraction starting from 2011 and extending through 2012; Elpida, arguably the industry’s biggest cheerleader for 3D Stacked DRAM, declared bankruptcy in February 2012; the important industry technical specifications for 3D Stacked DRAM in both its flavors – Wide I/O, and Hybrid Memory Cube, were lacking.

The Market research community, in their 3D Stacked DRAM wafer shipment forecasts from mid-year 2012, when many semiconductor capital equipment companies were committing to 3D Stacked DRAM equipment shipment forecasts for 2013 and 2014, indicated the need for fabrication equipment to be in-place and processing reasonable quantities of commercial Stacked 3D DRAM wafers in 2014, ready for a significant ramp in 2015.

Those were the processing tools (the new model you called the 3DrICer™) you committed to ship in 2013, or at least in early 2014 but, with the 3D Stacked DRAM forecast horse out in front of the commercial 3D Stacked DRAM shipment horse, and therefore the equipment shipment horse, you missed your commitment. And now bear the scars.

Those were the processing tools (the new model you called the 3DrICer™) you committed to ship in 2013, or at least in early 2014 but, with the 3D Stacked DRAM forecast horse out in front of the commercial 3D Stacked DRAM shipment horse, and therefore the equipment shipment horse, you missed your commitment. And now bear the scars.

But you hung tough and stayed loose, and seem to have reason to enjoy a renewed outlook for shipping your equipment in 2015 as those significant 3D Stacked DRAM structural issues clear.

Which they are doing – let’s check the progress.

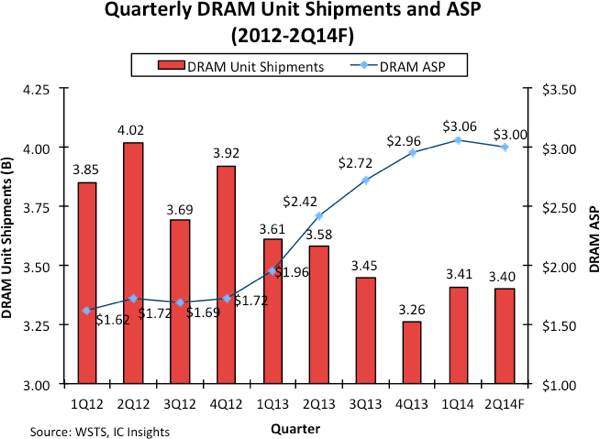

Overall, DRAM revenue is recovering steadily from its recent nadir in Q1 2012, according to the DRAM market statistics collected by Statista, although it was not until Q3 2014 that quarterly world-wide DRAM revenue surpassed the recent (Q2 2010) high water mark. DRAM ASPs also firmed considerably through 2014.

![]()

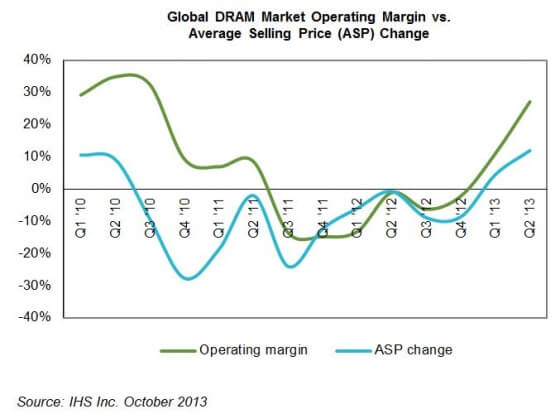

And DRAM profit margins? Doing nicely, starting in 2013, thank you for asking: “Having slimmed down and gained some self-discipline, the dynamic random access memory (DRAM) business is posting its highest profits in nearly three years, allowing suppliers to thrive despite the decline of the PC business that once dominated market demand.”

Ah yes, and about that slimming down, and about Elpida, one of 3D Stacked DRAM’s most important innovation engines: Elpida is now Micron. “Since the transaction was completed in July, 2013, we [Micron] have been working together to fully integrate our organizations and deliver on the promise of serving multiple market segments with an optimized memory portfolio and stable supply chain.”

The Rule of Three prevails once again, with the DRAM industry now consolidated down to three main players: Samsung, SK Hynix, and Micron.

Finally, casting a glance in the industry standards direction, JEDEC standards for Wide I/O 3D Stacked DRAM in the mobile space were released in January 2012; “Wide I/O mobile DRAM enables chip-level three dimensional (3D) stacking with Through Silicon Via (TSV) interconnects and memory chips directly stacked upon a System on a Chip (SoC). The standard defines features, functionalities, AC and DC characteristics, and ball/signal assignments. It is particularly well-suited for applications requiring extreme power efficiency and increased memory bandwidth (up to 17GBps).”

That at least opened the gate for the world to eventually see commercial products and devices with 3D Stacked Wide I/O mobile DRAM, albeit once the design spins were completed and the products vetted.

However, it wasn’t until October 2013 that JEDEC, after a long gestation (starting from June 2008), published the standard JESD235 for High Bandwidth Memory (HBM) DRAM / DDR3 3D memory stacks.

Welcome to the world, little standard. We’ve been waiting for you.

For Hybrid Memory Cube the story is much more compact; Micron and Samsung formed the Hybrid Memory Cube Consortium in October 2011, which is when the HMC specs (not “standards”) started being developed. The spec for HMC was released in April 2013.

That’s pretty quick. But still leaves a gap between when the spec was released and when products reach the hands of customers – a gap that’s probably something like at least as long as a smartphone upgrade cycle, if not longer.

Call it eighteen months or more if you were hoping Wide I/O mobile DRAM was going to create the pull for your 3D Stacked DRAM processing tools.

And if you were counting on HBM or HMC to float your equipment shipment boat then it might be even longer before your ship comes in.

Thanks to “The Consumer Revolution of Enterprise Computing,” “… [T]he traditional schedule of business software releases, like the schedule of new computer servers and desktop machines, [which] tended to track the same ‘every two-years or so’ schedule as Moore’s Law,” no longer necessarily relies on bigger and faster iron; rather, “When enterprise software companies like Workday live on cloud computing systems, the potential computing power is much less of a constraint — you just throw more machines at the cloud.”

Your effective computing power scales by throwing more of the same kind of machine at the problem. Not more-Moore machines. Just more machines. Machines that don’t necessarily yet benefit from the advanced memory performance HBM and HCM bring to the IT party. Although that’s coming.

3D stack technology for commercial integrated circuit fabrication continues to make progress, even if that progress is slower than 3D’s enthusiasts would like. Mark Bohr, Intel Senior Fellow, was quoted at ISS 2015 saying “Even I am surprised to see how long it is taking to make these [3D IC] products mainstream — its cost.” But at least it’s only cost.

For 3D Stacked DRAM, three very significant structural problems – the DRAM market contraction, Elpida’s bankruptcy, and the lack of standards – have been cleared, and with them some of the significant reasons why you didn’t ship 3D Stacked DRAM processing tools in 2014 per your 2012 forecast.

For 3D Stacked DRAM, three very significant structural problems – the DRAM market contraction, Elpida’s bankruptcy, and the lack of standards – have been cleared, and with them some of the significant reasons why you didn’t ship 3D Stacked DRAM processing tools in 2014 per your 2012 forecast.

For you and for your equipment shipments, 2015 is looking up.

From Pittsburgh, PA, thanks for reading.

PFW