2016 is a turning point for the Fan-Out packaging market since both leaders, Apple and TSMC changed the game and may create a trend of acceptance of fan-out packages. Yole Développement (Yole) is analyzing the current market and technologies trends and offers you to discover these results within a new report entitled Fan-Out: Technologies & Market Trends 2016.

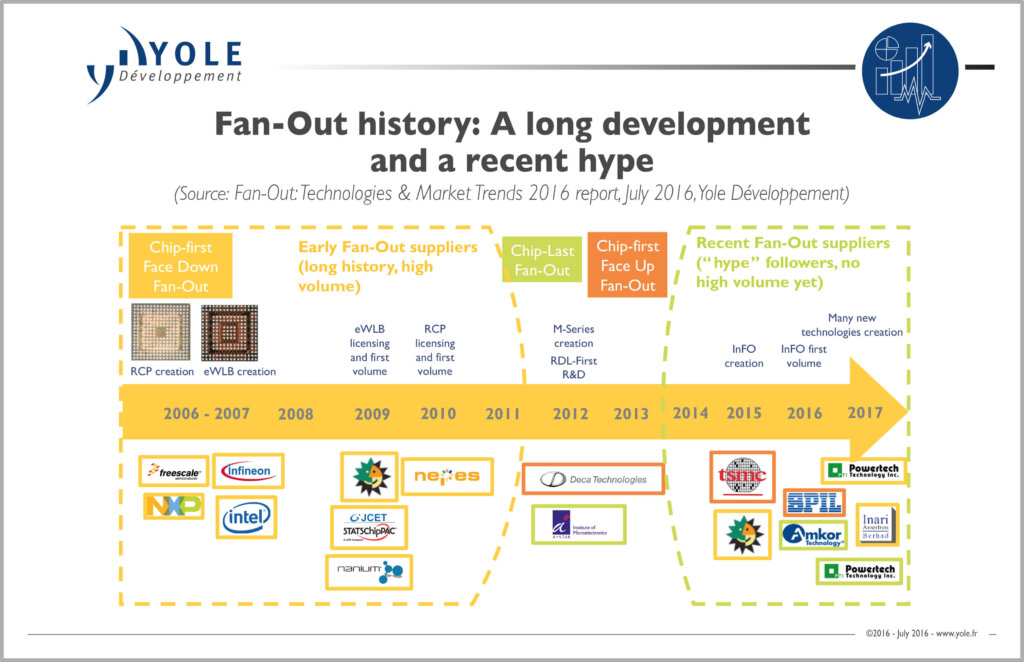

TSMC investment in fan-out wafer level packaging (FOWLP) and development of its integrated fan-out (InFO) changed the wafer level packaging (WLP) landscape. Following high volume adoption of InFO and further development of embedded wafer level ball grid array (eWLB) technology, a wave of new players and FO WLP technologies may enter the market. TSMC’s FO WLP solution called InFO will be used to package the Apple A10 application processor, implemented in the new iPhone 7 series… The success of FO packaging platforms is so undeniable today. What will be the status of the market tomorrow? What are the next steps of the leading FO players? Which technology will be the winning solutions? Yole’s analysts tell you today the story…

“Production starts in 2016 and represents a big change in the Fan-Out industry for several reasons”, confirms Jérôme Azémar, Market & Technology Analyst, Advanced Packaging & Manufacturing at Yole. And he explains:

- First of all, in terms of volume, capturing the Apple processor market is a big asset for fan-out technology. iPhone 7 phones are expected to be sold in more than 200 million units.

- In terms of technology capability, it is also a major turn: processors require thousands of connections while the FO market was essentially focused on limited IO count applications so far.

- Eventually, the potential for market spread is very high: the Apple brand brings more interest to the FO platform.

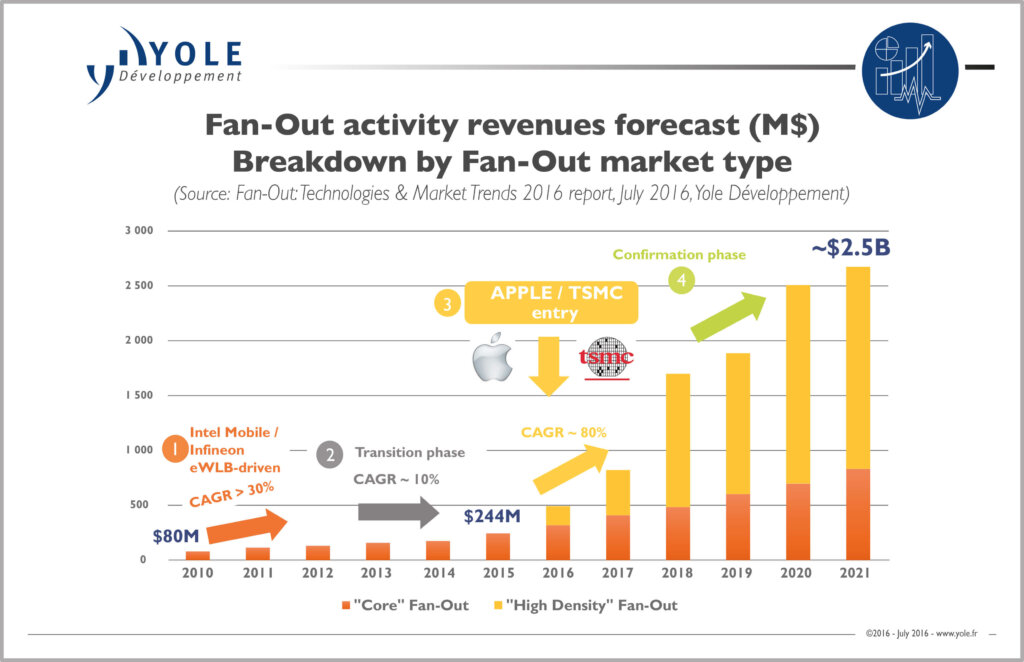

According to Yole’s advanced packaging & semiconductor manufacturing team, the market will actually be split into two types:

- The “core” market of FO, including single die applications such as Baseband, Power management, RF transceivers, etc. This is the main pool for FO WLP solutions and will keep growing

- The “high-density” FO market, started by Apple application processor engine (APE) that will include larger I/O count applications such as processors, memories, etc. This market is more uncertain and will require new integration solutions and high performing FO packages but has a very high potential.

Apart from TSMC, STATS ChipPAC is willing to make further investments powered by JCET, ASE extends its partnership with Deca Technologies while Amkor, SPIL, and Powertech are in development phase eyeing future production. Samsung is seemingly lagging behind and is considering its options to raise competitiveness.

“With such a high potential for the high-density FO and solid growth of the core FO, the supply chain is also expected to evolve with a considerable amount of investment in Fan-Out packaging capabilities”, asserts Jérôme Azemar from Yole. Several players are already offering FO WLP while many others are developing their competitive Fan-Out platforms to enter the Fan-Out landscape and enlarge their portfolio.

What are the next steps of the leading Fan-Out players? Yole’s FO report analyzes in detail the strategies and offers of main players involved. It describes potential success scenarios for all of them. It also helps to define what FO Packaging is and what are the different products and platforms, player per player… Visit i-micronews.com, advanced packaging reports section to discover a full description of this technology & market analysis.

Source: www.yole.fr