The recent MEPTEC – SEMI Symposium on “The Great Miniaturization” featured two days of talks on just that subject at the Biltmore Hotel in Santa Clara, CA, the week of November 9 2015. Thank you MEPTEC, thank you SEMI, and thank you to all speakers for the work you did preparing for, and then putting on, the symposium.

It was my pleasure and my honor to moderate the panel discussion, which closed the symposium, as our four distinguished panelists shared their thoughts, and took questions from the audience, on the topic we called “The Great Consolidation.”

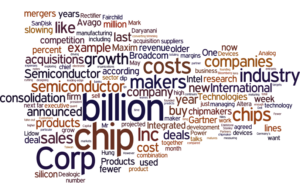

Anyone reading the electronics industry trade press this year will know just why it is we chose the topic we did. By some counts, the deal volume of chipmaker, tool supplier, and OSAT consolidation will exceed $160B in 2015. This represents the greatest total deal volume ever, truly making 2015 the hottest year on record … for semiconductor M&A.

As panel discussion moderator it was difficult for me to simultaneously take notes and run the microphone between the panelists and the audience during the discussion, so let me speak here purely for myself, rather than for the panelists themselves, who were Trevor Yancey (TechSearch International), Eelco Bergman (ASE), Tarun Verma (Silicon Catalyst), and Ivor Barber (Xilinx).

Thank you all for sharing your wit and wisdom!

I have long been convinced there is a Rule of Three at work in all mature industries: “In competitive, mature markets, there is only room for three full-line generalists, along with several (in some markets, numerous) product or market specialists. Together, the three ‘inner circle’ competitors typically control, in varying proportions, between 70 per cent and 90 per cent of the market.”

I have long been convinced there is a Rule of Three at work in all mature industries: “In competitive, mature markets, there is only room for three full-line generalists, along with several (in some markets, numerous) product or market specialists. Together, the three ‘inner circle’ competitors typically control, in varying proportions, between 70 per cent and 90 per cent of the market.”

Think about the American automobile industry and its Big Three.

Or about music …

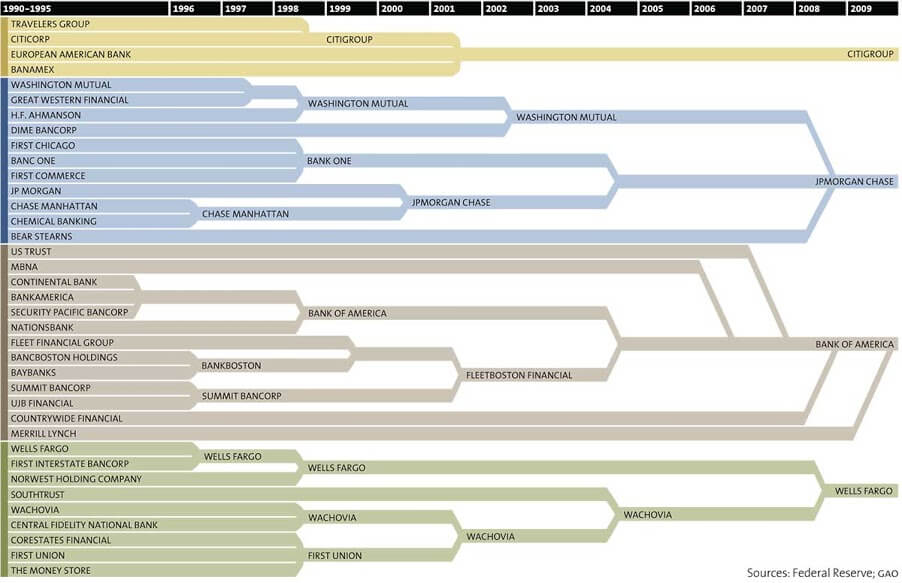

Banking in the United States is headed that way, particularly after The Great Recession.

And now so are semiconductors and the semiconductor supply chain. It’s all about that word “mature” in the phrase “competitive, mature markets.”

It’s not that consolidation is a bad thing; after all, consolidation eons and eons ago of a vast disk composed of plasma, gas, and solid matter resulted in the formation of our remarkable solar system, the blue specialty planet Earth we call home, and three (or four) generalist gas giants.And it runs like clockwork, this consolidated solar system of ours. (“The universe works on a math equation / that never even ever really even ends in the end / Infinity spirals out creation …” Modest Mouse, also covered by Sun Kil Moon.)

It’s not that consolidation is a bad thing; after all, consolidation eons and eons ago of a vast disk composed of plasma, gas, and solid matter resulted in the formation of our remarkable solar system, the blue specialty planet Earth we call home, and three (or four) generalist gas giants.And it runs like clockwork, this consolidated solar system of ours. (“The universe works on a math equation / that never even ever really even ends in the end / Infinity spirals out creation …” Modest Mouse, also covered by Sun Kil Moon.)

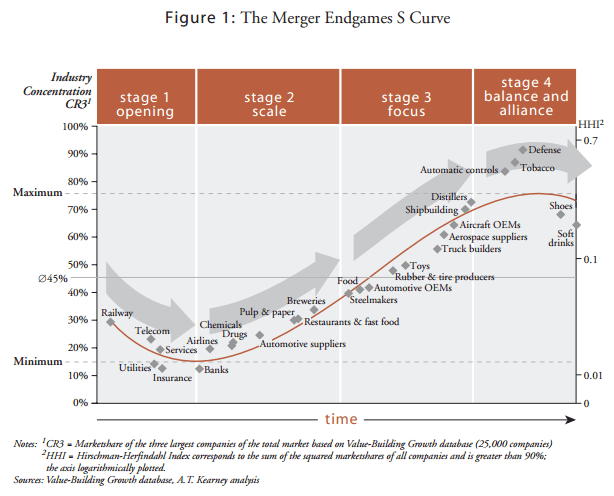

And, just as the heavens have been studied by astronomers from the time of ancient days, of naked eye observing, through to the observations made by the powerful telescopes we now orbit beyond our veiling atmosphere, instruments that have revealed dense galactic clusters in what was once thought to have been “empty” space, so too has the constellation of commercial enterprises been studied and modeled by professional economists and the business academes. Their observations about consolidation, and effective business strategies for dealing with same, are presented in “The Merger Endgames S Curve.”

From that work we have this about the characteristic evolution of the business universe, present industry included, which occurs in four stages:

- Stage 1 “A period of unparalleled new activity, and the smell of opportunity whets the appetites of venture capitalists and entrepreneurs alike.”

- Stage 2 “Industry leaders stand tall. The race to capture market-share comes into full swing; positioning of the leaders frequently changes.”

- Stage 3 “Characterized by megadeals and large-scale consolidation plays. The goal now is to emerge as one of the small number of global industry powerhouses.”

- Stage 4 “Populated by a very few, very large companies that have won their industry consolidation race. Often subject to government scrutiny because of being part of a perceived oligopoly or monopoly. As a result, alliances and spin-offs become much more attractive strategies.”

Friends, the semiconductor industry now seems to be powerfully in the thralls of Consolidation Stage 3.

Friends, the semiconductor industry now seems to be powerfully in the thralls of Consolidation Stage 3.

“Total deal volume now stands at an all-time high …”

The word cloud says it all. We are in the days of the Billion Chip Corp.

Proceed accordingly.

From Santa Clara, CA, thanks for reading. ~PFW