At the recent Arizona SEMI Breakfast Forum, held April 17, 2015, semiconductor suppliers gathered at the Mother Ship (aka Intel) in Ocotillo, AZ, to hear information that could affect their sales of tools and materials, based on the expectations of industry capacity expansion over the coming years. As the theme for the day was “Wafers to Wall Street: Emerging Markets”, SEMI organizers tapped into the industry’s financial and market research experts to update attendees on industry trends from economic, market, technology, and manufacturing perspectives, as well as the impact of emerging technologies (Internet of Things, Cloud/Mobile Computing, 3D Printing and others) on regional and global economies.

Determining Risk

Intel’s Sr. Supply Chain Analyst, Jim Vidic headlined the morning with a detailed presentation on the “journey” he took to figure out Intel’s Financial Risk Model, and how the company uses it to evaluate its existing and potential suppliers. The title of Vidic’s talk was “Assessing Supply Chain Financial Risks in the Era of Moore’s Law.” Contrary to what some economic experts believe, Vidic says Moore’s Law continues to progress, resulting in a need for new materials and tool types. “A robust supply chain is critical in the Era of Moore’s Law,” he stated. “Cost reduction is on track.”

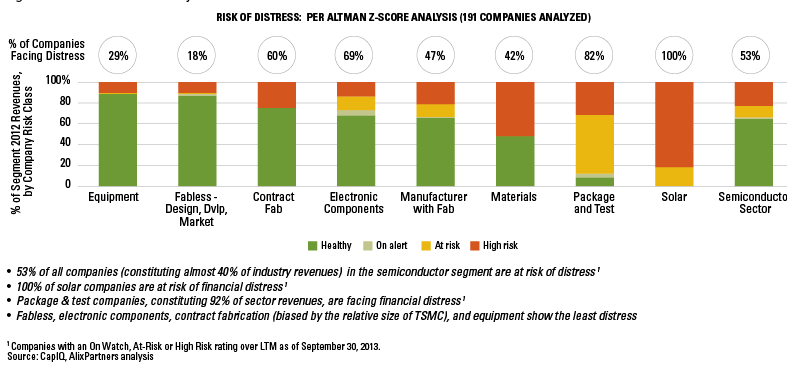

Calling Altman’s Z-Score analysis implemented by Alix Partners for predicting bankruptcy “insufficient to manage supply chain risk”, (Figure1), Vidic said he developed and deployed Intel’s Proprietary Financial Risk model four years ago, and he credits it with “minimizing unexpected financial distress events.” Without divulging all the details (it is proprietary after all) Vidic explained that he found that “Big Data” analytics weren’t enough to assess the financial risk of some companies, and that he actually had to develop two ratios that didn’t exist previously to develop the model.

According to Vidic, attributes to the model include:

- It can be run on individual companies

- The algorithm is stable

- It’s not computationally burdensome

- it can be run on public and private companies

- It provides sufficient warning for a company’s risk

- It out-performs commercial alternatives

Vidic talked about case studies he ran on companies that had been through bankruptcy to test its accuracy, including Eastman Kodak, which filed for Chapter 11 in 2011, restructured, and returned from bankruptcy. According to Vidic, the Intel model could tell if the company would go through bankruptcy in time to put an exit strategy in place. Likewise, he tested the model on Japan Airlines to see if it applied globally, and on Evergreen Solar, a Massachusetts-based manufacturer of solar panels, cells and wafers founded in 1994 that went out of business in the US in July 2012. When Vidic ran Evergreen through the Intel Financial Risk Model, he predicted a steady downward trend for the company based on its last three years, demonstrating the predictive ability of the model. Vidic said he even ran Intel through its own model a few years ago, and he said that it actually didn’t do that well, so he sent the results to the senior finance guys, and the company has since stabilized.

Essentially, Vidic’s message to existing and potential suppliers – it’s not enough to have the best equipment available on the market for a specific process. Part of Intel’s supply chain strategy is to put suppliers through this financial risk assessment to determine if they will still be around in the future to service their tools and provide parts and support.

Let’s make a Deal

The next two speakers, Sean McCarthy, regional chief investment officer, Wells Fargo; and Christian Dieseldorff, senior analyst, director of market research, SEMI, focused on the deal environment for mergers and acquisitions, sustaining the global recovery, fab consolidations, memory capacity, the IoT, and how all of this will affect Capex spending over the next few years.

McCarthy said mergers and acquisitions picked up to the tune of $31B last year, and are “plenty fertile” for more to happen this year. He said as a result, we can expect to see 10% fewer players in the industry. China is expected to spend up to 100B in investments and acquisition abroad to grow its semiconductor industry by more than 20% over next 5 years. He predicted 8% growth for worldwide chip sales in 2015, and said that if we are to produce the 26B* connections required for the Internet of Things (IoT) by 2020, the US needs to pick up the pace a bit.

On the topic of memory, McCarthy reported that although February memory sales were up 15% from last February, there was a slow-down from the previous 18 months. Micron and Sandisk had lowered projections in March due to a slowing at the beginning of the year. On the DRAM side, he said Micron sales were only up only up 1% in February, and will be 1% in May. Sandisk reported Flash memory sales are up 1%, and has lowered its estimate. McCarthy said there’s a disconnect between projections and what’s actually happening.

In comparing industry investment and capital efficiency, McCarthy said that while TSMC says it plans to spend on 16nm FinFet technology to get volume up, the company doesn’t necessarily plan to buy new equipment as it can leverage what it purchased at 20nm. “We don’t see investment picking up because there’s too much capacity,” he explained, noting that worldwide semiconductor industry is at 65.5% capacity, which is almost recessionary, compared to 90% capacity historically. He added that the US is currently at 75% capacity, which is fine.

SEMI has tracked 1174 active and future fabs worldwide in both R&D and high volume manufacturing (HVM), representing over 500 companies and 58 future facilities starting HVM in 2015 or later, and according to Dieseldorff,190 facilities are expected to spend over $40 billion in fab equipment in 2015.

He presented detailed data on front-end fab spending worldwide to support predictions that we can expect 10-13% growth in capex spending this year, despite the major consolidations that continue to take place (Fujitsu wound down chip operations in August of 2014; GlobalFoundries bought IBM’s semiconductor business in October 2014 , NXP and Freescale announced a merger in March 2015) Dieseldorff pointed to other indicators used in forecasting, such as semiconductor revenue, which is predicted to be positive in both 2015 and 2016. He also talked about expansion projects vs. upgrade projects.

Dieseldorff also noted (oh joy of joys for the 3D fans among us) that more money has been spent in the last few years adding capacity for 3D, and that will continue. Micron is ramping 3D in Singapore in the first half of 2015, and they are focusing 100% on 3D NAND after 16nm due to cost/performance ratio, noted Dieseldorff. Sk Hynix is also ramping 3D in the first half of 2015, and in the second half of the year, Sandisk will launch its 3D BICS pilot line. He counts four new dedicated DRAM fabs, and noted there is an increase in Fab construction projects in 2016.

IOT Impact on Capacity

And let’s not forget the impact the IoT will have. If we are to have 35B* connected devices by 2020, what does this mean for fabs? Gartner research predicts we will need 100K wafers/month to meet these requirements, and both 200mm and 300mm wafer fabs will be needed to reach this. In answer to the audience question of whether we would be able to meet the volume of MEMS and sensors required for the IoT, Dieseldorff noted that growth rates for MEMS and sensors are in double digits, but volumes are smaller than logic and memory. “It’s hard to say where all this goes. There are still 200mm fabs being built, and we see 300mm fabs becoming legacy. We’re not sure what the impact is on sensors and MEMs,” he said.

Jim Feldhan, SEMICO Research, noted that first-generation 300mm fabs could be repurposed into manufacturing older technologies, as these are what are being used for many of the connected devices. Additionally, used equipment companies are refurbishing 200mm equipment, and this is a catalyst to keep them going.

Embrace Technology Innovation

In their presentations, Feldhan and Hans Stork, ON Semiconductor, took the discussion in a slightly different direction: how market needs are driving technology changes.

Feldhan focused on emerging technologies, 3D printing and graphene, to illustrate his point that disruptive technology is what is changing the world, and how the next generation help drive the market towards these new innovations.

Feldman explained that we need to move away from commoditization towards innovation to differentiate our technology from China. “We can’t out produce them, we need to take technology and do something with it, such as with 3D printing, to keep this industry moving forward,” he said. McCarthy offered some insight on how to sustain expansion not let it become a commodity business. Growth opportunities exist, particularly in meeting the challenge to achieve 34B* connected devices within 5 years. That will require innovation, and there will be a race to come up with solutions. The bigger players are the ones who can make the investment, and he says they will be the companies that survive.

Stork talked about market pressures that dictate change in the semiconductor business, using ON’s expertise in automotive image and RF sensors to demonstrate how the market needs are evolving. For example, he talked about how difficult it is to build image sensors for automotive applications due to the high dynamic range requirements. This is driving advanced technology for image processing, and ON has found the solution in wafer to wafer stacking processes to integrate logic and image sensor wafers. To this end, ON has made great strides in adopting manufacturing changes to enable stacking such as plasma dicing, wafer thinning using the Taiko process, which thins the center of the wafer only and leaves a rigid support ring to eliminate the need for carrier wafers.

Summing it up

So what’s the overall message suppliers could take home from the morning? If you want to be an Intel supplier, it’s more important to be stable than innovative, unless you’re REALLY innovative. If you want to be a supplier to the IoT market, breathe life back into your 200mm tools by configuring them for MEMS/Sensor processes. And if you want to be part of an innovative future, be willing to take risks and be disruptive, but be patient when it comes to your return on investment. ~ F.v.T

*The three different figures are not a typo. Depending on who you talk to, the IoT will require 26B, 36B or 35B connected devices. All three numbers were presented during the breakfast forum.